BlackRock Investment Quality Municipal Trust Inc. (BKN)

Price:

11.25 USD

( - -0.01 USD)

Your position:

0 USD

ACTION PANEL

ABOUT

Check the

KEY TAKEAWAYS

ASK OUR AI ABOUT THE COMPANY (REGISTER FOR EARLY ACCESS)

(REGISTER FOR EARLY ACCESS) CHOOSE A PROMPT ABOVE TO ASK OUR AI ABOUT THE SPECIFIC INFORMATION

SIMILAR COMPANIES STI SCORE

Similar STI Score

Citigroup Capital XIII TR PFD SECS

VALUE SCORE:

6

2nd position

FS Credit Opportunities Corp.

VALUE SCORE:

13

The best

ClearBridge Energy Midstream Opportunity Fund Inc

VALUE SCORE:

15

FUNDAMENTALS

FUNDAMENTALS

FUNDAMENTALS

FUNDAMENTALS PER SHARE

TECHNICAL

DIVIDEND

SIMILAR COMPANIES

DESCRIPTION

BlackRock Investment Quality Municipal Trust Inc. is a closed ended fixed income mutual fund launched by BlackRock, Inc. It is managed by BlackRock Advisors, LLC. The fund invests in fixed income markets. It invests primarily in investment grade municipal bonds municipal obligations exempt from federal income taxes. Blackrock Investment Quality Municipal Trust Inc. was formed on February 28, 1993 and is domiciled in United States.

NEWS

Cetera Investment Advisers Grows Stock Holdings in Blackrock Investment Quality Municipal Trust $BKN

defenseworld.net

2025-12-02 04:10:55Cetera Investment Advisers raised its stake in Blackrock Investment Quality Municipal Trust (NYSE: BKN) by 85.3% during the undefined quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The firm owned 146,575 shares of the company's stock after purchasing an additional 67,470 shares during the quarter.

BKN: A High Distribution Part Funded By Return Of Capital

seekingalpha.com

2025-08-04 06:07:30I avoid funds like BKN that fund distributions with return of capital, as it risks misleading investors about true income. While the fund offers a high tax-free distribution rate, a significant portion is return of capital, not earned income, which I find problematic. Long-tenor muni bond funds like BKN inherently carry interest rate risk, but that's a normal trade-off for higher yields in this space.

BKN: A Good Closed-End Fund Way To Access Munis

seekingalpha.com

2024-06-09 08:39:52BlackRock Investment Quality Municipal Trust is a closed-end fund that offers exposure to tax-exempt municipal bonds. The fund has a well-diversified portfolio with strong credit quality and a focus on capital preservation. BKN may lag behind the iShares National Muni Bond ETF due to its higher fees and use of leverage, but it offers tax advantages for investors.

Distribution Dates and Amounts Announced for Certain BlackRock Closed-End Funds

businesswire.com

2024-03-01 16:30:00NEW YORK--(BUSINESS WIRE)--Certain BlackRock closed-end funds (the “Funds”) announced distributions today as detailed below. Municipal Funds: Declaration- 3/1/2024 Ex-Date- 3/14/2024 Record- 3/15/2024 Payable- 4/1/2024 National Funds Ticker Distribution Change From Prior Distribution BlackRock Municipal Income Quality Trust* BYM $0.052500 - BlackRock Long-Term Municipal Advantage Trust* BTA $0.043500 - BlackRock MuniAssets Fund, Inc.* MUA $0.055500 - BlackRock Municipal Income Fund, Inc.

Distribution Dates and Amounts Announced for Certain BlackRock Closed-End Funds

businesswire.com

2023-12-05 17:00:00NEW YORK--(BUSINESS WIRE)--Certain BlackRock closed-end funds (the “Funds”) announced distributions today as detailed below. BlackRock Floating Rate Income Trust (NYSE: BGT), BlackRock Floating Rate Income Strategies Fund, Inc. (NYSE: FRA) and BlackRock Debt Strategies Fund, Inc. (NYSE: DSU) announced increases to their monthly distributions. Certain BlackRock municipal Funds previously declared their December, January and February distributions and declared special distributions today in order.

