Audacy, Inc. (AUD)

Price:

0.09 USD

( - 0 USD)

Your position:

0 USD

ACTION PANEL

ABOUT

Check the

KEY TAKEAWAYS

ASK OUR AI ABOUT THE COMPANY (REGISTER FOR EARLY ACCESS)

(REGISTER FOR EARLY ACCESS) CHOOSE A PROMPT ABOVE TO ASK OUR AI ABOUT THE SPECIFIC INFORMATION

SIMILAR COMPANIES STI SCORE

Similar STI Score

Gray Media, Inc.

VALUE SCORE:

4

2nd position

Comcast Holdings Corp.

VALUE SCORE:

8

The best

TEGNA Inc.

VALUE SCORE:

9

FUNDAMENTALS

FUNDAMENTALS

FUNDAMENTALS

FUNDAMENTALS PER SHARE

TECHNICAL

DIVIDEND

SIMILAR COMPANIES

No data to display

No data to display

No data to display

No data to display

No data to display

DESCRIPTION

Audacy, Inc., a multi-platform audio content and entertainment company, engages in the radio broadcasting business in the United States. The company owns and operates radio stations in various formats, such as news, sports, talk, classic rock, urban, adult contemporary, alternative, country, and others, as well as offers integrated marketing solutions across its broadcast, digital, podcast, and event platforms. It also creates live and original events, including concerts and live performances, and crafted food and beverage events. The company was formerly known as Entercom Communications Corp. and changed its name to Audacy, Inc. in April 2021. Audacy, Inc. was founded in 1968 and is headquartered in Philadelphia, Pennsylvania.

