AXT, Inc. (AXTI)

Price:

2.82 USD

( + 0.34 USD)

Your position:

0 USD

ACTION PANEL

ABOUT

Check the

KEY TAKEAWAYS

ASK OUR AI ABOUT THE COMPANY (REGISTER FOR EARLY ACCESS)

(REGISTER FOR EARLY ACCESS) CHOOSE A PROMPT ABOVE TO ASK OUR AI ABOUT THE SPECIFIC INFORMATION

SIMILAR COMPANIES STI SCORE

Similar STI Score

Advanced Micro Devices, Inc.

VALUE SCORE:

6

2nd position

Applied Materials, Inc.

VALUE SCORE:

10

The best

ACM Research, Inc.

VALUE SCORE:

11

FUNDAMENTALS

FUNDAMENTALS

FUNDAMENTALS

FUNDAMENTALS PER SHARE

TECHNICAL

DIVIDEND

SIMILAR COMPANIES

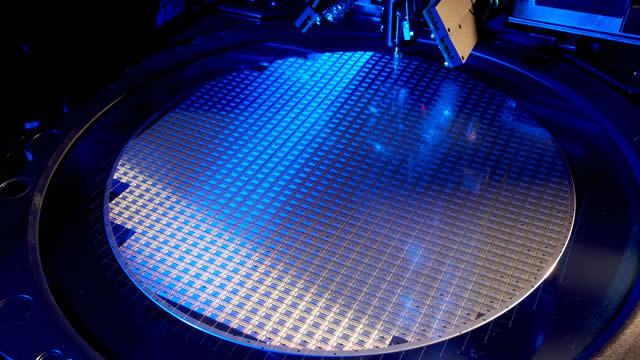

DESCRIPTION

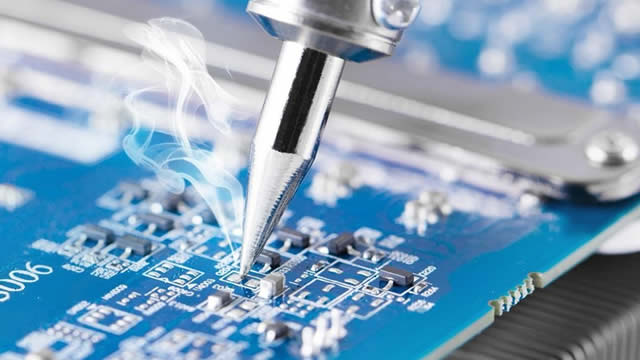

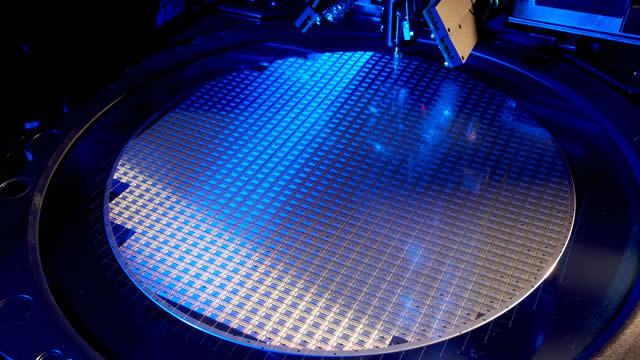

AXT, Inc. designs, develops, manufactures, and distributes compound and single element semiconductor substrates. It produces semiconductor substrates using its proprietary vertical gradient freeze technology. The company offers indium phosphide for use in data center connectivity using light/lasers, 5G communications, fiber optic lasers and detectors, passive optical networks, silicon photonics, photonic integrated circuits, terrestrial solar cells, RF amplifier and switching, infrared light-emitting diode (LEDS) motion control, lidar for robotics and autonomous vehicles, and infrared thermal imaging. It also provides semi-insulating gallium arsenide (GaAs) substrates for use in Wi-Fi and IoT devices, transistors, direct broadcast television, power amplifiers, satellite communications, and solar cells; and semi-conducting GaAs substrates that are used in LED, screen displays, printer head lasers and LEDs, 3-D sensing using VCSELs, data center communication using VCSELs, sensors for industrial robotics/near-infrared sensors, optical couplers, solar cells, night vision goggles, lidar for robotics and autonomous vehicles, and other lasers, as well as laser machining, cutting, and drilling. In addition, the company offers germanium substrates for use in multi-junction solar cells for satellites, optical sensors and detectors, terrestrial concentrated photo voltaic cells, infrared detectors, and carrier wafer for LED. Further, it provides 6N+ and 7N+ purified gallium, boron trioxide, gallium-magnesium alloy, pyrolytic boron nitride (pBN) crucibles, and pBN insulating parts. AXT, Inc. sells its products through direct salesforce in the United States, China, and Europe, as well as through independent sales representatives and distributors in Japan, Taiwan, Korea, and internationally. The company was formerly known as American Xtal Technology, Inc. and changed its name to AXT, Inc. in July 2000. AXT, Inc. was incorporated in 1986 and is headquartered in Fremont, California.

NEWS

AXT Reports Weak Q2 2025 Results Due To Permit Delays

seekingalpha.com

