Invesco BulletShares 2022 Corporate Bond ETF (BSCM)

Price:

21.16 USD

( - -0.01 USD)

Your position:

0 USD

ACTION PANEL

ABOUT

Check the

KEY TAKEAWAYS

ASK OUR AI ABOUT THE COMPANY (REGISTER FOR EARLY ACCESS)

(REGISTER FOR EARLY ACCESS) CHOOSE A PROMPT ABOVE TO ASK OUR AI ABOUT THE SPECIFIC INFORMATION

SIMILAR COMPANIES STI SCORE

Similar STI Score

Invesco BulletShares 2021 Corporate Bond ETF

VALUE SCORE:

0

2nd position

Vanguard Emerging Markets Government Bond Index Fund

VALUE SCORE:

12

The best

Vanguard Long-Term Corporate Bond Index Fund

VALUE SCORE:

12

FUNDAMENTALS

FUNDAMENTALS

FUNDAMENTALS

FUNDAMENTALS PER SHARE

TECHNICAL

DIVIDEND

SIMILAR COMPANIES

No data to display

No data to display

No data to display

No data to display

No data to display

No data to display

No data to display

No data to display

No data to display

DESCRIPTION

The fund generally will invest at least 80% of its total assets in securities that comprise the underlying index. The underlying index seeks to measure the performance of a portfolio of U.S. dollar-denominated investment grade corporate bonds with maturities or, in some cases, "effective maturities" in the year 2022 (collectively, "2022 Bonds").

NEWS

U.S. Weekly FundFlows Insight Report: Heading Into The Holidays Large Cap ETFs Suffer Largest Outflow Of 2022 While Conventional Large Cap Funds Record Largest Inflow Of The Year

seekingalpha.com

2023-01-01 00:05:00At the close of Refinitiv Lipper's fund-flows week, U.S. broad-based equity indices reported negative performance for the second week in three. The 10-two Treasury yield spread remained negative (-0.53), marking the one-hundred-and-twenty-second straight trading session with an inverted yield curve.

10 Super-Low-Risk Ways To Profit From The Fed's Rate Hikes

investors.com

2022-09-22 08:00:26Interest rate hikes terrify most S&P 500 investors. And for good reason.

Building A Bond Ladder With ETFs

etf.com

2021-12-08 10:57:32Investors can access the benefits of short and long duration bonds by building a bond ladder with ETFs.