NEWS

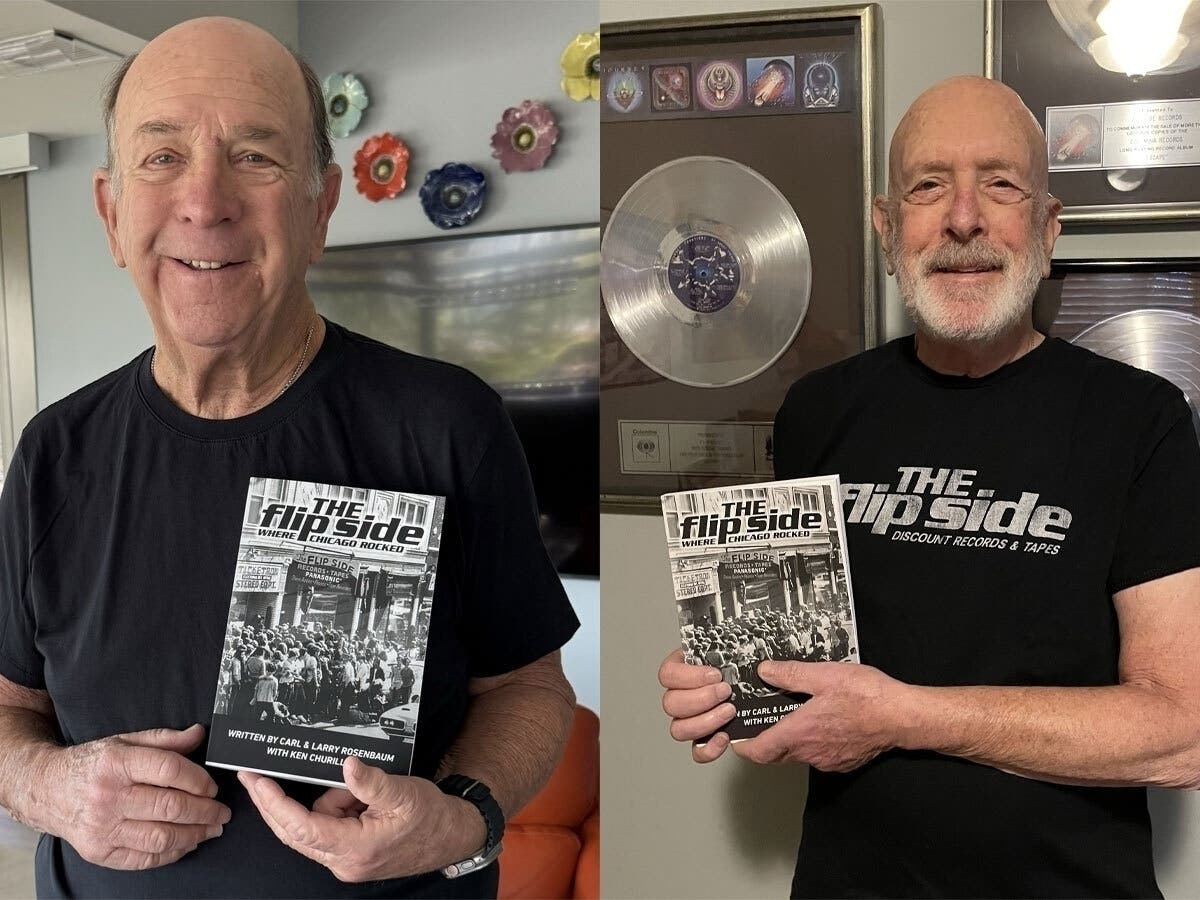

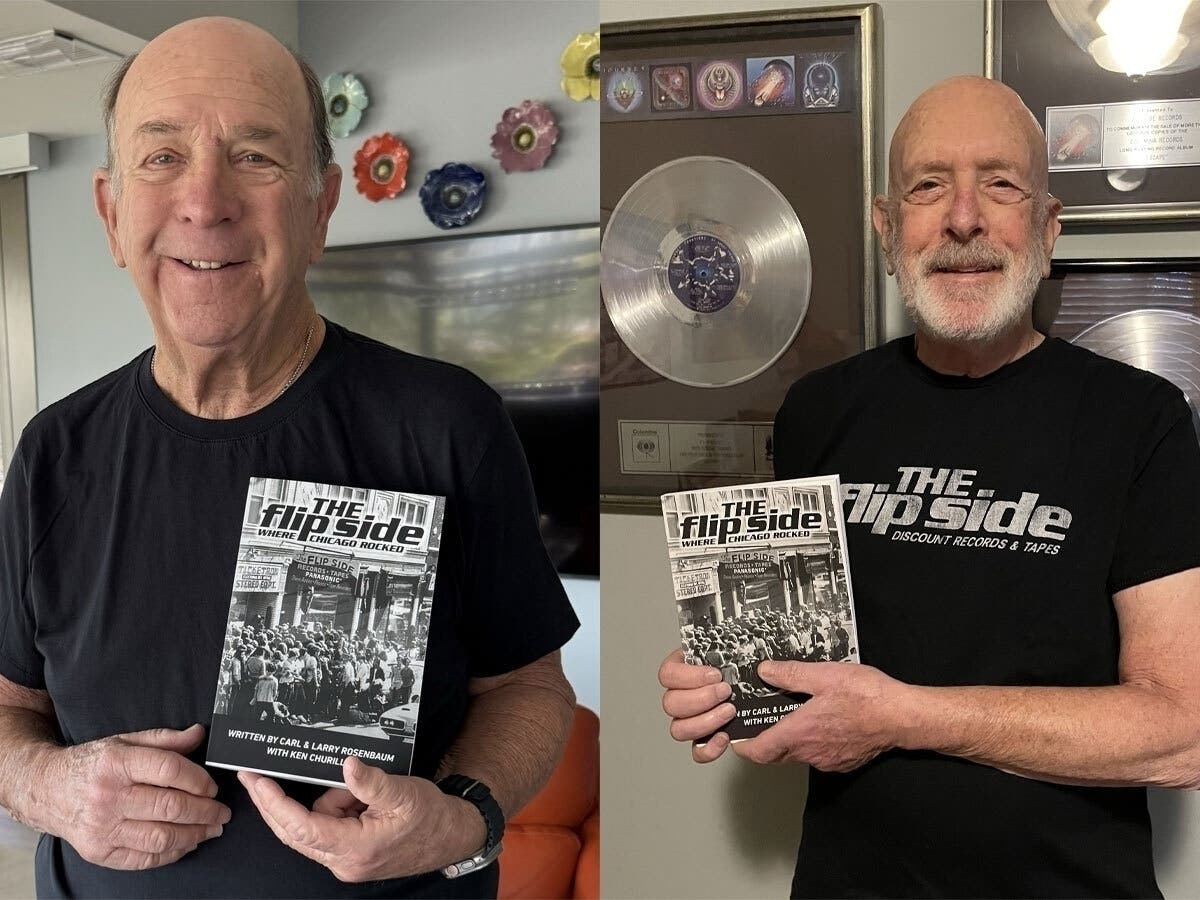

Flip Side Founder Recalls Days When Record Stores Were Hallowed Ground

https://www.patch.com

2025-04-11 12:02:37CHICAGO — If you’re of a certain age — we won’t say what age — you probably experienced the joy of camping out in front of a Flip Side Records store waiting for the Ticketron outlet to open so you could buy tickets for The Who. Just in time for Record Store Day 2025, Larry Rosenbaum, 81, recalls the glory days of Flip Side Records, the greatest record store chain in Chicagoland history, that he co-founded with his brother, Carl, 83, in “The Flip Side: Where Chicago Rocked” (Eckharzt Press). From 1968 to 1995, Flip Side ruled Chicago’s record market, with locations tucked away in strip malls and storefronts across the city and suburbs. The concert arm of the Rosenbaum brothers’ enterprise was Celebration Flip Side, which produced all the big concerts of the 1970s and 1980s. Carl and Larry weren’t necessarily into music, growing up on Chicago’s North Side in West Ridge (West Rogers Park). They just wanted to be their own boss. “We were working for an electronics parts distributor in 1968,” Larry, 81, told Patch. “We were interested in going into business ourselves. Our choices were narrowed down to a record store, Vienna hot dog stand and a dry cleaner. Our dad was a CPA and one of his clients owned a lucrative dry cleaning business.” Both brothers were in their early 20s, married and with babies, because that’s what you did back then. “We decided on a record store,” Larry said. “Interestingly enough, we weren’t into music. We were just looking for a business to get into.” The brothers made a deal with the landlord for a former bakery on Foster Avenue between Kedzie and Kimball. “We were in the record business,” Larry said. Their stiffest competition was another record store four blocks away called Little Al’s Records that had been around forever. One day, when Larry was working on turning the bakery into a record store, he saw a big fat guy staring through the window. It was Little Al. “He took us out for coffee. He said he was going to do stuff to make us fail, but figured we’d just fail anyway,” Larry recalled. “At 22, it scared the crap out of me. From a competitive angle, here’s a big fat schlub coming in and telling us we were going to fail. We were each married with one kid. This was how we were going to make a living.” The brothers would go on to prove Little Al wrong. Looking for a name for their new venture, a young marketing executive, who lived in the apartment next door to Larry, came up with the name Flip Side. “The timing was great,” Larry said. “It was a great time to be in the music business, especially in the 1970s.” People line up in front of a Flip Side store in 1975, waiting to buy Rolling Stones tickets. Feeding the rock-crazed young consumers on Chicago’s Northwest Side, Carl