The Bank of New York Mellon Corporation (BK)

Price:

114.64 USD

( - -3.54 USD)

Your position:

0 USD

ACTION PANEL

ABOUT

Check the

KEY TAKEAWAYS

ASK OUR AI ABOUT THE COMPANY (REGISTER FOR EARLY ACCESS)

(REGISTER FOR EARLY ACCESS) CHOOSE A PROMPT ABOVE TO ASK OUR AI ABOUT THE SPECIFIC INFORMATION

SIMILAR COMPANIES STI SCORE

Similar STI Score

Ameriprise Financial, Inc.

VALUE SCORE:

11

2nd position

FS Credit Opportunities Corp.

VALUE SCORE:

13

The best

RiverNorth Opportunities Fund, Inc.

VALUE SCORE:

14

FUNDAMENTALS

FUNDAMENTALS

FUNDAMENTALS

FUNDAMENTALS PER SHARE

TECHNICAL

DIVIDEND

SIMILAR COMPANIES

DESCRIPTION

The Bank of New York Mellon Corporation provides a range of financial products and services in the United States and internationally. The company operates through Securities Services, Market and Wealth Services, Investment and Wealth Management, and Other segments. The Securities Services segment offers custody, trust and depositary, accounting, exchange-traded funds, middle-office solutions, transfer agency, services for private equity and real estate funds, foreign exchange, securities lending, liquidity/lending services, prime brokerage, and data analytics. This segment also provides trustee, paying agency, fiduciary, escrow and other financial, issuer, and support services for brokers and investors. The Market and Wealth Services segment offers clearing and custody, investment, wealth and retirement solutions, technology and enterprise data management, trading, and prime brokerage services; and clearance and collateral management services. This segment also provides integrated cash management solutions, including payments, foreign exchange, liquidity management, receivables processing and payables management, and trade finance and processing services. The Investment and Wealth Management segment offers investment management strategies and distribution of investment products, investment management, custody, wealth and estate planning, private banking, investment, and information management services. The Other segment engages in the provision of leasing, corporate treasury, derivative and other trading, corporate and bank-owned life insurance, renewable energy investment, and business exit services. It serves central banks and sovereigns, financial institutions, asset managers, insurance companies, corporations, local authorities and high net-worth individuals, and family offices. The company was founded in 1784 and is headquartered in New York, New York.

NEWS

Empirical Financial Services LLC d.b.a. Empirical Wealth Management Increases Stake in The Bank of New York Mellon Corporation $BK

defenseworld.net

2026-02-21 04:42:52Empirical Financial Services LLC d.b.a. Empirical Wealth Management raised its holdings in shares of The Bank of New York Mellon Corporation (NYSE: BK) by 17.3% during the undefined quarter, according to its most recent filing with the Securities and Exchange Commission (SEC). The fund owned 155,519 shares of the bank's stock after acquiring

The Bank of New York Mellon Keeps Its Bullish Case As FY 2025 Results Show More Upside Drivers

seekingalpha.com

2026-02-20 08:30:32The Bank of New York Mellon Keeps Its Bullish Case As FY 2025 Results Show More Upside Drivers

The Bank of New York Mellon Corporation $BK Shares Bought by Axxcess Wealth Management LLC

defenseworld.net

2026-02-20 04:58:54Axxcess Wealth Management LLC lifted its position in shares of The Bank of New York Mellon Corporation (NYSE: BK) by 27.6% during the third quarter, according to the company in its most recent Form 13F filing with the Securities and Exchange Commission. The firm owned 24,152 shares of the bank's stock after acquiring

