iShares USD Green Bond ETF (BGRN)

Price:

47.99 USD

( - -0.05 USD)

Your position:

0 USD

ACTION PANEL

Check the

KEY TAKEAWAYS

ASK OUR AI ABOUT THE COMPANY (REGISTER FOR EARLY ACCESS)

(REGISTER FOR EARLY ACCESS) CHOOSE A PROMPT ABOVE TO ASK OUR AI ABOUT THE SPECIFIC INFORMATION

SIMILAR COMPANIES STI SCORE

Similar STI Score

Invesco BulletShares 2027 High Yield Corporate Bond ETF

VALUE SCORE:

11

2nd position

Vanguard Emerging Markets Government Bond Index Fund

VALUE SCORE:

12

The best

Vanguard Long-Term Corporate Bond Index Fund

VALUE SCORE:

12

FUNDAMENTALS

FUNDAMENTALS

FUNDAMENTALS

FUNDAMENTALS PER SHARE

TECHNICAL

DIVIDEND

SIMILAR COMPANIES

DESCRIPTION

The fund seeks to track the investment results of the underlying index, which measures the performance of U.S. dollar-denominated investment-grade green bonds issued by U.S. and non-U.S. issuers to fund projects with direct environmental benefits.

NEWS

Disruptive Theme of the Week: Carbon Capture Utilization and Storage

etftrends.com

2024-06-26 15:13:56Ultimately, climate change solutions will need cooperation from all parties, especially in hard-to-abate industries. This includes categories such as natural gas, steel, cement, and chemicals.

Dimensional Expands Sustainable ETF Suite

etf.com

2022-11-17 13:23:38The launch reflects a growing demand in green investing.

Dimensional Launches First Sustainable ETFs

etf.com

2022-11-04 04:36:09The launch reflects growing demand for green investing.

ETF Odds & Ends: Quiet Yet Eventful Week

etf.com

2022-03-05 09:04:32Global events seem to have put a damper on the U.S. ETF industry.

Responsible Investing Making Strides With U.S. Investors, Fund Companies, And Regulators In 2021

seekingalpha.com

2021-12-17 10:33:00Momentum for the U.S. Responsible Investing industry picked up in January when President Joe Biden signed executive orders to re-enter into the Paris Climate Agreement. In 2021 through October month-end, there were 110 equity and fixed income funds that launched focused on Responsible Investing—71 RI-related ETFs and 39 RI-related mutual funds.

Clean And Green Investing For A Low-Carbon Economy

seekingalpha.com

2021-08-30 11:33:00Given the magnitude of the changes we foresee, long-term investors may find opportunities in the technologies and innovations that create renewable energy sources or reduce the carbon intensity of energy production. Net zero is about reducing greenhouse gas emissions so that over time we can achieve an overall balance between emissions produced, and the emissions removed from the overall atmosphere.

7 Top International Stocks to Buy Today

investorplace.com

2021-06-18 10:19:30If you want to invest in overseas markets, these seven top international stocks can help diversify your portfolio with more good returns. The post 7 Top International Stocks to Buy Today appeared first on InvestorPlace.

Introducing The Pale Blue Portfolio

seekingalpha.com

2020-07-29 17:20:54The Pale Blue Portfolio prioritizes corporate responsibility and growth at a reasonable price. It limits the investing universe to companies that receive at least an A grade from MSCI's ESG database.

The Reopening Killed The V-Shaped Recovery

seekingalpha.com

2020-06-29 07:43:33This is a weekly series focused on analyzing the previous week’s economic data releases. The objective is to concentrate on leading indicators of economic activ