came up with the idea to go over to the Aragon Ballroom in Uptown to sell records when rock acts were playing at the venue. “We made a deal with the owner,” Larry said. “Every weekend during shows, we’d pack up an old station wagon and set up in the corner.” Among the many innovations Flip Side contributed to the music biz was bringing Ticketron outlets — the original computerized ticket company — into the stores. The cover of the music business bio features a line of people outside a Flip Side store in 1975 waiting to buy tickets to see Rolling Stones at the Chicago Stadium. "Because of the contacts we made at the Aragon, we ultimately got into the concert business ourselves, promoting concerts. Back in the 1970s, we were the premiere concert promoters in Chicago. We worked with the Loop, WCKG and WXRT. “We would contract with bands, sign the bands from the first step to the stage, from the Rollling Stones to the Who to Cheap Trick to Steve Martin,” Larry said. At its peak, Flip Side had 21 stores in Chicago, Hoffman Estates, Schaumburg, Buffalo Grove, Downers Grove, Naperville and Wheaton, to name a few. The Rosenbaums kept Flip Side going until 1995 when they closed their last store, after Best Buy and Circuit City entered the record biz. “[Best Buy and Circuit City] wanted to get people in their stores and used CDs as a loss-leader,” Larry said. “Within three years, they put every privately owned regional chain out of business. They killed the market. If you go to a Best Buy now, you can’t find any records or CDs. After a few years, both got out of the music business.” “The Flip Side: Where Chicago Rocked,” by Carl and Larry Rosenbaum, with Ken Churilla, is available through Erkhartz Press and Amazon. The oral history covers the life spans of the iconic record store chain as well as their concert business, encompassing the classic rock bands of the 1970s and 1980s. “The best way to sum it up, at least for my brother and me, to use the words of the Grateful Dead, 'what a long, strange trip it's been,'” Larry said. “It was a great run, the friends we made, the lives we impacted, there just isn’t any words.” In honor of Record Store Day Saturday, April 12, Larry Rosenbaum will be signing copies of the book from11 a.m. to 12:30 p.m. at the legendary Val’s Halla, 239 Harrison St., Oak Park. After Oak Park, Larry will be zooming up to Scratched Vinyl, 119 Barrington Commons Court, Barrington, from 2 to 3 p.m. Record Store Day is a global event that celebrates the vanishing independent record shops, hallowed grounds that once flourished on street corners and downtown shopping districts during the pre-digital and streaming age. Special vinyl and CD exclusives and various promotional products are also made for the day, released only to independently owned record shops, along with RSD first and small run/regional releases. View the RSD 2025 list, and a list of participating Illinois record stores.