2025-08-06 10:46:48AXT posted lower revenues and gross profit for Q2. Permit delays for gallium arsenide exports caused the decrease. Q3 2025 results are also expected to be weaker.

AXT (AXTI) Q2 Revenue Drops 36%

fool.com

2025-08-01 15:11:30AXT (AXTI) Q2 Revenue Drops 36%

AXT, Inc. (AXTI) Q2 2025 Earnings Call Transcript

seekingalpha.com

2025-07-31 21:23:53AXT, Inc. (NASDAQ:AXTI ) Q2 2025 Earnings Conference Call July 31, 2025 4:30 PM ET Company Participants Gary L. Fischer - CFO, VP & Corporate Secretary Leslie Green - Investor Relations Morris S.

AXT (AXTI) Reports Q2 Loss, Beats Revenue Estimates

zacks.com

2025-07-31 18:26:28AXT (AXTI) came out with a quarterly loss of $0.15 per share versus the Zacks Consensus Estimate of a loss of $0.13. This compares to a loss of $0.02 per share a year ago.

AXT, Inc. Announces Second Quarter 2025 Financial Results

businesswire.com

2025-07-31 16:05:00FREMONT, Calif.--(BUSINESS WIRE)--AXT, Inc. (NasdaqGS: AXTI), a leading manufacturer of compound semiconductor wafer substrates, today reported financial results for the second quarter, ended June 30, 2025. Management Qualitative Comments “Our substrate revenue increased in Q2 from the prior quarter, though the increase was less than we had expected as a result of longer processing times for gallium arsenide export permits, coupled with some sluggishness in the demand environment in China, whic.

Earnings Preview: AXT (AXTI) Q2 Earnings Expected to Decline

zacks.com

2025-07-24 11:07:35AXT (AXTI) doesn't possess the right combination of the two key ingredients for a likely earnings beat in its upcoming report. Get prepared with the key expectations.

Should You Buy AXT (AXTI) After Golden Cross?

zacks.com

2025-07-22 10:55:16AXT Inc (AXTI) is looking like an interesting pick from a technical perspective, as the company reached a key level of support. Recently, AXTI's 50-day simple moving average crossed above its 200-day simple moving average, known as a "golden cross.

AXT, Inc. Announces Passing of Board Member Christine Russell

businesswire.com

2025-07-17 18:02:00FREMONT, Calif.--(BUSINESS WIRE)--AXT, Inc. (NasdaqGS: AXTI), a leading manufacturer of compound semiconductor substrates, is saddened to report that Ms. Christine Russell, a member of the Company's Board of Directors, passed away on July 11, 2025. Ms. Russell joined the Company's Board in December 2019 as an independent director. Ms. Russell served as Chair of the Audit Committee and was a member of the Compensation Committee and the Nominating and Corporate Governance Committee. “AXT is grate.

AXT Drops On Negative Q1 2025 Profit Margins And Weak Q2 Outlook

seekingalpha.com

2025-07-13 08:00:00AXT reported poor financial performance for Q1 2025 with negative profit margins. The company is still dealing with Chinese prohibitions on indium phosphide exports. AXT downgraded its own revenue expectations for Q2 2025.