Value Is A Poor Timing Tool

seekingalpha.com

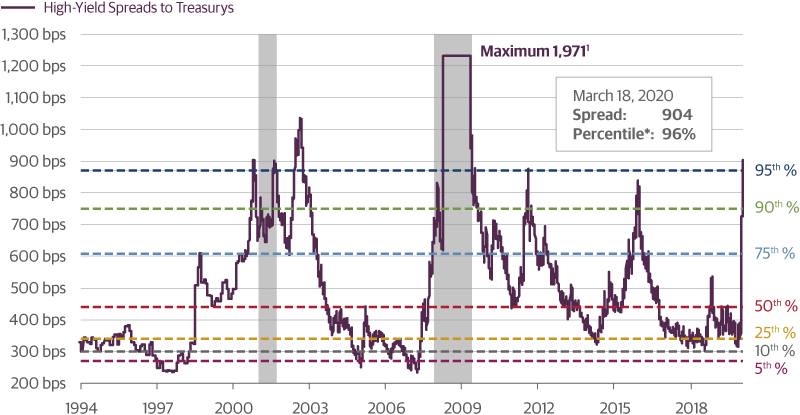

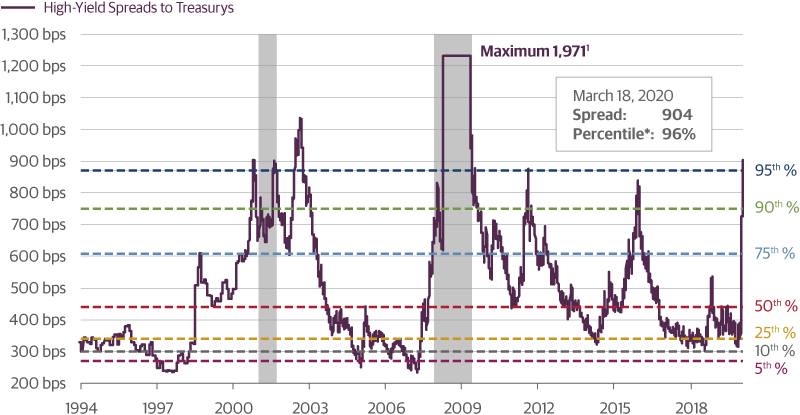

2020-03-20 20:38:16Investment-grade and high-yield bonds have traded cheaper than where they are right now less than 10 percent of the time. But markets often overshoot, and just

No data to display

Disruptive Theme of the Week: Carbon Capture Utilization and Storage

etftrends.com

2024-06-26 15:13:56Ultimately, climate change solutions will need cooperation from all parties, especially in hard-to-abate industries. This includes categories such as natural gas, steel, cement, and chemicals.

Dimensional Expands Sustainable ETF Suite

etf.com

2022-11-17 13:23:38The launch reflects a growing demand in green investing.

Dimensional Launches First Sustainable ETFs

etf.com

2022-11-04 04:36:09The launch reflects growing demand for green investing.

ETF Odds & Ends: Quiet Yet Eventful Week

etf.com

2022-03-05 09:04:32Global events seem to have put a damper on the U.S. ETF industry.

Responsible Investing Making Strides With U.S. Investors, Fund Companies, And Regulators In 2021

seekingalpha.com

2021-12-17 10:33:00Momentum for the U.S. Responsible Investing industry picked up in January when President Joe Biden signed executive orders to re-enter into the Paris Climate Agreement. In 2021 through October month-end, there were 110 equity and fixed income funds that launched focused on Responsible Investing—71 RI-related ETFs and 39 RI-related mutual funds.

Clean And Green Investing For A Low-Carbon Economy

seekingalpha.com

2021-08-30 11:33:00Given the magnitude of the changes we foresee, long-term investors may find opportunities in the technologies and innovations that create renewable energy sources or reduce the carbon intensity of energy production. Net zero is about reducing greenhouse gas emissions so that over time we can achieve an overall balance between emissions produced, and the emissions removed from the overall atmosphere.

7 Top International Stocks to Buy Today

investorplace.com

2021-06-18 10:19:30If you want to invest in overseas markets, these seven top international stocks can help diversify your portfolio with more good returns. The post 7 Top International Stocks to Buy Today appeared first on InvestorPlace.

Introducing The Pale Blue Portfolio

seekingalpha.com

2020-07-29 17:20:54The Pale Blue Portfolio prioritizes corporate responsibility and growth at a reasonable price. It limits the investing universe to companies that receive at least an A grade from MSCI's ESG database.

The Reopening Killed The V-Shaped Recovery

seekingalpha.com

2020-06-29 07:43:33This is a weekly series focused on analyzing the previous week’s economic data releases. The objective is to concentrate on leading indicators of economic activ

Value Is A Poor Timing Tool

seekingalpha.com

2020-03-20 20:38:16Investment-grade and high-yield bonds have traded cheaper than where they are right now less than 10 percent of the time. But markets often overshoot, and just