Certain BlackRock Municipal Closed-End Funds Announce Variable Rate Muni Term Preferred Shares Actions

businesswire.com

2023-11-02 17:15:00NEW YORK--(BUSINESS WIRE)--BlackRock Advisors, LLC today announced BlackRock Municipal Income Trust (NYSE: BFK), BlackRock Investment Quality Municipal Trust, Inc. (NYSE: BKN), BlackRock Municipal Income Trust II (NYSE: BLE), BlackRock Municipal Income Quality Trust (NYSE: BYM), BlackRock MuniHoldings Fund, Inc. (NYSE: MHD), BlackRock MuniYield Quality Fund II, Inc. (NYSE: MQT), BlackRock MuniHoldings Quality Fund II, Inc. (NYSE: MUE), BlackRock MuniVest Fund, Inc. (NYSE: MVF), and BlackRock MuniVest Fund II, Inc. (NYSE: MVT) (collectively, the “Funds”) intend to redeem a portion of their outstanding Series W-7 Variable Rate Muni Term Preferred Shares (“VMTP Shares”) on or about November 24, 2023, at a redemption price equal to the liquidation preference of $100,000 per share, together with accumulated and unpaid dividends through the day prior to the redemption date. Shareholders are expected to benefit from lower expenses as a result of the redemptions.

BlackRock Announces Withdrawal of Municipal Closed-End Fund Merger Proposals

businesswire.com

2023-10-30 19:00:00NEW YORK--(BUSINESS WIRE)--The Boards of Directors/Trustees of BlackRock MuniYield Michigan Quality Fund, Inc. (NYSE: MIY), BlackRock MuniYield Pennsylvania Quality Fund (NYSE: MPA), BlackRock Virginia Municipal Bond Trust (NYSE: BHV), BlackRock Investment Quality Municipal Trust, Inc. (NYSE: BKN) and BlackRock MuniYield Quality Fund III, Inc. (NYSE: MYI) (each, a “Fund” and collectively, the “Funds”) today announced the withdrawal of merger proposals that were previously approved by the Boards.

BlackRock Announces Board Approval of Municipal Closed-End Fund Mergers

businesswire.com

2023-09-08 16:30:00NEW YORK--(BUSINESS WIRE)--BlackRock Advisors, LLC announced today that the Boards of Directors/Trustees of BlackRock MuniYield Michigan Quality Fund, Inc. (NYSE: MIY), BlackRock MuniYield Pennsylvania Quality Fund (NYSE: MPA), BlackRock Virginia Municipal Bond Trust (NYSE: BHV), BlackRock Investment Quality Municipal Trust, Inc. (NYSE: BKN) and BlackRock MuniYield Quality Fund III, Inc. (NYSE: MYI) (each, a “Fund” and collectively, the “Funds”) have approved the mergers of each of MIY, MPA, BHV and BKN with and into MYI, with MYI continuing as the surviving Fund (collectively, the “Mergers”).

Weekly Closed-End Fund Roundup: February 12, 2023

seekingalpha.com

2023-02-21 17:50:301 out of 22 CEF sectors positive on price and 0 out of 22 sectors positive on NAV last week. Senior loans lead while real estate lags.

BlackRock Announces Fiscal Year End Changes for Certain Municipal Closed-End Funds

businesswire.com

2022-06-03 16:30:00NEW YORK--(BUSINESS WIRE)--BlackRock Advisors, LLC (“BlackRock”) announced today a change to the fiscal year end (“FYE”) for each Fund listed below. These changes were made to reduce operating costs for the Funds and will be effective as of July 31, 2022. Ticker (NYSE) Fund Current FYE New FYE BKN BlackRock Investment Quality Municipal Trust, Inc. 4/30 7/31 BTA BlackRock Long-Term Municipal Advantage Trust 4/30 7/31 MUA BlackRock MuniAssets Fund, Inc. 4/30 7/31 MUI BlackRock Municipal Income Fu

BKN: Strong Municipal Bond CEF, Diversified Holdings, 5.3% Distribution Yield, Industry-Beating Returns

seekingalpha.com

2022-02-27 03:50:10BKN: Strong Municipal Bond CEF, Diversified Holdings, 5.3% Distribution Yield, Industry-Beating Returns

CEF Weekly Market Review: Funds Take A Breather

seekingalpha.com

2021-07-25 05:25:14We review CEF market valuation and performance over the past week and highlight recent events. CEF prices stalled in July on the back of lower risk sentiment driving discounts wider.

