Invesco BulletShares (R) 2022 USD Emerging Markets Debt ETF (BSBE)

Price:

23.82 USD

( + 0.01 USD)

Your position:

0 USD

ACTION PANEL

ABOUT

Check the

KEY TAKEAWAYS

ASK OUR AI ABOUT THE COMPANY (REGISTER FOR EARLY ACCESS)

(REGISTER FOR EARLY ACCESS) CHOOSE A PROMPT ABOVE TO ASK OUR AI ABOUT THE SPECIFIC INFORMATION

SIMILAR COMPANIES STI SCORE

Similar STI Score

iShares USD Bond Factor ETF

VALUE SCORE:

0

2nd position

Vanguard Emerging Markets Government Bond Index Fund

VALUE SCORE:

12

The best

Vanguard Long-Term Corporate Bond Index Fund

VALUE SCORE:

12

FUNDAMENTALS

FUNDAMENTALS

FUNDAMENTALS

FUNDAMENTALS PER SHARE

TECHNICAL

DIVIDEND

SIMILAR COMPANIES

DESCRIPTION

The fund generally will invest at least 80% of its total assets in securities that comprise the underlying index. The underlying index seeks to measure the performance of a portfolio of U.S. dollar-denominated emerging markets bonds with maturities or, in some cases, “effective maturities” in the year 2022 (collectively, “2022 Bonds”). The fund is non-diversified.

NEWS

Spotting Opportunities And Risks Across The EM Investment Universe

seekingalpha.com

2022-08-31 11:40:00In emerging markets valuations look attractive today after the losses across financial markets early this year. PIMCO's investment process is founded upon our macroeconomic outlook and our in-house country and credit research.

Technical Tailwinds May Lift EMFX

seekingalpha.com

2021-11-30 13:45:00Performance of emerging markets local currency bonds has been negatively impacted by the U.S. dollar's strength since mid-year, despite the higher real yields and upside growth surprises in many emerging markets. Currency returns can be volatile, and external factors can have a bigger short-term impact on an emerging markets currency (EMFX) even if relatively attractive fundamentals may provide longer-term support.

Investing In Emerging Markets As Global Rates Rise

seekingalpha.com

2021-02-22 18:39:51Past experience shows us that emerging markets have historically reacted positively to higher global rates, especially if the latter reflects an improving global growth outlook. Most emerging markets will start normalizing rates well before the U.S. and developed markets.

3 Big Challenges For Emerging Markets Amid COVID-19

seekingalpha.com

2020-08-13 13:29:50Today, China's economic recovery continues ticking along, and we are even seeing some indicators showing growth relative to last year.

The Reopening Killed The V-Shaped Recovery

seekingalpha.com

2020-06-29 07:43:33This is a weekly series focused on analyzing the previous week’s economic data releases. The objective is to concentrate on leading indicators of economic activ

Invesco BulletShares 2022 USD Emerging Markets Debt ETF (NYSEARCA:BSBE) Shares Sold by Bank of America Corp DE

thelincolnianonline.com

2020-04-26 08:38:48Bank of America Corp DE cut its stake in shares of Invesco BulletShares 2022 USD Emerging Markets Debt ETF (NYSEARCA:BSBE) by 10.2% in the fourth quarter, according to its most recent disclosure with the SEC. The firm owned 29,064 shares of the company’s stock after selling 3,287 shares during the period. Bank of America Corp […]

Invesco BulletShares 2022 USD Emerging Markets Debt ETF (NYSEARCA:BSBE) Shares Down 0.3%

thelincolnianonline.com

2020-04-18 05:52:47Shares of Invesco BulletShares 2022 USD Emerging Markets Debt ETF (NYSEARCA:BSBE) were down 0.3% during mid-day trading on Friday . The company traded as low as $25.08 and last traded at $25.08, approximately 1,700 shares traded hands during trading. A decline of 13% from the average daily volume of 1,961 shares. The stock had previously […]

No data to display

Spotting Opportunities And Risks Across The EM Investment Universe

seekingalpha.com

2022-08-31 11:40:00In emerging markets valuations look attractive today after the losses across financial markets early this year. PIMCO's investment process is founded upon our macroeconomic outlook and our in-house country and credit research.

Technical Tailwinds May Lift EMFX

seekingalpha.com

2021-11-30 13:45:00Performance of emerging markets local currency bonds has been negatively impacted by the U.S. dollar's strength since mid-year, despite the higher real yields and upside growth surprises in many emerging markets. Currency returns can be volatile, and external factors can have a bigger short-term impact on an emerging markets currency (EMFX) even if relatively attractive fundamentals may provide longer-term support.

Investing In Emerging Markets As Global Rates Rise

seekingalpha.com

2021-02-22 18:39:51Past experience shows us that emerging markets have historically reacted positively to higher global rates, especially if the latter reflects an improving global growth outlook. Most emerging markets will start normalizing rates well before the U.S. and developed markets.

3 Big Challenges For Emerging Markets Amid COVID-19

seekingalpha.com

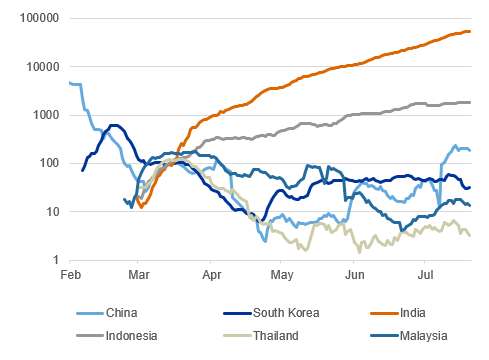

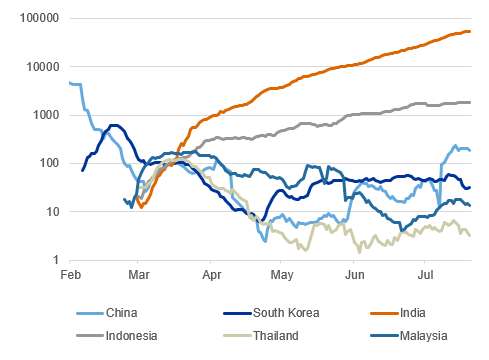

2020-08-13 13:29:50Today, China's economic recovery continues ticking along, and we are even seeing some indicators showing growth relative to last year.

The Reopening Killed The V-Shaped Recovery

seekingalpha.com

2020-06-29 07:43:33This is a weekly series focused on analyzing the previous week’s economic data releases. The objective is to concentrate on leading indicators of economic activ

Invesco BulletShares 2022 USD Emerging Markets Debt ETF (NYSEARCA:BSBE) Shares Sold by Bank of America Corp DE

thelincolnianonline.com

2020-04-26 08:38:48Bank of America Corp DE cut its stake in shares of Invesco BulletShares 2022 USD Emerging Markets Debt ETF (NYSEARCA:BSBE) by 10.2% in the fourth quarter, according to its most recent disclosure with the SEC. The firm owned 29,064 shares of the company’s stock after selling 3,287 shares during the period. Bank of America Corp […]

Invesco BulletShares 2022 USD Emerging Markets Debt ETF (NYSEARCA:BSBE) Shares Down 0.3%

thelincolnianonline.com

2020-04-18 05:52:47Shares of Invesco BulletShares 2022 USD Emerging Markets Debt ETF (NYSEARCA:BSBE) were down 0.3% during mid-day trading on Friday . The company traded as low as $25.08 and last traded at $25.08, approximately 1,700 shares traded hands during trading. A decline of 13% from the average daily volume of 1,961 shares. The stock had previously […]