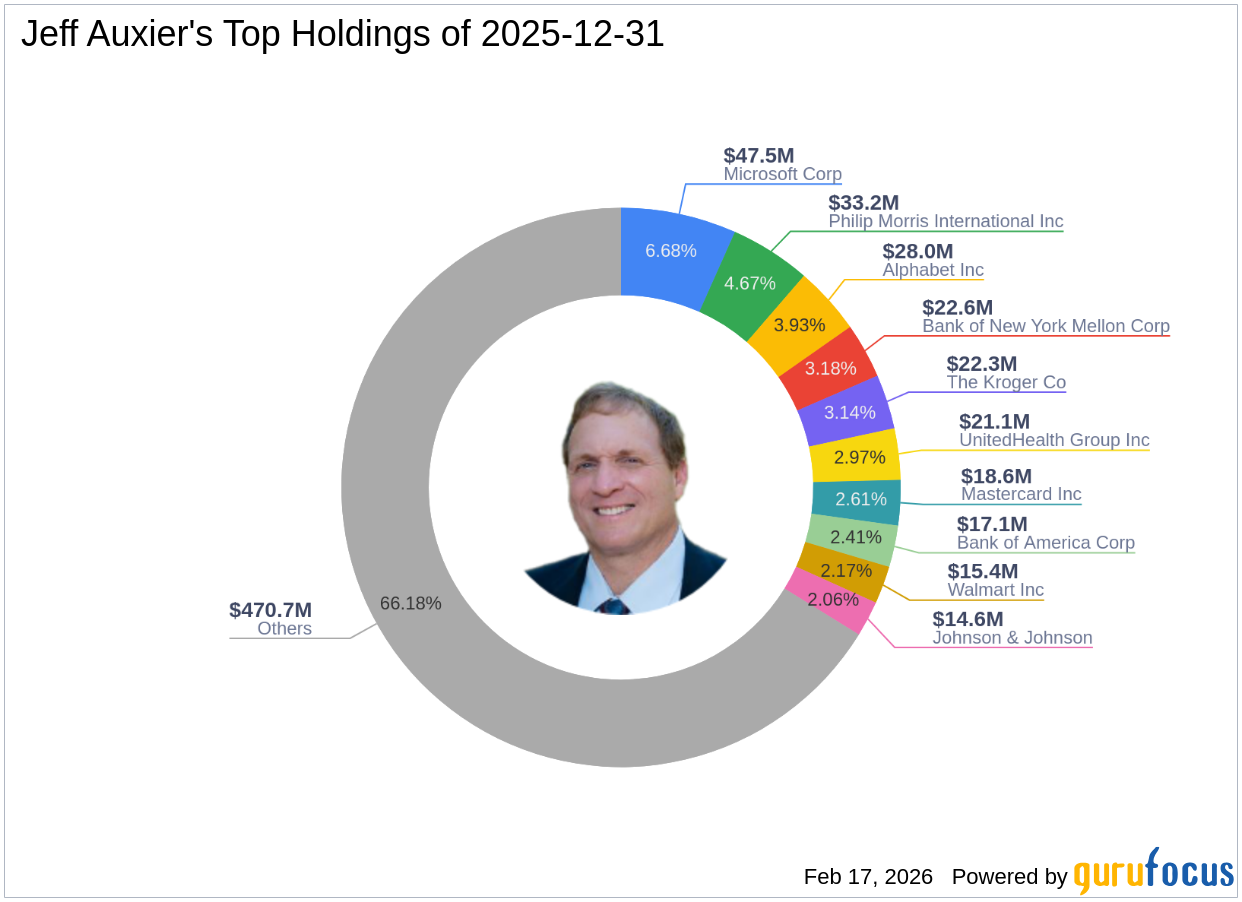

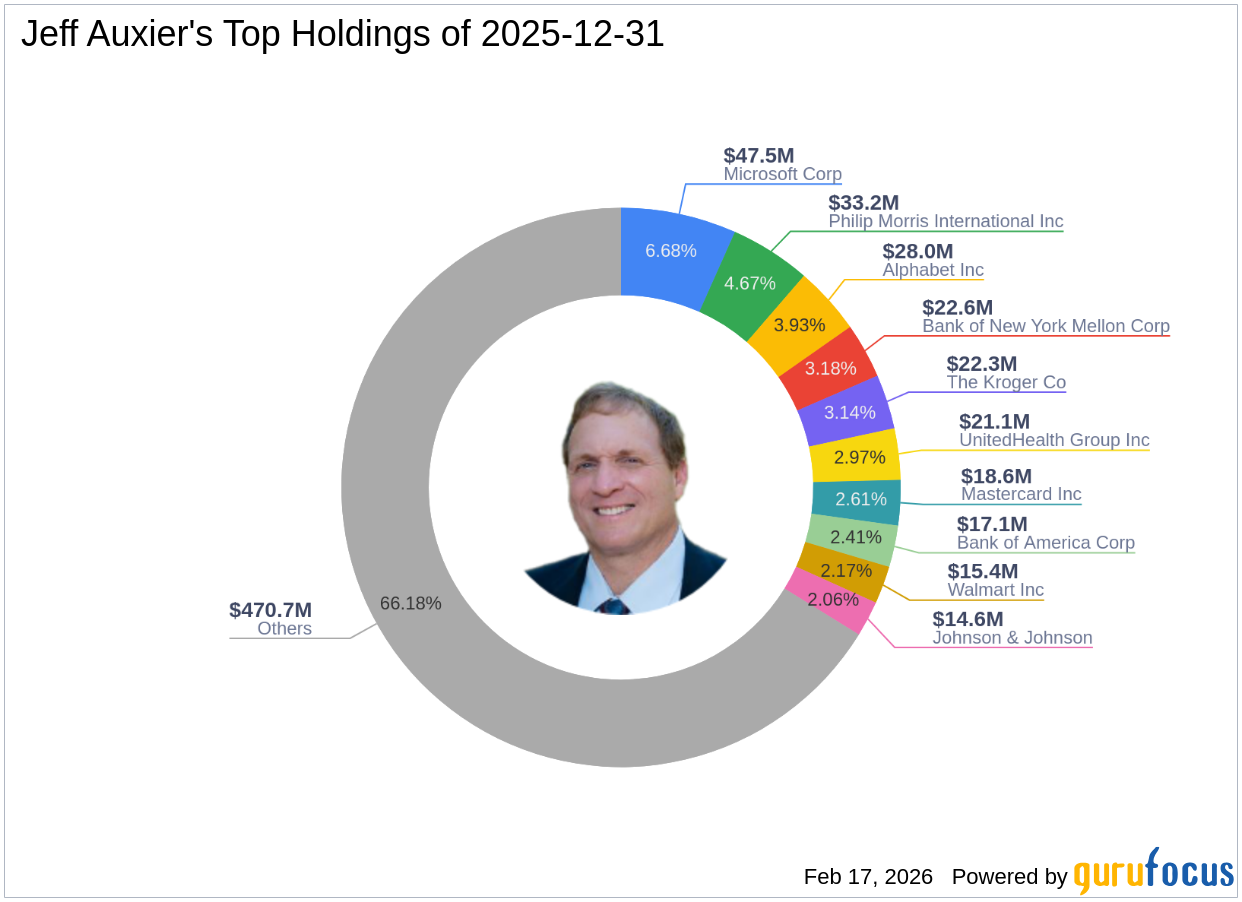

Fiserv Inc: A Significant Move in Jeff Auxier's Portfolio

gurufocus.com

2026-02-17 18:09:00Exploring the Strategic Investment Decisions of a Renowned Value Investor Jeff Auxier (Trades, Portfolio) recently submitted the 13F filing for the fourth quar

Aberdeen Group plc Reduces Position in The Bank of New York Mellon Corporation $BK

defenseworld.net

2026-02-16 03:16:58Aberdeen Group plc trimmed its holdings in The Bank of New York Mellon Corporation (NYSE: BK) by 4.5% during the third quarter, according to its most recent 13F filing with the Securities and Exchange Commission (SEC). The institutional investor owned 646,191 shares of the bank's stock after selling 30,446 shares during the quarter.

Assetmark Inc. Acquires 41,473 Shares of The Bank of New York Mellon Corporation $BK

defenseworld.net

2026-02-15 04:44:52Assetmark Inc. grew its stake in The Bank of New York Mellon Corporation (NYSE: BK) by 29.1% during the third quarter, according to its most recent 13F filing with the Securities and Exchange Commission. The firm owned 184,128 shares of the bank's stock after acquiring an additional 41,473 shares during the quarter. Assetmark

Dodge & Cox's Strategic Moves: A Closer Look at Brookfield Corp's Impact

gurufocus.com

2026-02-13 14:00:00Insightful Analysis of Dodge and Cox (Trades, Portfolio)'s Fourth Quarter 2025 13F Filing Dodge and Cox recently submitted their 13F filing for the fourth quarter

BNY clients hedge dollar exposure by most since 2023, bank says

reuters.com

2026-02-13 11:22:49Clients of BNY, one of the world's biggest custodians, are hedging their exposure to the dollar by the most in over two years, a senior strategist told Reuters on Friday, reflecting an increase in investor caution towards the U.S. currency this year.