Learn How the Different Japanese Yen Forex Pairs Behave

https://www.tipranks.com

2024-05-20 14:31:01Walk into the world of JPY pairs, and you’ll find AUD-JPY, USD-JPY, and GBP-JPY locked in a constant battle. Each one offers its own flavor of risk, reward, and the

Australian dollar buoyant near 4-month highs as commodity prices surge

https://www.marketscreener.com

2024-05-19 23:32:59SYDNEY, May 20 (Reuters) - The Australian dollar hovered near a four-month top on Monday, supported by a surge in commodity prices after China unveiled huge steps to stabilise the property market, while the kiwi was on edge ahead of its central bank policy meeting. The Aussie rose 0.1% to $0.6700, after gaining 1.4% last week to as high as $0.6714, the strongest since early January. It broke a major resistance level of $0.6650 as a softening in U.S. inflation revived chances of rate cuts globally, boosting risk appetite. The kiwi dollar, however, slipped 0.1% at $0.6126, having also jumped 1.9% last week to as high as $0.6141. It has support at around $0.6082. On Friday, China announced "historic" steps to stabilise its property sector, with the central bank facilitating 1 trillion yuan ($138 billion) in extra funding and easing mortgage rules, and local governments set to buy "some" apartments. That boosted share markets on Monday. Growth-sensitive copper prices surged to a record high, while prices for iron ore - Australia's biggest export to China - jumped to a one-week top. Analysts at Morgan Stanley are bullish on the Australian dollar given the currency's close correlations to commodity prices, yield differentials and market sentiment on the Chinese growth outlook. "The government's fiscally expansionary stance should keep the economy growing at a robust pace into 2025. The RBA does not appear likely to cut rates for the foreseeable future even as other central banks are likely to lower rates, moving front-end yields in AUD's favour," they said in a note to clients. "Moves in highly correlated assets also suggest both AUD/USD and AUD/NZD would rise in reaction." The Reserve Bank of Australia will release the minutes for its May policy meeting on Tuesday, and traders will be looking for signs about how serious the central bank considered a rate hike after strong first-quarter inflation figures. Nonetheless, markets have swung back to pricing in rate cuts after jobs and wages data disappointed, with the first easing in December now a 50/50 chance. Across the Tasman, the Reserve Bank of New Zealand will set interest rates on Wednesday and is expected to leave its main cash rate at 5.5%, with the main question being whether it will change the projected outlook for rates out to next year. Swaps are pricing in about two rate cuts this year. (Reporting by Stella Qiu; Editing by Christopher Cushing)

Velox Defines Second Exploration Target at the North Queensland Vanadium Project, Australia

accesswire.com

2024-05-14 09:10:00TORONTO, ON / ACCESSWIRE / May 14, 2024 / Velox Energy Materials Inc. (TSXV:VLX) ("Velox" or the "Company") is pleased to report the review and definition of a drill-defined Exploration Target for the Runnymede area in the central tenement area of the North Queensland Vanadium Project ("NQVP") situated within the "Vanadium Hub", approximately 370 km west of the port of Townsville, Queensland, Australia (Figure 1). The Runnymede Exploration Target is located approximately 66 km north-west of the township of Richmond and currently measures approximately 4.3 km in length and 3.5 km in width, with an average thickness of 10.70m and an average depth of 3.6m (Figure 2).

Diversity Atlas, World-Leading DEI Data Platform, Secure $6 Million in Bridge Funding

businesswire.com

2024-04-15 19:12:00MELBOURNE, Australia--(BUSINESS WIRE)--Diversity Atlas, the world's leading diversity data analytics platform which was born out of Cultural Infusion, announced a funding round of $AUD 6 million from Canadian funding platform, Gener8.VC, to support the commercial growth of the data platform, after unprecedented demand. Diversity Atlas, uses data and a proprietary algorithm to track cultural diversity and sentiment within a company, offering leadership valuable insights into their company profil.