AXT, Inc. Announces a Preliminary Revenue Range for Second Quarter 2025

businesswire.com

2025-07-09 16:05:00FREMONT, Calif.--(BUSINESS WIRE)--AXT, Inc. (NasdaqGS: AXTI), a leading manufacturer of compound semiconductor substrates, today announced a preliminary revenue range for its second quarter, ended June 30, 2025. AXT's full financial results for the second quarter of 2025 are scheduled to be announced on July 31, 2025. AXT expects preliminary revenue for the second quarter of 2025 to be in the range of $17.5 to $18 million, below the company's previously stated guidance of $20 million to $22 mil.

Squarepoint Ops LLC Sells 56,686 Shares of AXT, Inc. (NASDAQ:AXTI)

https://www.defenseworld.net

2025-06-11 03:36:52Squarepoint Ops LLC lessened its stake in shares of AXT, Inc. (NASDAQ:AXTI – Free Report) by 76.4% during the fourth quarter, according to the company in its most recent disclosure with the SEC. The fund owned 17,523 shares of the semiconductor company’s stock after selling 56,686 shares during the quarter. Squarepoint Ops LLC’s holdings in AXT were worth $38,000 as of its most recent SEC filing. Other hedge funds and other institutional investors have also recently modified their holdings of the company. Point72 Asset Management L.P. bought a new stake in shares of AXT during the fourth quarter worth $628,000. Pacific Ridge Capital Partners LLC grew its stake in shares of AXT by 65.4% during the fourth quarter. Pacific Ridge Capital Partners LLC now owns 1,937,424 shares of the semiconductor company’s stock worth $4,204,000 after buying an additional 766,122 shares during the last quarter. Empowered Funds LLC grew its stake in shares of AXT by 5.2% in the fourth quarter. Empowered Funds LLC now owns 145,664 shares of the semiconductor company’s stock worth $316,000 after purchasing an additional 7,165 shares during the last quarter. Bleakley Financial Group LLC bought a new stake in shares of AXT in the fourth quarter worth $29,000. Finally, Jane Street Group LLC bought a new stake in shares of AXT in the fourth quarter worth $60,000. Institutional investors own 49.52% of the company’s stock. AXT Trading Up 6.0% Shares of AXTI opened at $1.94 on Wednesday. The stock has a market capitalization of $88.47 million, a P/E ratio of -6.93 and a beta of 1.98. The firm’s fifty day simple moving average is $1.41 and its two-hundred day simple moving average is $1.79. AXT, Inc. has a 12 month low of $1.13 and a 12 month high of $4.03. AXT (NASDAQ:AXTI – Get Free Report) last issued its quarterly earnings results on Thursday, May 1st. The semiconductor company reported ($0.20) EPS for the quarter, missing analysts’ consensus estimates of ($0.13) by ($0.07). AXT had a negative net margin of 11.70% and a negative return on equity of 5.27%. As a group, research analysts predict that AXT, Inc. will post -0.12 EPS for the current fiscal year. Analysts Set New Price Targets AXTI has been the topic of several analyst reports. Wall Street Zen raised shares of AXT to a “sell” rating in a research note on Friday, April 25th. B. Riley reduced their price objective on shares of AXT from $6.00 to $4.50 and set a “buy” rating on the stock in a research note on Friday, May 2nd. Wedbush reissued an “outperform” rating and issued a $4.50 price objective on shares of AXT in a research note on Tuesday, April 29th. Finally, Needham & Company LLC reissued a “buy” rating and issued a $5.00 price objective on shares of AXT in a research note on Friday, February 21st. One analyst has rated the stock with a sell rating and four have issued a buy rating to the stock. Based on data from MarketBeat, the company presently has a consensus rating of “Moderate Buy” and a consensus target price of $4.75. Read Our Latest Stock Report on AXT AXT Company Profile (Free Report) AXT, Inc designs, develops, manufactures, and distributes compound and single element semiconductor substrates. The company offers indium phosphide for use in data center connectivity using light/lasers, high-speed data transfer in data centers, 5G communications, fiber optic lasers and detectors, consumer devices, passive optical networks, silicon photonics, photonic integrated circuits, thermo-photovoltaics, RF amplifier and switching, infrared light-emitting diode (LEDS) motion control, lidar for robotics and autonomous vehicles, and infrared thermal imaging.