Rotation Choices For Expensive Muni CEFs

seekingalpha.com

2021-06-22 16:55:26The muni CEF sector has continued to rally this year due to the resilience of municipal bond yields and tight CEF discounts.

CEF Weekly Market Review: The Everything Rally

seekingalpha.com

2021-06-13 08:43:57We review CEF market valuation and performance over the first week of June and highlight recent events. The CEF market pushed higher at the start of June with a favorable backdrop of stable Treasury yields and rising equity prices.

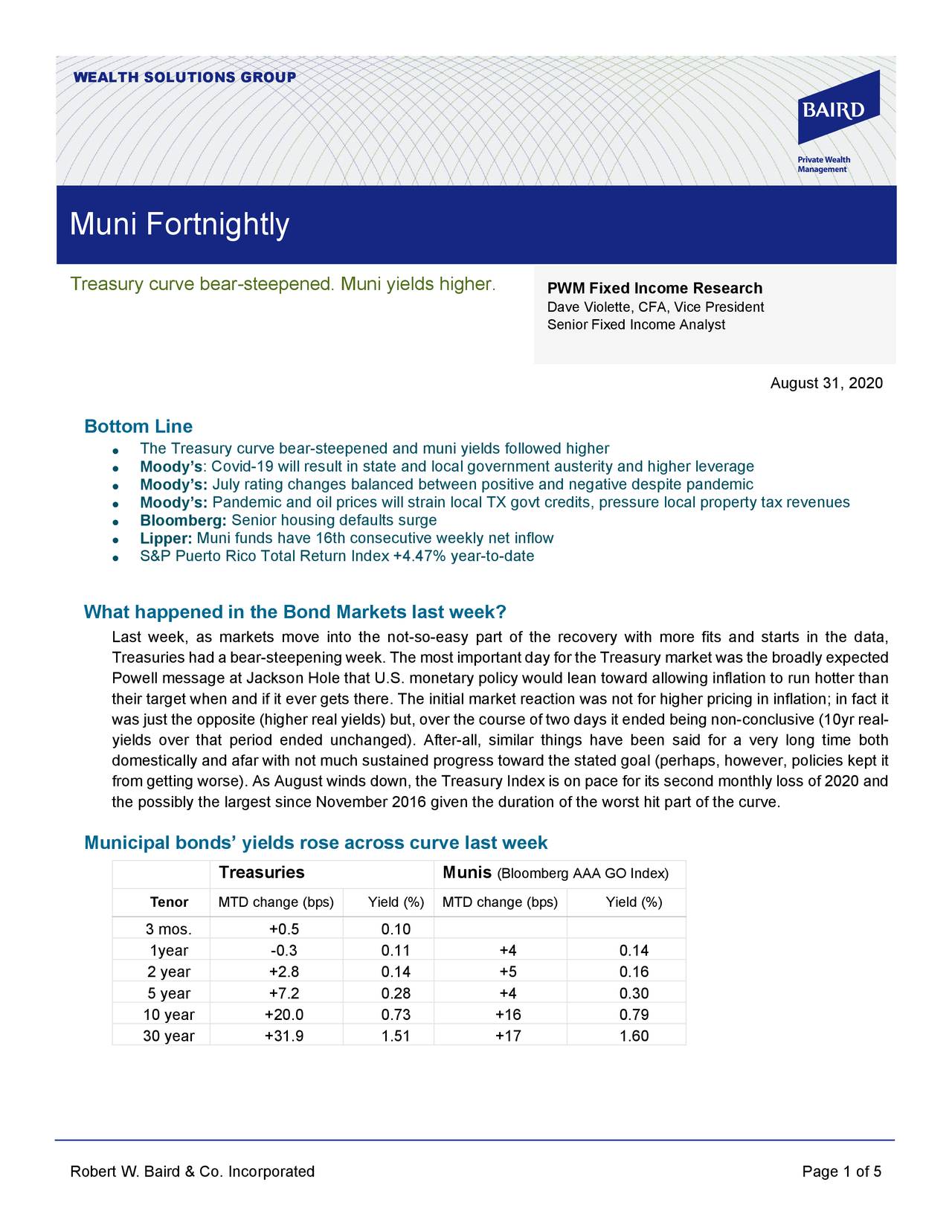

Treasury Curve Bear-Steepened; Muni Yields Higher - Muni Fortnightly, August 31, 2020