FOX News Audio Expands Audacy Partnership to Include FOX Weather Stream

businesswire.com

2023-11-01 10:41:00NEW YORK--(BUSINESS WIRE)--FOX News Audio has expanded its partnership with Audacy to include FOX Weather, FOX News Media's free, ad-supported streaming television (“FAST”) weather service. Effective November 1, the deal will expand FOX News Audio's existing relationship with Audacy, which also distributes FOX News Podcasts and the FOX News Talk audio streams. Available on both the Audacy app and Audacy.com, listeners will have on-the-go access to FOX Weather's critical weather news, reporting.

Audacy Provides NYSE Listing Update

businesswire.com

2023-10-30 12:57:00PHILADELPHIA--(BUSINESS WIRE)--Audacy, Inc. (NYSE: AUD; OTC: AUDA) (the “Company” or “Audacy”) today announced that its appeal of the determination by the New York Stock Exchange (“NYSE”) to commence proceedings to delist Audacy's Class A Common Stock (the “Common Stock”) from the NYSE was not successful. As a result, the NYSE today filed a Form 25 relating to the delisting from the NYSE of its Common Stock with the Securities and Exchange Commission (the “SEC”), which will become effective on.

Audacy Provides Capital Structure Update

businesswire.com

2023-10-02 06:30:00PHILADELPHIA--(BUSINESS WIRE)--Audacy, Inc. (NYSE: AUD; OTC: AUDA) (the “Company” or “Audacy”) today provided an update on its ongoing discussions with lenders to refinance its debt and optimize the Company's balance sheet to position the Company for long-term growth, capitalizing on its scaled leadership position across the audio market. To continue to facilitate its discussions with lenders, Audacy has elected to utilize the 30-day grace period for the cash interest payment in the amount of a.

Audacy Reports Second Quarter Results

businesswire.com

2023-08-04 08:00:00PHILADELPHIA--(BUSINESS WIRE)--Audacy, Inc. (NYSE: AUD; OTC: AUDA) today reported financial results for the quarter ended June 30, 2023. Second Quarter Summary Net revenues for the quarter were $298.5 million, down 6.6% compared to $319.4 million in the second quarter of 2022. Local spot was down 3.7%, while national spot was down 16.6% Digital revenues, were $66.7 million, down 4% compared to the second quarter of 2022. Local digital outperformed national, increasing 7.1% year-over-year Total.

Why Is Audacy (AUD) Stock Up 40% Today?

investorplace.com

2023-05-11 08:17:51Audacy (NYSE: AUD ) stock is on the rise Thursday as shares continue to rally after the release of its earnings report yesterday. That earnings report saw the podcast company post revenue of $259.64 million.

Audacy (AUD) Reports Q1 Loss, Tops Revenue Estimates

zacks.com

2023-05-10 10:41:35Audacy (AUD) came out with a quarterly loss of $0.25 per share in line with the Zacks Consensus Estimate. This compares to loss of $0.08 per share a year ago.

7 Stocks to Sell in May Before They Crash and Burn

investorplace.com

2023-05-03 13:55:48While not the most comfortable topic to discuss, with the fifth month of the year upon us, it's time to discuss stocks to sell in May. If you've been around the market for a while, you probably heard the phrase, “Sell in May and Go Away.

Audacy, Inc. to Report 2023 First Quarter Financial Results, Host Conference Call on May 10

businesswire.com

2023-04-25 10:00:00PHILADELPHIA--(BUSINESS WIRE)--Audacy, Inc. (NYSE: AUD) will report its 2023 first quarter financial results before the market opens on Wednesday, May 10, 2023. The Company will host a conference call and simultaneous webcast at 10:00 a.m. ET that morning to review the results and recent progress against its strategic initiatives. To participate in the conference call, please dial (877) 407-9208 or (201) 493-6784 five minutes prior to the start of the call and provide the following conference n.

Audacy, Inc. (AUD) Q4 2022 Earnings Call Transcript

seekingalpha.com

2023-03-15 12:47:10Audacy, Inc. (NYSE:AUD ) Q4 2022 Earnings Conference Call March 15, 2023 10:00 AM ET Company Participants Richard Schmaeling - Chief Financial Officer and Executive Vice President David Field - Chairman, President, and Chief Executive Officer Conference Call Participants Aaron Watts - Deutsch Bank Avi Steiner - JPMorgan Dan Day - B. Riley Securities Craig Huber - Huber Research Partners Operator Good morning and welcome to Audacy's Fourth Quarter 2022 Earnings Release Conference Call.