AXT, Inc. (AXTI) Q1 2025 Earnings Call Transcript

seekingalpha.com

2025-05-01 23:05:26AXT, Inc. (AXTI) Q1 2025 Earnings Call Transcript

AXT (AXTI) Reports Q1 Loss, Tops Revenue Estimates

zacks.com

2025-05-01 19:00:42AXT (AXTI) came out with a quarterly loss of $0.19 per share versus the Zacks Consensus Estimate of a loss of $0.13. This compares to loss of $0.03 per share a year ago.

AXT, Inc. Announces First Quarter 2025 Financial Results

businesswire.com

2025-05-01 16:05:00FREMONT, Calif.--(BUSINESS WIRE)--AXT, Inc. (NasdaqGS: AXTI), a leading manufacturer of compound semiconductor wafer substrates, today reported financial results for the first quarter, ended March 31, 2025. Management Qualitative Comments “While the geopolitical environment is creating undeniable challenges, we are focusing our energies where we can drive positive returns today,” said Morris Young, chief executive officer. “Tongmei, our China subsidiary, is uniquely positioned to optimize growt.

AXT, Inc. Schedules First Quarter 2025 Earnings Release for May 1, 2025

businesswire.com

2025-04-03 16:05:00FREMONT, Calif.--(BUSINESS WIRE)--AXT, Inc. (NasdaqGS: AXTI), a leading manufacturer of compound semiconductor substrates, will announce its financial results for the first quarter 2025 in a press release immediately following the close of market on May 1, 2025. The company will also host a conference call to discuss these results on May 1, 2025 at 1:30 p.m. PT. The conference call can be accessed at (800) 715-9871 (passcode 4378083). The call will also be simulcast at www.axt.com. Replays will.

AXT, Inc. Reported Improved Q4 Financial Performance But Q1 Outlook Disappoints

seekingalpha.com

2025-02-24 13:04:44AXT, Inc. reported increased revenues QoQ and YoY due to higher demand for its indium phosphide wafers. The company expects lower Q1 2025 revenues due to new regulations in China over exports of indium phosphide. The company's stock price hit its 52-week low last Friday due to the weak Q1 outlook.

No data to display

AXT Reports Weak Q2 2025 Results Due To Permit Delays

seekingalpha.com

2025-08-06 10:46:48AXT posted lower revenues and gross profit for Q2. Permit delays for gallium arsenide exports caused the decrease. Q3 2025 results are also expected to be weaker.

AXT (AXTI) Q2 Revenue Drops 36%

fool.com

2025-08-01 15:11:30AXT (AXTI) Q2 Revenue Drops 36%

AXT, Inc. (AXTI) Q2 2025 Earnings Call Transcript

seekingalpha.com

2025-07-31 21:23:53AXT, Inc. (NASDAQ:AXTI ) Q2 2025 Earnings Conference Call July 31, 2025 4:30 PM ET Company Participants Gary L. Fischer - CFO, VP & Corporate Secretary Leslie Green - Investor Relations Morris S.

AXT (AXTI) Reports Q2 Loss, Beats Revenue Estimates

zacks.com

2025-07-31 18:26:28AXT (AXTI) came out with a quarterly loss of $0.15 per share versus the Zacks Consensus Estimate of a loss of $0.13. This compares to a loss of $0.02 per share a year ago.

AXT, Inc. Announces Second Quarter 2025 Financial Results

businesswire.com

2025-07-31 16:05:00FREMONT, Calif.--(BUSINESS WIRE)--AXT, Inc. (NasdaqGS: AXTI), a leading manufacturer of compound semiconductor wafer substrates, today reported financial results for the second quarter, ended June 30, 2025. Management Qualitative Comments “Our substrate revenue increased in Q2 from the prior quarter, though the increase was less than we had expected as a result of longer processing times for gallium arsenide export permits, coupled with some sluggishness in the demand environment in China, whic.