seekingalpha.com

2020-09-06 01:50:00The Treasury curve bear-steepened and muni yields followed higher. Moody’s: Covid-19 will result in state and local government austerity and higher leverage.

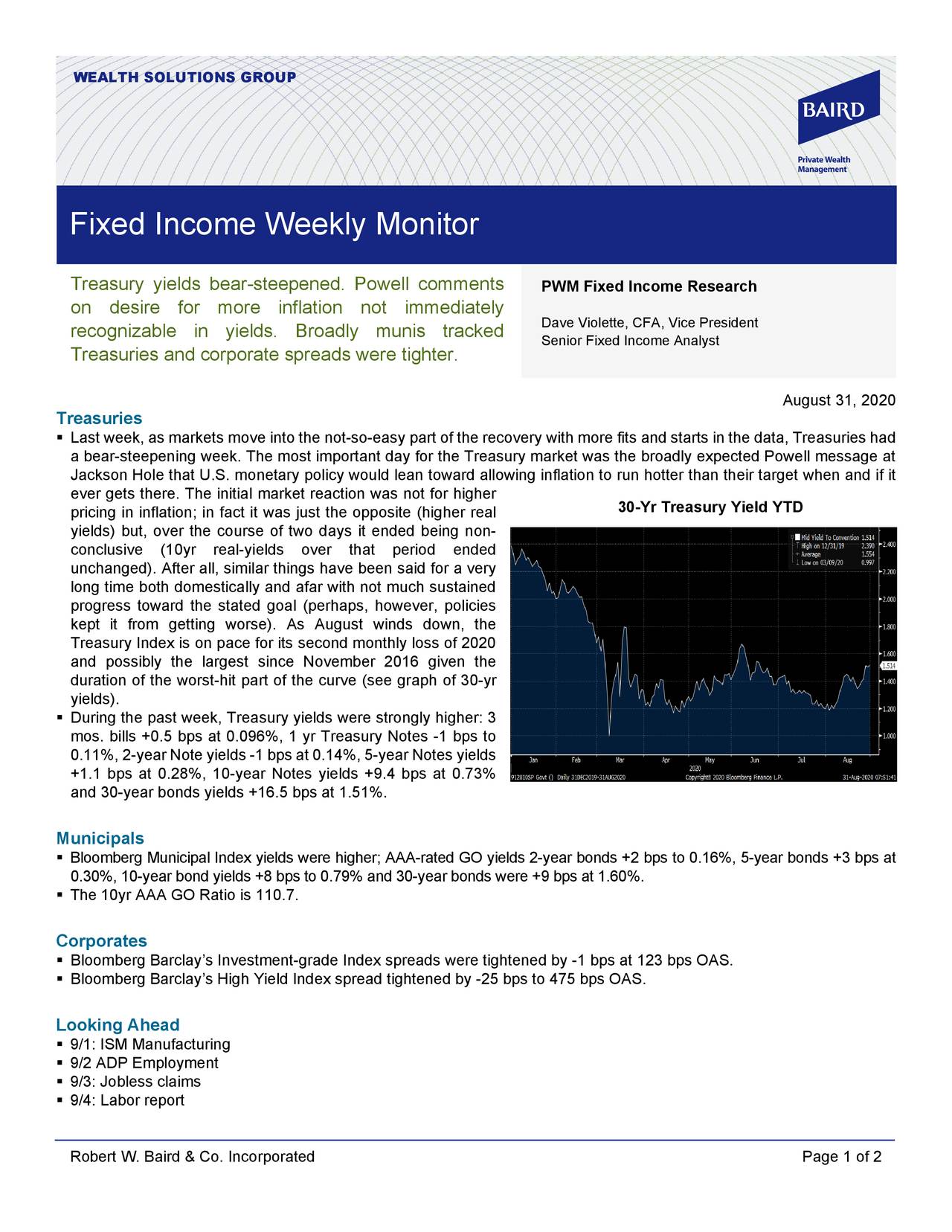

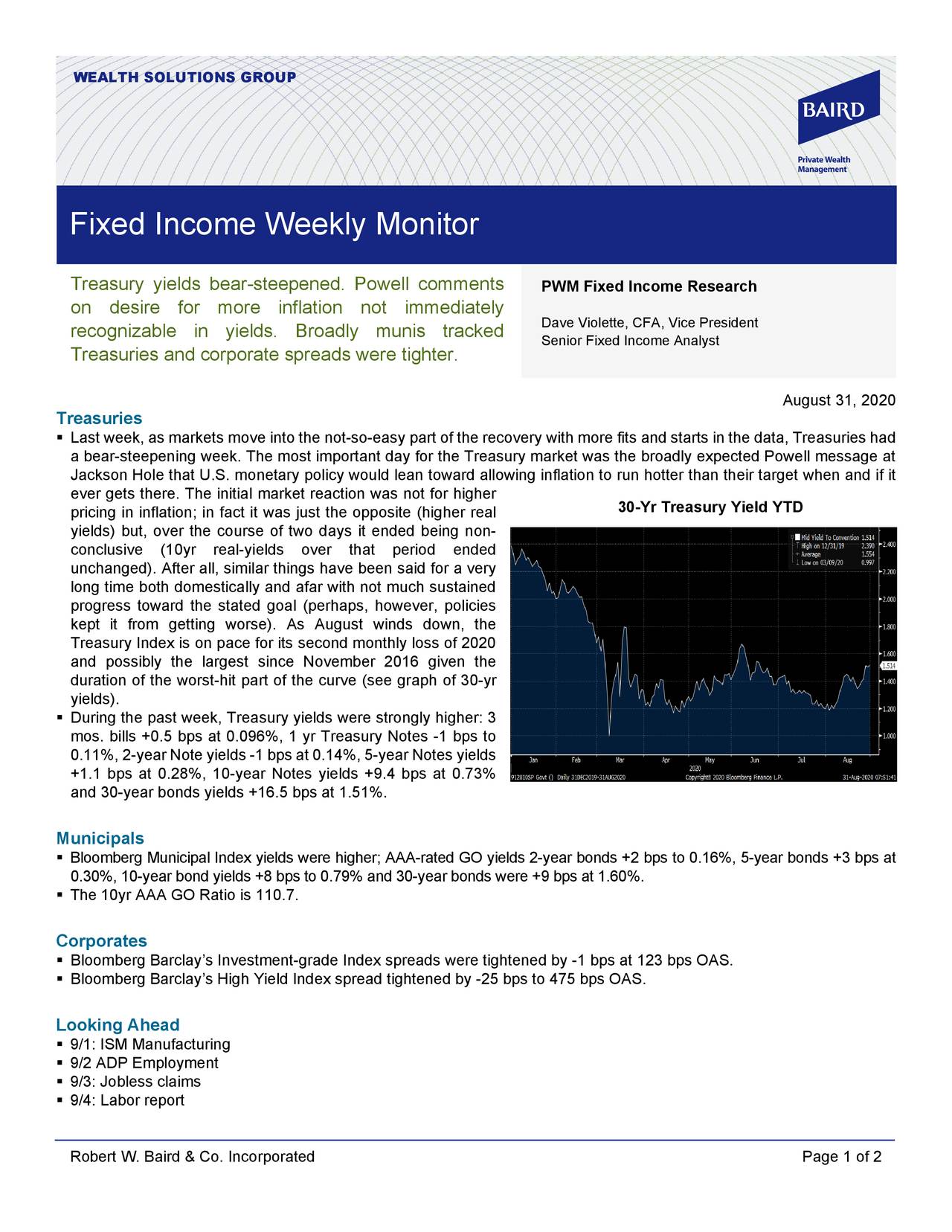

Treasuries Had A Bear-Steepening Week: Fixed Income Weekly Monitor, August 31, 2020

seekingalpha.com

2020-09-02 03:00:00Treasury yields bear-steepened. Powell comments on desire for more inflation not immediately recognizable in yields.

