Aurora Acquisition Corp. (AURC)

Price:

17.44 USD

( - -6.91 USD)

Your position:

0 USD

ACTION PANEL

ABOUT

Check the

KEY TAKEAWAYS

ASK OUR AI ABOUT THE COMPANY (REGISTER FOR EARLY ACCESS)

(REGISTER FOR EARLY ACCESS) CHOOSE A PROMPT ABOVE TO ASK OUR AI ABOUT THE SPECIFIC INFORMATION

SIMILAR COMPANIES STI SCORE

Similar STI Score

Churchill Capital Corp X

VALUE SCORE:

7

2nd position

Range Capital Acquisition Corp.

VALUE SCORE:

10

The best

M3-Brigade Acquisition V Corp. Units

VALUE SCORE:

10

FUNDAMENTALS

FUNDAMENTALS

FUNDAMENTALS

FUNDAMENTALS PER SHARE

TECHNICAL

DIVIDEND

SIMILAR COMPANIES

No data to display

No data to display

No data to display

No data to display

No data to display

No data to display

No data to display

No data to display

No data to display

DESCRIPTION

Aurora Acquisition Corp. does not have significant operations. It intends to effect a merger, share exchange, asset acquisition, share purchase, reorganization, or similar business combination with one or more businesses. The company was incorporated in 2020 and is based in London, the United Kingdom.

NEWS

Better.com's public market debut was Miserable.com

techcrunch.com

2023-08-27 10:16:23Welcome back to The Interchange, where we take a look at the hottest fintech news of the previous week. Better.com finally went public last week, and the stock's performance was worse than expected.

ICYMI: Mortgage firm Better.com goes public in worst mortgage market for decades

proactiveinvestors.com

2023-08-25 11:52:58Sometimes things go better, sometimes things go worse. Other times a mortgage lender goes public just as new American mortgage applications slump to the lowest level in 28 years.

Better Home (BETR) Stock Plunges 90% After AURC SPAC Merger

investorplace.com

2023-08-24 14:05:57In today's market, the company feeling considerable heat today is Better Home (NASDAQ:BETR), also known as Better.com. At the time of writing, BETR stock has plunged more than 93% from yesterday's close.

Better.com's stock tanks after SPAC combination brings it to the public markets

techcrunch.com

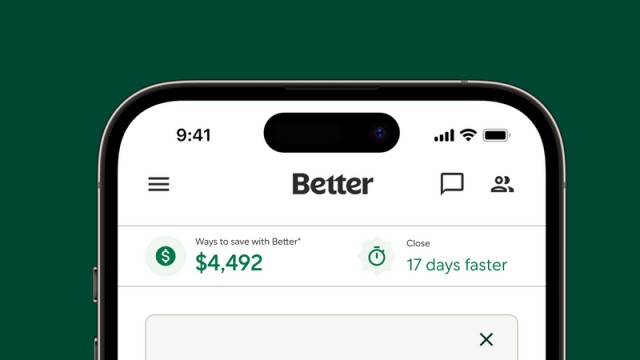

2023-08-24 10:30:41Shares of Better.com are getting hammered into the ground Thursday morning after the digital mortgage company completed its long-delayed SPAC merger and began to trade as a public company for the first time. When Better first announced plans to go public in 2021 at a $7.7 billion valuation, it was a different time.

Online mortgage lender Better sees stock implode after SPAC merger

marketwatch.com

2023-08-24 10:28:00Shares of mortgage lender Better Home & Finance Holding Co. BETR, -94.90% fell flat in the company's public debut, falling 93% in morning action Thursday on their first day of trading since the completion of Better's merger with a special-purpose acquisition company. The company announced Wednesday that its previously disclosed merger with Aurora Acquisition Corp. had been completed.

Better Is Going Public at a Bad Time for Mortgage Lenders

barrons.com

2023-08-24 03:30:00Mortgage demand isn't what it used to be: Both home purchase and refinance application volume have dropped below their booming levels in 2020 and 2021.

Better.Com planning IPO via reverse merger

proactiveinvestors.com

2023-08-23 08:11:10A company that gained notoriety when the CEO canned 900 staff via Zoom is seeking a stock market listing. Online mortgage originator Better.Com is planning to go public via Aurora Acquisition Corp, a SPAC (special-purpose acquisition company).

Online mortgage lender Better.com goes public amid weak demand for home-buying

marketwatch.com

2023-08-23 07:05:00Despite a bleak outlook for home buying, online mortgage lender Better.com has pushed ahead with its long-awaited plans to go public.