Earnings Preview: AXT (AXTI) Q2 Earnings Expected to Decline

zacks.com

2025-07-24 11:07:35AXT (AXTI) doesn't possess the right combination of the two key ingredients for a likely earnings beat in its upcoming report. Get prepared with the key expectations.

Should You Buy AXT (AXTI) After Golden Cross?

zacks.com

2025-07-22 10:55:16AXT Inc (AXTI) is looking like an interesting pick from a technical perspective, as the company reached a key level of support. Recently, AXTI's 50-day simple moving average crossed above its 200-day simple moving average, known as a "golden cross.

AXT, Inc. Announces Passing of Board Member Christine Russell

businesswire.com

2025-07-17 18:02:00FREMONT, Calif.--(BUSINESS WIRE)--AXT, Inc. (NasdaqGS: AXTI), a leading manufacturer of compound semiconductor substrates, is saddened to report that Ms. Christine Russell, a member of the Company's Board of Directors, passed away on July 11, 2025. Ms. Russell joined the Company's Board in December 2019 as an independent director. Ms. Russell served as Chair of the Audit Committee and was a member of the Compensation Committee and the Nominating and Corporate Governance Committee. “AXT is grate.

AXT Drops On Negative Q1 2025 Profit Margins And Weak Q2 Outlook

seekingalpha.com

2025-07-13 08:00:00AXT reported poor financial performance for Q1 2025 with negative profit margins. The company is still dealing with Chinese prohibitions on indium phosphide exports. AXT downgraded its own revenue expectations for Q2 2025.

AXT, Inc. Announces a Preliminary Revenue Range for Second Quarter 2025

businesswire.com

2025-07-09 16:05:00FREMONT, Calif.--(BUSINESS WIRE)--AXT, Inc. (NasdaqGS: AXTI), a leading manufacturer of compound semiconductor substrates, today announced a preliminary revenue range for its second quarter, ended June 30, 2025. AXT's full financial results for the second quarter of 2025 are scheduled to be announced on July 31, 2025. AXT expects preliminary revenue for the second quarter of 2025 to be in the range of $17.5 to $18 million, below the company's previously stated guidance of $20 million to $22 mil.

Squarepoint Ops LLC Sells 56,686 Shares of AXT, Inc. (NASDAQ:AXTI)