Cetera Investment Advisers Grows Stock Holdings in Blackrock Investment Quality Municipal Trust $BKN

defenseworld.net

2025-12-02 04:10:55Cetera Investment Advisers raised its stake in Blackrock Investment Quality Municipal Trust (NYSE: BKN) by 85.3% during the undefined quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The firm owned 146,575 shares of the company's stock after purchasing an additional 67,470 shares during the quarter.

BKN: A High Distribution Part Funded By Return Of Capital

seekingalpha.com

2025-08-04 06:07:30I avoid funds like BKN that fund distributions with return of capital, as it risks misleading investors about true income. While the fund offers a high tax-free distribution rate, a significant portion is return of capital, not earned income, which I find problematic. Long-tenor muni bond funds like BKN inherently carry interest rate risk, but that's a normal trade-off for higher yields in this space.

BKN: A Good Closed-End Fund Way To Access Munis

seekingalpha.com

2024-06-09 08:39:52BlackRock Investment Quality Municipal Trust is a closed-end fund that offers exposure to tax-exempt municipal bonds. The fund has a well-diversified portfolio with strong credit quality and a focus on capital preservation. BKN may lag behind the iShares National Muni Bond ETF due to its higher fees and use of leverage, but it offers tax advantages for investors.

Distribution Dates and Amounts Announced for Certain BlackRock Closed-End Funds

businesswire.com

2024-03-01 16:30:00NEW YORK--(BUSINESS WIRE)--Certain BlackRock closed-end funds (the “Funds”) announced distributions today as detailed below. Municipal Funds: Declaration- 3/1/2024 Ex-Date- 3/14/2024 Record- 3/15/2024 Payable- 4/1/2024 National Funds Ticker Distribution Change From Prior Distribution BlackRock Municipal Income Quality Trust* BYM $0.052500 - BlackRock Long-Term Municipal Advantage Trust* BTA $0.043500 - BlackRock MuniAssets Fund, Inc.* MUA $0.055500 - BlackRock Municipal Income Fund, Inc.

Distribution Dates and Amounts Announced for Certain BlackRock Closed-End Funds

businesswire.com

2023-12-05 17:00:00NEW YORK--(BUSINESS WIRE)--Certain BlackRock closed-end funds (the “Funds”) announced distributions today as detailed below. BlackRock Floating Rate Income Trust (NYSE: BGT), BlackRock Floating Rate Income Strategies Fund, Inc. (NYSE: FRA) and BlackRock Debt Strategies Fund, Inc. (NYSE: DSU) announced increases to their monthly distributions. Certain BlackRock municipal Funds previously declared their December, January and February distributions and declared special distributions today in order.

Certain BlackRock Municipal Closed-End Funds Announce Variable Rate Muni Term Preferred Shares Actions

businesswire.com

2023-11-02 17:15:00NEW YORK--(BUSINESS WIRE)--BlackRock Advisors, LLC today announced BlackRock Municipal Income Trust (NYSE: BFK), BlackRock Investment Quality Municipal Trust, Inc. (NYSE: BKN), BlackRock Municipal Income Trust II (NYSE: BLE), BlackRock Municipal Income Quality Trust (NYSE: BYM), BlackRock MuniHoldings Fund, Inc. (NYSE: MHD), BlackRock MuniYield Quality Fund II, Inc. (NYSE: MQT), BlackRock MuniHoldings Quality Fund II, Inc. (NYSE: MUE), BlackRock MuniVest Fund, Inc. (NYSE: MVF), and BlackRock MuniVest Fund II, Inc. (NYSE: MVT) (collectively, the “Funds”) intend to redeem a portion of their outstanding Series W-7 Variable Rate Muni Term Preferred Shares (“VMTP Shares”) on or about November 24, 2023, at a redemption price equal to the liquidation preference of $100,000 per share, together with accumulated and unpaid dividends through the day prior to the redemption date. Shareholders are expected to benefit from lower expenses as a result of the redemptions.