Short Squeeze Stocks: APRN, AURC Top List of 5 Most Likely Short Squeezes

investorplace.com

2023-08-21 17:31:55A former short squeeze favorite is back on top of Fintel's Short Squeeze Leaderboard this week. The market analytics platform provides a detailed screener and leaderboard listing the most likely short squeeze stocks every week, as determined by quantitative analysis.

Short Squeeze Stocks: APRN, LUNR and 3 Other Names Ready to Surge

investorplace.com

2023-08-14 15:27:41There have been some rather incredible moves among highly shorted stocks in recent days. Among the short squeeze stocks in focus for many investors is trucking company Yellow (NASDAQ: YELL ), which saw an incredible move higher (and lower) over the past two weeks as it made various announcements tied to its bankruptcy.

U.S. IPO Weekly Recap: IPO Market Sees Fitness, Liquor Marketing, And Medical Devices

seekingalpha.com

2023-08-12 06:00:00Three small issuers began trading this past week, two of which were eligible for inclusion in our IPO stats. While most IPOs are biding their time through the August break, the SPAC market is churning out deals. Three IPOs are currently scheduled to list in the week ahead, although other small issuers may join the calendar during the week.

It's official: Better.com is going public

techcrunch.com

2023-08-11 17:11:02We didn't think we'd see the day. Digital mortgage lender Better.com's proposal to combine with Aurora Acquisition Corp. via a SPAC (special purpose acquisition) has been approved by shareholders, the company confirmed today.

Aurora Acquisition Corp. Shareholders Approve Proposed Business Combination with Better HoldCo, Inc.

businesswire.com

2023-08-11 16:05:00NEW YORK--(BUSINESS WIRE)--Aurora Acquisition Corp. (“Aurora”) (NASDAQ: AURC, AURCU, AURCW), a publicly traded special purpose acquisition company, and Better HoldCo, Inc. (“Better”) today announced that Aurora's shareholders voted to approve the proposed business combination (the "Business Combination") with Better and each related proposal at an extraordinary general meeting of Aurora's shareholders (“Special Meeting”) held earlier today, August 11, 2023. Aurora's sponsor, directors and execu.

AURC Stock Shoots Higher Again Ahead of Better.com Merger

investorplace.com

2023-08-02 13:19:14Shares of Aurora Acquisition (NASDAQ: AURC ) — a special purpose acquisition company (SPAC) that has no operations of its own but exists to merge with a private business enterprise — popped sharply on Wednesday in anticipation of a critical shareholder vote. Aurora seeks to merge with mortgage automation platform Better.com, a deal delayed multiple times in part due to controversies.

Why Is Aurora Acquisition (AURC) Stock Up 20% Today?

investorplace.com

2023-07-31 08:52:35Aurora Acquisition (NASDAQ: AURC ) stock is rising higher on Monday after the company got an update on its planned SPAC merger with Better. A letter filed by the company details that the SEC has declared effective the SPAC merger between Aurora Acquisition and Better.

AURC Stock Pops Ahead of Better.com SPAC Merger Vote

investorplace.com

2023-07-28 15:00:13Aurora Acquisition (NASDAQ: AURC ) stock is screaming higher today, up 160% as we speak. As a result, AURC stock is clearly trending on Friday.

No data to display

Better.com's public market debut was Miserable.com

techcrunch.com

2023-08-27 10:16:23Welcome back to The Interchange, where we take a look at the hottest fintech news of the previous week. Better.com finally went public last week, and the stock's performance was worse than expected.

ICYMI: Mortgage firm Better.com goes public in worst mortgage market for decades

proactiveinvestors.com

2023-08-25 11:52:58Sometimes things go better, sometimes things go worse. Other times a mortgage lender goes public just as new American mortgage applications slump to the lowest level in 28 years.

Better Home (BETR) Stock Plunges 90% After AURC SPAC Merger

investorplace.com

2023-08-24 14:05:57In today's market, the company feeling considerable heat today is Better Home (NASDAQ:BETR), also known as Better.com. At the time of writing, BETR stock has plunged more than 93% from yesterday's close.

Better.com's stock tanks after SPAC combination brings it to the public markets

techcrunch.com

2023-08-24 10:30:41Shares of Better.com are getting hammered into the ground Thursday morning after the digital mortgage company completed its long-delayed SPAC merger and began to trade as a public company for the first time. When Better first announced plans to go public in 2021 at a $7.7 billion valuation, it was a different time.