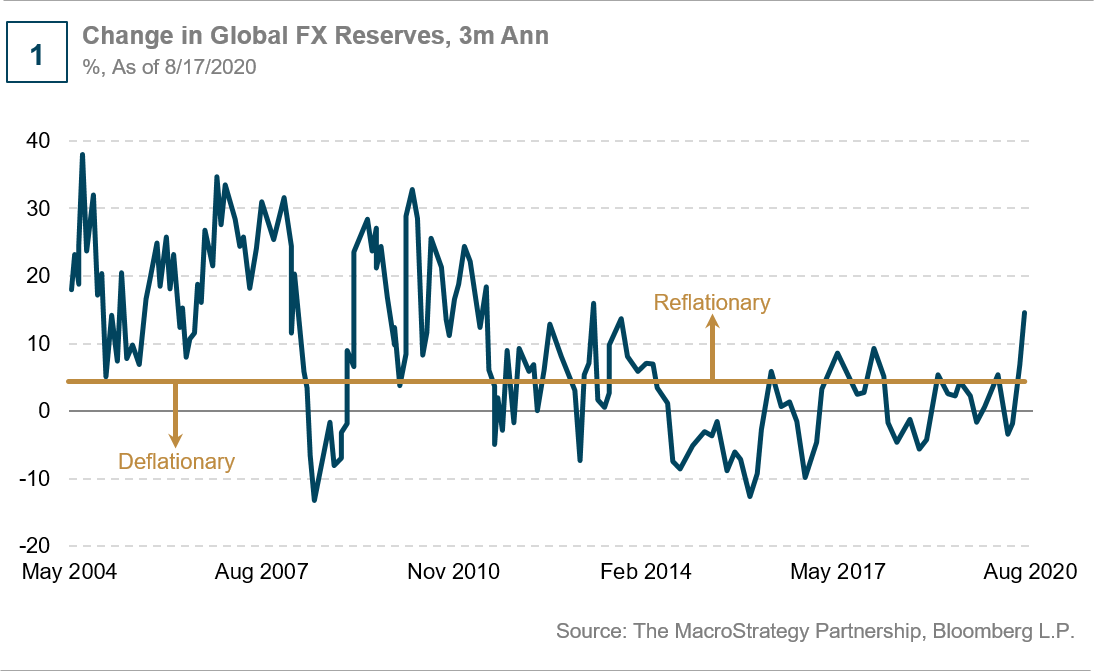

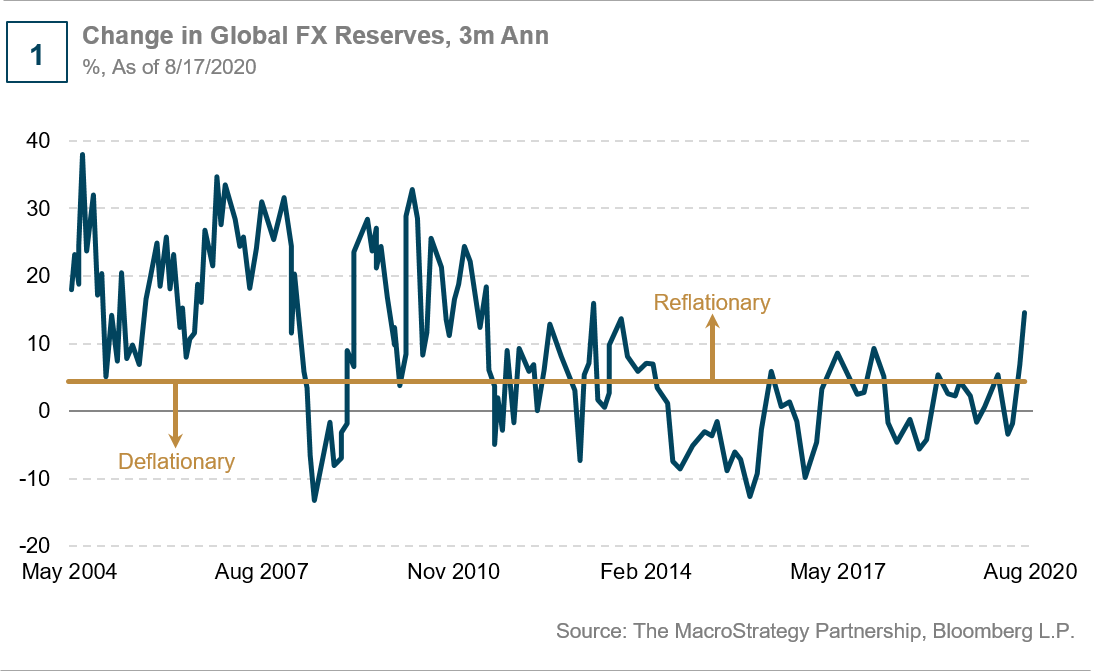

A Cyclical Rotation In Corporate Credit

seekingalpha.com

2020-09-09 06:38:50The sudden stop to markets induced by COVID-19 caused a substantial repricing of credit risk globally, and central banks, treasuries, and ministries of finance around the world responded unequivocally.

Changing Credit Views Amid Volatility

seekingalpha.com

2020-09-09 02:30:00We downgrade investment grade credit to neutral and increase our overweight in high yield as we see volatility rising after a rally in risk assets.