BlackRock Announces Withdrawal of Municipal Closed-End Fund Merger Proposals

businesswire.com

2023-10-30 19:00:00NEW YORK--(BUSINESS WIRE)--The Boards of Directors/Trustees of BlackRock MuniYield Michigan Quality Fund, Inc. (NYSE: MIY), BlackRock MuniYield Pennsylvania Quality Fund (NYSE: MPA), BlackRock Virginia Municipal Bond Trust (NYSE: BHV), BlackRock Investment Quality Municipal Trust, Inc. (NYSE: BKN) and BlackRock MuniYield Quality Fund III, Inc. (NYSE: MYI) (each, a “Fund” and collectively, the “Funds”) today announced the withdrawal of merger proposals that were previously approved by the Boards.

BlackRock Announces Board Approval of Municipal Closed-End Fund Mergers

businesswire.com

2023-09-08 16:30:00NEW YORK--(BUSINESS WIRE)--BlackRock Advisors, LLC announced today that the Boards of Directors/Trustees of BlackRock MuniYield Michigan Quality Fund, Inc. (NYSE: MIY), BlackRock MuniYield Pennsylvania Quality Fund (NYSE: MPA), BlackRock Virginia Municipal Bond Trust (NYSE: BHV), BlackRock Investment Quality Municipal Trust, Inc. (NYSE: BKN) and BlackRock MuniYield Quality Fund III, Inc. (NYSE: MYI) (each, a “Fund” and collectively, the “Funds”) have approved the mergers of each of MIY, MPA, BHV and BKN with and into MYI, with MYI continuing as the surviving Fund (collectively, the “Mergers”).

Weekly Closed-End Fund Roundup: February 12, 2023

seekingalpha.com

2023-02-21 17:50:301 out of 22 CEF sectors positive on price and 0 out of 22 sectors positive on NAV last week. Senior loans lead while real estate lags.

BlackRock Announces Fiscal Year End Changes for Certain Municipal Closed-End Funds

businesswire.com

2022-06-03 16:30:00NEW YORK--(BUSINESS WIRE)--BlackRock Advisors, LLC (“BlackRock”) announced today a change to the fiscal year end (“FYE”) for each Fund listed below. These changes were made to reduce operating costs for the Funds and will be effective as of July 31, 2022. Ticker (NYSE) Fund Current FYE New FYE BKN BlackRock Investment Quality Municipal Trust, Inc. 4/30 7/31 BTA BlackRock Long-Term Municipal Advantage Trust 4/30 7/31 MUA BlackRock MuniAssets Fund, Inc. 4/30 7/31 MUI BlackRock Municipal Income Fu

BKN: Strong Municipal Bond CEF, Diversified Holdings, 5.3% Distribution Yield, Industry-Beating Returns

seekingalpha.com

2022-02-27 03:50:10BKN: Strong Municipal Bond CEF, Diversified Holdings, 5.3% Distribution Yield, Industry-Beating Returns

CEF Weekly Market Review: Funds Take A Breather

seekingalpha.com

2021-07-25 05:25:14We review CEF market valuation and performance over the past week and highlight recent events. CEF prices stalled in July on the back of lower risk sentiment driving discounts wider.

Rotation Choices For Expensive Muni CEFs

seekingalpha.com

2021-06-22 16:55:26The muni CEF sector has continued to rally this year due to the resilience of municipal bond yields and tight CEF discounts.

CEF Weekly Market Review: The Everything Rally

seekingalpha.com

2021-06-13 08:43:57We review CEF market valuation and performance over the first week of June and highlight recent events. The CEF market pushed higher at the start of June with a favorable backdrop of stable Treasury yields and rising equity prices.

Treasury Curve Bear-Steepened; Muni Yields Higher - Muni Fortnightly, August 31, 2020

seekingalpha.com

2020-09-06 01:50:00The Treasury curve bear-steepened and muni yields followed higher. Moody’s: Covid-19 will result in state and local government austerity and higher leverage.

Treasuries Had A Bear-Steepening Week: Fixed Income Weekly Monitor, August 31, 2020

seekingalpha.com

2020-09-02 03:00:00Treasury yields bear-steepened. Powell comments on desire for more inflation not immediately recognizable in yields.