Caisse Des Depots ET Consignations Lowers Stock Holdings in The Bank of New York Mellon Corporation $BK

defenseworld.net

2026-02-12 06:21:08Caisse Des Depots ET Consignations cut its holdings in The Bank of New York Mellon Corporation (NYSE: BK) by 42.6% in the undefined quarter, according to its most recent 13F filing with the SEC. The fund owned 43,217 shares of the bank's stock after selling 32,012 shares during the period. Caisse Des Depots

The Bank of New York Mellon Corporation (BK) Presents at Bank of America Financial Services Conference 2026 Transcript

seekingalpha.com

2026-02-11 15:34:22The Bank of New York Mellon Corporation (BK) Presents at Bank of America Financial Services Conference 2026 Transcript

The Bank of New York Mellon Corporation $BK Shares Acquired by Advisors Asset Management Inc.

defenseworld.net

2026-02-11 03:36:56Advisors Asset Management Inc. increased its position in The Bank of New York Mellon Corporation (NYSE: BK) by 7.4% during the undefined quarter, according to its most recent filing with the Securities and Exchange Commission. The firm owned 108,192 shares of the bank's stock after buying an additional 7,450 shares during the quarter.

America's Oldest Bank Bets Big On AI

youtube.com

2026-02-09 10:40:56America's oldest bank is going all in on AI. BNY spends nearly $4 billion a year on technology, or about 19 percent of its revenue – a proportion far higher than any of its big-bank peers.

18,436 Shares in The Bank of New York Mellon Corporation $BK Bought by Sunesis Advisors LLC

defenseworld.net

2026-02-09 04:48:43Sunesis Advisors LLC acquired a new stake in shares of The Bank of New York Mellon Corporation (NYSE: BK) during the undefined quarter, according to its most recent disclosure with the Securities and Exchange Commission (SEC). The firm acquired 18,436 shares of the bank's stock, valued at approximately $2,009,000. Bank of New York

The Bank of New York Mellon Corporation $BK Shares Sold by Envestnet Asset Management Inc.

defenseworld.net

2026-02-06 04:46:53Envestnet Asset Management Inc. cut its stake in shares of The Bank of New York Mellon Corporation (NYSE: BK) by 10.1% during the third quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The fund owned 2,056,364 shares of the bank's stock after selling 231,323 shares

The Bank of New York Mellon Corporation (NYSE:BK) Receives Consensus Recommendation of “Moderate Buy” from Analysts

defenseworld.net

2026-02-06 02:01:16The Bank of New York Mellon Corporation (NYSE: BK - Get Free Report) has earned an average rating of "Moderate Buy" from the twelve research firms that are currently covering the company, Marketbeat.com reports. Four investment analysts have rated the stock with a hold rating, seven have given a buy rating and one has assigned a

Meridian Wealth Management LLC Has $1.38 Million Stock Holdings in The Bank of New York Mellon Corporation $BK

defenseworld.net

2026-02-03 05:02:46Meridian Wealth Management LLC raised its position in shares of The Bank of New York Mellon Corporation (NYSE: BK) by 168.8% in the undefined quarter, according to the company in its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The institutional investor owned 12,621 shares of the bank's stock

Empirical Financial Services LLC d.b.a. Empirical Wealth Management Increases Stake in The Bank of New York Mellon Corporation $BK

defenseworld.net

2026-02-21 04:42:52Empirical Financial Services LLC d.b.a. Empirical Wealth Management raised its holdings in shares of The Bank of New York Mellon Corporation (NYSE: BK) by 17.3% during the undefined quarter, according to its most recent filing with the Securities and Exchange Commission (SEC). The fund owned 155,519 shares of the bank's stock after acquiring

The Bank of New York Mellon Keeps Its Bullish Case As FY 2025 Results Show More Upside Drivers

seekingalpha.com

2026-02-20 08:30:32The Bank of New York Mellon Keeps Its Bullish Case As FY 2025 Results Show More Upside Drivers

The Bank of New York Mellon Corporation $BK Shares Bought by Axxcess Wealth Management LLC

defenseworld.net

2026-02-20 04:58:54Axxcess Wealth Management LLC lifted its position in shares of The Bank of New York Mellon Corporation (NYSE: BK) by 27.6% during the third quarter, according to the company in its most recent Form 13F filing with the Securities and Exchange Commission. The firm owned 24,152 shares of the bank's stock after acquiring

Fiserv Inc: A Significant Move in Jeff Auxier's Portfolio

gurufocus.com

2026-02-17 18:09:00Exploring the Strategic Investment Decisions of a Renowned Value Investor Jeff Auxier (Trades, Portfolio) recently submitted the 13F filing for the fourth quar

Aberdeen Group plc Reduces Position in The Bank of New York Mellon Corporation $BK

defenseworld.net

2026-02-16 03:16:58Aberdeen Group plc trimmed its holdings in The Bank of New York Mellon Corporation (NYSE: BK) by 4.5% during the third quarter, according to its most recent 13F filing with the Securities and Exchange Commission (SEC). The institutional investor owned 646,191 shares of the bank's stock after selling 30,446 shares during the quarter.