Audacy, Inc. to Report 2022 Fourth Quarter Financial Results, Host Conference Call on March 15

businesswire.com

2023-02-22 11:38:00PHILADELPHIA--(BUSINESS WIRE)--Audacy, Inc. (NYSE: AUD) will report its 2022 fourth quarter financial results before the market opens on Wednesday, March 15, 2023. The Company will host a conference call and simultaneous webcast at 10:00 a.m. ET that morning to review the results and recent progress against its strategic initiatives.

Flip Side Founder Recalls Days When Record Stores Were Hallowed Ground

https://www.patch.com

2025-04-11 12:02:37CHICAGO — If you’re of a certain age — we won’t say what age — you probably experienced the joy of camping out in front of a Flip Side Records store waiting for the Ticketron outlet to open so you could buy tickets for The Who. Just in time for Record Store Day 2025, Larry Rosenbaum, 81, recalls the glory days of Flip Side Records, the greatest record store chain in Chicagoland history, that he co-founded with his brother, Carl, 83, in “The Flip Side: Where Chicago Rocked” (Eckharzt Press). From 1968 to 1995, Flip Side ruled Chicago’s record market, with locations tucked away in strip malls and storefronts across the city and suburbs. The concert arm of the Rosenbaum brothers’ enterprise was Celebration Flip Side, which produced all the big concerts of the 1970s and 1980s. Carl and Larry weren’t necessarily into music, growing up on Chicago’s North Side in West Ridge (West Rogers Park). They just wanted to be their own boss. “We were working for an electronics parts distributor in 1968,” Larry, 81, told Patch. “We were interested in going into business ourselves. Our choices were narrowed down to a record store, Vienna hot dog stand and a dry cleaner. Our dad was a CPA and one of his clients owned a lucrative dry cleaning business.” Both brothers were in their early 20s, married and with babies, because that’s what you did back then. “We decided on a record store,” Larry said. “Interestingly enough, we weren’t into music. We were just looking for a business to get into.” The brothers made a deal with the landlord for a former bakery on Foster Avenue between Kedzie and Kimball. “We were in the record business,” Larry said. Their stiffest competition was another record store four blocks away called Little Al’s Records that had been around forever. One day, when Larry was working on turning the bakery into a record store, he saw a big fat guy staring through the window. It was Little Al. “He took us out for coffee. He said he was going to do stuff to make us fail, but figured we’d just fail anyway,” Larry recalled. “At 22, it scared the crap out of me. From a competitive angle, here’s a big fat schlub coming in and telling us we were going to fail. We were each married with one kid. This was how we were going to make a living.” The brothers would go on to prove Little Al wrong. Looking for a name for their new venture, a young marketing executive, who lived in the apartment next door to Larry, came up with the name Flip Side. “The timing was great,” Larry said. “It was a great time to be in the music business, especially in the 1970s.” People line up in front of a Flip Side store in 1975, waiting to buy Rolling Stones tickets. Feeding the rock-crazed young consumers on Chicago’s Northwest Side, Carl came up with the idea to go over to the Aragon Ballroom in Uptown to sell records when rock acts were playing at the venue. “We made a deal with the owner,” Larry said. “Every weekend during shows, we’d pack up an old station wagon and set up in the corner.” Among the many innovations Flip Side contributed to the music biz was bringing Ticketron outlets — the original computerized ticket company — into the stores. The cover of the music business bio features a line of people outside a Flip Side store in 1975 waiting to buy tickets to see Rolling Stones at the Chicago Stadium. "Because of the contacts we made at the Aragon, we ultimately got into the concert business ourselves, promoting concerts. Back in the 1970s, we were the premiere concert promoters in Chicago. We worked with the Loop, WCKG and WXRT. “We would contract with bands, sign the bands from the first step to the stage, from the Rollling Stones to the Who to Cheap Trick to Steve Martin,” Larry said. At its peak, Flip Side had 21 stores in Chicago, Hoffman Estates, Schaumburg, Buffalo Grove, Downers Grove, Naperville and Wheaton, to name a few. The Rosenbaums kept Flip Side going until 1995 when they closed their last store, after Best Buy and Circuit City entered the record biz. “[Best Buy and Circuit City] wanted to get people in their stores and used CDs as a loss-leader,” Larry said. “Within three years, they put every privately owned regional chain out of business. They killed the market. If you go to a Best Buy now, you can’t find any records or CDs. After a few years, both got out of the music business.” “The Flip Side: Where Chicago Rocked,” by Carl and Larry Rosenbaum, with Ken Churilla, is available through Erkhartz Press and Amazon. The oral history covers the life spans of the iconic record store chain as well as their concert business, encompassing the classic rock bands of the 1970s and 1980s. “The best way to sum it up, at least for my brother and me, to use the words of the Grateful Dead, 'what a long, strange trip it's been,'” Larry said. “It was a great run, the friends we made, the lives we impacted, there just isn’t any words.” In honor of Record Store Day Saturday, April 12, Larry Rosenbaum will be signing copies of the book from11 a.m. to 12:30 p.m. at the legendary Val’s Halla, 239 Harrison St., Oak Park. After Oak Park, Larry will be zooming up to Scratched Vinyl, 119 Barrington Commons Court, Barrington, from 2 to 3 p.m. Record Store Day is a global event that celebrates the vanishing independent record shops, hallowed grounds that once flourished on street corners and downtown shopping districts during the pre-digital and streaming age. Special vinyl and CD exclusives and various promotional products are also made for the day, released only to independently owned record shops, along with RSD first and small run/regional releases. View the RSD 2025 list, and a list of participating Illinois record stores.