Online mortgage lender Better sees stock implode after SPAC merger

marketwatch.com

2023-08-24 10:28:00Shares of mortgage lender Better Home & Finance Holding Co. BETR, -94.90% fell flat in the company's public debut, falling 93% in morning action Thursday on their first day of trading since the completion of Better's merger with a special-purpose acquisition company. The company announced Wednesday that its previously disclosed merger with Aurora Acquisition Corp. had been completed.

Better Is Going Public at a Bad Time for Mortgage Lenders

barrons.com

2023-08-24 03:30:00Mortgage demand isn't what it used to be: Both home purchase and refinance application volume have dropped below their booming levels in 2020 and 2021.

Better.Com planning IPO via reverse merger

proactiveinvestors.com

2023-08-23 08:11:10A company that gained notoriety when the CEO canned 900 staff via Zoom is seeking a stock market listing. Online mortgage originator Better.Com is planning to go public via Aurora Acquisition Corp, a SPAC (special-purpose acquisition company).

Online mortgage lender Better.com goes public amid weak demand for home-buying

marketwatch.com

2023-08-23 07:05:00Despite a bleak outlook for home buying, online mortgage lender Better.com has pushed ahead with its long-awaited plans to go public.

Short Squeeze Stocks: APRN, AURC Top List of 5 Most Likely Short Squeezes

investorplace.com

2023-08-21 17:31:55A former short squeeze favorite is back on top of Fintel's Short Squeeze Leaderboard this week. The market analytics platform provides a detailed screener and leaderboard listing the most likely short squeeze stocks every week, as determined by quantitative analysis.

Short Squeeze Stocks: APRN, LUNR and 3 Other Names Ready to Surge

investorplace.com

2023-08-14 15:27:41There have been some rather incredible moves among highly shorted stocks in recent days. Among the short squeeze stocks in focus for many investors is trucking company Yellow (NASDAQ: YELL ), which saw an incredible move higher (and lower) over the past two weeks as it made various announcements tied to its bankruptcy.

U.S. IPO Weekly Recap: IPO Market Sees Fitness, Liquor Marketing, And Medical Devices

seekingalpha.com

2023-08-12 06:00:00Three small issuers began trading this past week, two of which were eligible for inclusion in our IPO stats. While most IPOs are biding their time through the August break, the SPAC market is churning out deals. Three IPOs are currently scheduled to list in the week ahead, although other small issuers may join the calendar during the week.

It's official: Better.com is going public

techcrunch.com

2023-08-11 17:11:02We didn't think we'd see the day. Digital mortgage lender Better.com's proposal to combine with Aurora Acquisition Corp. via a SPAC (special purpose acquisition) has been approved by shareholders, the company confirmed today.

Aurora Acquisition Corp. Shareholders Approve Proposed Business Combination with Better HoldCo, Inc.

businesswire.com

2023-08-11 16:05:00NEW YORK--(BUSINESS WIRE)--Aurora Acquisition Corp. (“Aurora”) (NASDAQ: AURC, AURCU, AURCW), a publicly traded special purpose acquisition company, and Better HoldCo, Inc. (“Better”) today announced that Aurora's shareholders voted to approve the proposed business combination (the "Business Combination") with Better and each related proposal at an extraordinary general meeting of Aurora's shareholders (“Special Meeting”) held earlier today, August 11, 2023. Aurora's sponsor, directors and execu.

AURC Stock Shoots Higher Again Ahead of Better.com Merger

investorplace.com

2023-08-02 13:19:14Shares of Aurora Acquisition (NASDAQ: AURC ) — a special purpose acquisition company (SPAC) that has no operations of its own but exists to merge with a private business enterprise — popped sharply on Wednesday in anticipation of a critical shareholder vote. Aurora seeks to merge with mortgage automation platform Better.com, a deal delayed multiple times in part due to controversies.

Why Is Aurora Acquisition (AURC) Stock Up 20% Today?

investorplace.com

2023-07-31 08:52:35Aurora Acquisition (NASDAQ: AURC ) stock is rising higher on Monday after the company got an update on its planned SPAC merger with Better. A letter filed by the company details that the SEC has declared effective the SPAC merger between Aurora Acquisition and Better.

AURC Stock Pops Ahead of Better.com SPAC Merger Vote

investorplace.com

2023-07-28 15:00:13Aurora Acquisition (NASDAQ: AURC ) stock is screaming higher today, up 160% as we speak. As a result, AURC stock is clearly trending on Friday.