Cash Is The 'New' Bond: Unlike Edgar Winter's 'Free Ride'

seekingalpha.com

2020-07-16 04:36:02The Great Swan Dive of March 2020 was the “tide” referred to in Warren Buffett’s quote: Only when the tide goes out do you discover who's been swimming naked.

Impact Of COVID-19 On USD Corporate Bond Liquidity

seekingalpha.com

2020-07-02 00:55:00We examine the effects of the crisis on the year-to-date liquidity of USD corporate bonds, as measured by the price liquidity ratio. The price liquidity ratio c

The Reopening Killed The V-Shaped Recovery

seekingalpha.com

2020-06-29 07:43:33This is a weekly series focused on analyzing the previous week’s economic data releases. The objective is to concentrate on leading indicators of economic activ

D.B. Root & Company LLC Purchases 2,401 Shares of Invesco BulletShares 2022 Corporate Bond ETF (NYSEARCA:BSCM)

thelincolnianonline.com

2020-05-02 10:26:46D.B. Root & Company LLC boosted its position in Invesco BulletShares 2022 Corporate Bond ETF (NYSEARCA:BSCM) by 22.2% in the 1st quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission (SEC). The fund owned 13,215 shares of the company’s stock after purchasing an additional 2,401 shares during the […]

No data to display

U.S. Weekly FundFlows Insight Report: Heading Into The Holidays Large Cap ETFs Suffer Largest Outflow Of 2022 While Conventional Large Cap Funds Record Largest Inflow Of The Year

seekingalpha.com

2023-01-01 00:05:00At the close of Refinitiv Lipper's fund-flows week, U.S. broad-based equity indices reported negative performance for the second week in three. The 10-two Treasury yield spread remained negative (-0.53), marking the one-hundred-and-twenty-second straight trading session with an inverted yield curve.

10 Super-Low-Risk Ways To Profit From The Fed's Rate Hikes

investors.com

2022-09-22 08:00:26Interest rate hikes terrify most S&P 500 investors. And for good reason.

Building A Bond Ladder With ETFs

etf.com

2021-12-08 10:57:32Investors can access the benefits of short and long duration bonds by building a bond ladder with ETFs.

A Cyclical Rotation In Corporate Credit

seekingalpha.com

2020-09-09 06:38:50The sudden stop to markets induced by COVID-19 caused a substantial repricing of credit risk globally, and central banks, treasuries, and ministries of finance around the world responded unequivocally.

Changing Credit Views Amid Volatility

seekingalpha.com

2020-09-09 02:30:00We downgrade investment grade credit to neutral and increase our overweight in high yield as we see volatility rising after a rally in risk assets.

Cash Is The 'New' Bond: Unlike Edgar Winter's 'Free Ride'

seekingalpha.com

2020-07-16 04:36:02The Great Swan Dive of March 2020 was the “tide” referred to in Warren Buffett’s quote: Only when the tide goes out do you discover who's been swimming naked.

Impact Of COVID-19 On USD Corporate Bond Liquidity

seekingalpha.com

2020-07-02 00:55:00We examine the effects of the crisis on the year-to-date liquidity of USD corporate bonds, as measured by the price liquidity ratio. The price liquidity ratio c

The Reopening Killed The V-Shaped Recovery

seekingalpha.com

2020-06-29 07:43:33This is a weekly series focused on analyzing the previous week’s economic data releases. The objective is to concentrate on leading indicators of economic activ

D.B. Root & Company LLC Purchases 2,401 Shares of Invesco BulletShares 2022 Corporate Bond ETF (NYSEARCA:BSCM)

thelincolnianonline.com

2020-05-02 10:26:46D.B. Root & Company LLC boosted its position in Invesco BulletShares 2022 Corporate Bond ETF (NYSEARCA:BSCM) by 22.2% in the 1st quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission (SEC). The fund owned 13,215 shares of the company’s stock after purchasing an additional 2,401 shares during the […]