Learn How the Different Japanese Yen Forex Pairs Behave

https://www.tipranks.com

2024-05-20 14:31:01Walk into the world of JPY pairs, and you’ll find AUD-JPY, USD-JPY, and GBP-JPY locked in a constant battle. Each one offers its own flavor of risk, reward, and the

Australian dollar buoyant near 4-month highs as commodity prices surge

https://www.marketscreener.com

2024-05-19 23:32:59SYDNEY, May 20 (Reuters) - The Australian dollar hovered near a four-month top on Monday, supported by a surge in commodity prices after China unveiled huge steps to stabilise the property market, while the kiwi was on edge ahead of its central bank policy meeting. The Aussie rose 0.1% to $0.6700, after gaining 1.4% last week to as high as $0.6714, the strongest since early January. It broke a major resistance level of $0.6650 as a softening in U.S. inflation revived chances of rate cuts globally, boosting risk appetite. The kiwi dollar, however, slipped 0.1% at $0.6126, having also jumped 1.9% last week to as high as $0.6141. It has support at around $0.6082. On Friday, China announced "historic" steps to stabilise its property sector, with the central bank facilitating 1 trillion yuan ($138 billion) in extra funding and easing mortgage rules, and local governments set to buy "some" apartments. That boosted share markets on Monday. Growth-sensitive copper prices surged to a record high, while prices for iron ore - Australia's biggest export to China - jumped to a one-week top. Analysts at Morgan Stanley are bullish on the Australian dollar given the currency's close correlations to commodity prices, yield differentials and market sentiment on the Chinese growth outlook. "The government's fiscally expansionary stance should keep the economy growing at a robust pace into 2025. The RBA does not appear likely to cut rates for the foreseeable future even as other central banks are likely to lower rates, moving front-end yields in AUD's favour," they said in a note to clients. "Moves in highly correlated assets also suggest both AUD/USD and AUD/NZD would rise in reaction." The Reserve Bank of Australia will release the minutes for its May policy meeting on Tuesday, and traders will be looking for signs about how serious the central bank considered a rate hike after strong first-quarter inflation figures. Nonetheless, markets have swung back to pricing in rate cuts after jobs and wages data disappointed, with the first easing in December now a 50/50 chance. Across the Tasman, the Reserve Bank of New Zealand will set interest rates on Wednesday and is expected to leave its main cash rate at 5.5%, with the main question being whether it will change the projected outlook for rates out to next year. Swaps are pricing in about two rate cuts this year. (Reporting by Stella Qiu; Editing by Christopher Cushing)

Velox Defines Second Exploration Target at the North Queensland Vanadium Project, Australia

accesswire.com

2024-05-14 09:10:00TORONTO, ON / ACCESSWIRE / May 14, 2024 / Velox Energy Materials Inc. (TSXV:VLX) ("Velox" or the "Company") is pleased to report the review and definition of a drill-defined Exploration Target for the Runnymede area in the central tenement area of the North Queensland Vanadium Project ("NQVP") situated within the "Vanadium Hub", approximately 370 km west of the port of Townsville, Queensland, Australia (Figure 1). The Runnymede Exploration Target is located approximately 66 km north-west of the township of Richmond and currently measures approximately 4.3 km in length and 3.5 km in width, with an average thickness of 10.70m and an average depth of 3.6m (Figure 2).