Assetmark Inc. Acquires 41,473 Shares of The Bank of New York Mellon Corporation $BK

defenseworld.net

2026-02-15 04:44:52Assetmark Inc. grew its stake in The Bank of New York Mellon Corporation (NYSE: BK) by 29.1% during the third quarter, according to its most recent 13F filing with the Securities and Exchange Commission. The firm owned 184,128 shares of the bank's stock after acquiring an additional 41,473 shares during the quarter. Assetmark

Dodge & Cox's Strategic Moves: A Closer Look at Brookfield Corp's Impact

gurufocus.com

2026-02-13 14:00:00Insightful Analysis of Dodge and Cox (Trades, Portfolio)'s Fourth Quarter 2025 13F Filing Dodge and Cox recently submitted their 13F filing for the fourth quarter

BNY clients hedge dollar exposure by most since 2023, bank says

reuters.com

2026-02-13 11:22:49Clients of BNY, one of the world's biggest custodians, are hedging their exposure to the dollar by the most in over two years, a senior strategist told Reuters on Friday, reflecting an increase in investor caution towards the U.S. currency this year.

Caisse Des Depots ET Consignations Lowers Stock Holdings in The Bank of New York Mellon Corporation $BK

defenseworld.net

2026-02-12 06:21:08Caisse Des Depots ET Consignations cut its holdings in The Bank of New York Mellon Corporation (NYSE: BK) by 42.6% in the undefined quarter, according to its most recent 13F filing with the SEC. The fund owned 43,217 shares of the bank's stock after selling 32,012 shares during the period. Caisse Des Depots

The Bank of New York Mellon Corporation (BK) Presents at Bank of America Financial Services Conference 2026 Transcript

seekingalpha.com

2026-02-11 15:34:22The Bank of New York Mellon Corporation (BK) Presents at Bank of America Financial Services Conference 2026 Transcript

The Bank of New York Mellon Corporation $BK Shares Acquired by Advisors Asset Management Inc.

defenseworld.net

2026-02-11 03:36:56Advisors Asset Management Inc. increased its position in The Bank of New York Mellon Corporation (NYSE: BK) by 7.4% during the undefined quarter, according to its most recent filing with the Securities and Exchange Commission. The firm owned 108,192 shares of the bank's stock after buying an additional 7,450 shares during the quarter.

America's Oldest Bank Bets Big On AI

youtube.com

2026-02-09 10:40:56America's oldest bank is going all in on AI. BNY spends nearly $4 billion a year on technology, or about 19 percent of its revenue – a proportion far higher than any of its big-bank peers.

18,436 Shares in The Bank of New York Mellon Corporation $BK Bought by Sunesis Advisors LLC

defenseworld.net

2026-02-09 04:48:43Sunesis Advisors LLC acquired a new stake in shares of The Bank of New York Mellon Corporation (NYSE: BK) during the undefined quarter, according to its most recent disclosure with the Securities and Exchange Commission (SEC). The firm acquired 18,436 shares of the bank's stock, valued at approximately $2,009,000. Bank of New York

The Bank of New York Mellon Corporation $BK Shares Sold by Envestnet Asset Management Inc.

defenseworld.net

2026-02-06 04:46:53Envestnet Asset Management Inc. cut its stake in shares of The Bank of New York Mellon Corporation (NYSE: BK) by 10.1% during the third quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The fund owned 2,056,364 shares of the bank's stock after selling 231,323 shares

The Bank of New York Mellon Corporation (NYSE:BK) Receives Consensus Recommendation of “Moderate Buy” from Analysts

defenseworld.net

2026-02-06 02:01:16The Bank of New York Mellon Corporation (NYSE: BK - Get Free Report) has earned an average rating of "Moderate Buy" from the twelve research firms that are currently covering the company, Marketbeat.com reports. Four investment analysts have rated the stock with a hold rating, seven have given a buy rating and one has assigned a

Meridian Wealth Management LLC Has $1.38 Million Stock Holdings in The Bank of New York Mellon Corporation $BK

defenseworld.net

2026-02-03 05:02:46Meridian Wealth Management LLC raised its position in shares of The Bank of New York Mellon Corporation (NYSE: BK) by 168.8% in the undefined quarter, according to the company in its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The institutional investor owned 12,621 shares of the bank's stock