https://www.defenseworld.net

2025-06-11 03:36:52Squarepoint Ops LLC lessened its stake in shares of AXT, Inc. (NASDAQ:AXTI – Free Report) by 76.4% during the fourth quarter, according to the company in its most recent disclosure with the SEC. The fund owned 17,523 shares of the semiconductor company’s stock after selling 56,686 shares during the quarter. Squarepoint Ops LLC’s holdings in AXT were worth $38,000 as of its most recent SEC filing. Other hedge funds and other institutional investors have also recently modified their holdings of the company. Point72 Asset Management L.P. bought a new stake in shares of AXT during the fourth quarter worth $628,000. Pacific Ridge Capital Partners LLC grew its stake in shares of AXT by 65.4% during the fourth quarter. Pacific Ridge Capital Partners LLC now owns 1,937,424 shares of the semiconductor company’s stock worth $4,204,000 after buying an additional 766,122 shares during the last quarter. Empowered Funds LLC grew its stake in shares of AXT by 5.2% in the fourth quarter. Empowered Funds LLC now owns 145,664 shares of the semiconductor company’s stock worth $316,000 after purchasing an additional 7,165 shares during the last quarter. Bleakley Financial Group LLC bought a new stake in shares of AXT in the fourth quarter worth $29,000. Finally, Jane Street Group LLC bought a new stake in shares of AXT in the fourth quarter worth $60,000. Institutional investors own 49.52% of the company’s stock. AXT Trading Up 6.0% Shares of AXTI opened at $1.94 on Wednesday. The stock has a market capitalization of $88.47 million, a P/E ratio of -6.93 and a beta of 1.98. The firm’s fifty day simple moving average is $1.41 and its two-hundred day simple moving average is $1.79. AXT, Inc. has a 12 month low of $1.13 and a 12 month high of $4.03. AXT (NASDAQ:AXTI – Get Free Report) last issued its quarterly earnings results on Thursday, May 1st. The semiconductor company reported ($0.20) EPS for the quarter, missing analysts’ consensus estimates of ($0.13) by ($0.07). AXT had a negative net margin of 11.70% and a negative return on equity of 5.27%. As a group, research analysts predict that AXT, Inc. will post -0.12 EPS for the current fiscal year. Analysts Set New Price Targets AXTI has been the topic of several analyst reports. Wall Street Zen raised shares of AXT to a “sell” rating in a research note on Friday, April 25th. B. Riley reduced their price objective on shares of AXT from $6.00 to $4.50 and set a “buy” rating on the stock in a research note on Friday, May 2nd. Wedbush reissued an “outperform” rating and issued a $4.50 price objective on shares of AXT in a research note on Tuesday, April 29th. Finally, Needham & Company LLC reissued a “buy” rating and issued a $5.00 price objective on shares of AXT in a research note on Friday, February 21st. One analyst has rated the stock with a sell rating and four have issued a buy rating to the stock. Based on data from MarketBeat, the company presently has a consensus rating of “Moderate Buy” and a consensus target price of $4.75. Read Our Latest Stock Report on AXT AXT Company Profile (Free Report) AXT, Inc designs, develops, manufactures, and distributes compound and single element semiconductor substrates. The company offers indium phosphide for use in data center connectivity using light/lasers, high-speed data transfer in data centers, 5G communications, fiber optic lasers and detectors, consumer devices, passive optical networks, silicon photonics, photonic integrated circuits, thermo-photovoltaics, RF amplifier and switching, infrared light-emitting diode (LEDS) motion control, lidar for robotics and autonomous vehicles, and infrared thermal imaging.

AXT, Inc. (AXTI) Q1 2025 Earnings Call Transcript

seekingalpha.com

2025-05-01 23:05:26AXT, Inc. (AXTI) Q1 2025 Earnings Call Transcript

AXT (AXTI) Reports Q1 Loss, Tops Revenue Estimates

zacks.com

2025-05-01 19:00:42AXT (AXTI) came out with a quarterly loss of $0.19 per share versus the Zacks Consensus Estimate of a loss of $0.13. This compares to loss of $0.03 per share a year ago.

AXT, Inc. Announces First Quarter 2025 Financial Results

businesswire.com

2025-05-01 16:05:00FREMONT, Calif.--(BUSINESS WIRE)--AXT, Inc. (NasdaqGS: AXTI), a leading manufacturer of compound semiconductor wafer substrates, today reported financial results for the first quarter, ended March 31, 2025. Management Qualitative Comments “While the geopolitical environment is creating undeniable challenges, we are focusing our energies where we can drive positive returns today,” said Morris Young, chief executive officer. “Tongmei, our China subsidiary, is uniquely positioned to optimize growt.

AXT, Inc. Schedules First Quarter 2025 Earnings Release for May 1, 2025

businesswire.com

2025-04-03 16:05:00FREMONT, Calif.--(BUSINESS WIRE)--AXT, Inc. (NasdaqGS: AXTI), a leading manufacturer of compound semiconductor substrates, will announce its financial results for the first quarter 2025 in a press release immediately following the close of market on May 1, 2025. The company will also host a conference call to discuss these results on May 1, 2025 at 1:30 p.m. PT. The conference call can be accessed at (800) 715-9871 (passcode 4378083). The call will also be simulcast at www.axt.com. Replays will.

AXT, Inc. Reported Improved Q4 Financial Performance But Q1 Outlook Disappoints

seekingalpha.com

2025-02-24 13:04:44AXT, Inc. reported increased revenues QoQ and YoY due to higher demand for its indium phosphide wafers. The company expects lower Q1 2025 revenues due to new regulations in China over exports of indium phosphide. The company's stock price hit its 52-week low last Friday due to the weak Q1 outlook.