Diversity Atlas, World-Leading DEI Data Platform, Secure $6 Million in Bridge Funding

businesswire.com

2024-04-15 19:12:00MELBOURNE, Australia--(BUSINESS WIRE)--Diversity Atlas, the world's leading diversity data analytics platform which was born out of Cultural Infusion, announced a funding round of $AUD 6 million from Canadian funding platform, Gener8.VC, to support the commercial growth of the data platform, after unprecedented demand. Diversity Atlas, uses data and a proprietary algorithm to track cultural diversity and sentiment within a company, offering leadership valuable insights into their company profil.

FOX News Audio Expands Audacy Partnership to Include FOX Weather Stream

businesswire.com

2023-11-01 10:41:00NEW YORK--(BUSINESS WIRE)--FOX News Audio has expanded its partnership with Audacy to include FOX Weather, FOX News Media's free, ad-supported streaming television (“FAST”) weather service. Effective November 1, the deal will expand FOX News Audio's existing relationship with Audacy, which also distributes FOX News Podcasts and the FOX News Talk audio streams. Available on both the Audacy app and Audacy.com, listeners will have on-the-go access to FOX Weather's critical weather news, reporting.

Audacy Provides NYSE Listing Update

businesswire.com

2023-10-30 12:57:00PHILADELPHIA--(BUSINESS WIRE)--Audacy, Inc. (NYSE: AUD; OTC: AUDA) (the “Company” or “Audacy”) today announced that its appeal of the determination by the New York Stock Exchange (“NYSE”) to commence proceedings to delist Audacy's Class A Common Stock (the “Common Stock”) from the NYSE was not successful. As a result, the NYSE today filed a Form 25 relating to the delisting from the NYSE of its Common Stock with the Securities and Exchange Commission (the “SEC”), which will become effective on.

Audacy Provides Capital Structure Update

businesswire.com

2023-10-02 06:30:00PHILADELPHIA--(BUSINESS WIRE)--Audacy, Inc. (NYSE: AUD; OTC: AUDA) (the “Company” or “Audacy”) today provided an update on its ongoing discussions with lenders to refinance its debt and optimize the Company's balance sheet to position the Company for long-term growth, capitalizing on its scaled leadership position across the audio market. To continue to facilitate its discussions with lenders, Audacy has elected to utilize the 30-day grace period for the cash interest payment in the amount of a.

Audacy Reports Second Quarter Results

businesswire.com

2023-08-04 08:00:00PHILADELPHIA--(BUSINESS WIRE)--Audacy, Inc. (NYSE: AUD; OTC: AUDA) today reported financial results for the quarter ended June 30, 2023. Second Quarter Summary Net revenues for the quarter were $298.5 million, down 6.6% compared to $319.4 million in the second quarter of 2022. Local spot was down 3.7%, while national spot was down 16.6% Digital revenues, were $66.7 million, down 4% compared to the second quarter of 2022. Local digital outperformed national, increasing 7.1% year-over-year Total.

Why Is Audacy (AUD) Stock Up 40% Today?

investorplace.com

2023-05-11 08:17:51Audacy (NYSE: AUD ) stock is on the rise Thursday as shares continue to rally after the release of its earnings report yesterday. That earnings report saw the podcast company post revenue of $259.64 million.

Audacy (AUD) Reports Q1 Loss, Tops Revenue Estimates

zacks.com

2023-05-10 10:41:35Audacy (AUD) came out with a quarterly loss of $0.25 per share in line with the Zacks Consensus Estimate. This compares to loss of $0.08 per share a year ago.

7 Stocks to Sell in May Before They Crash and Burn

investorplace.com

2023-05-03 13:55:48While not the most comfortable topic to discuss, with the fifth month of the year upon us, it's time to discuss stocks to sell in May. If you've been around the market for a while, you probably heard the phrase, “Sell in May and Go Away.

Audacy, Inc. to Report 2023 First Quarter Financial Results, Host Conference Call on May 10

businesswire.com

2023-04-25 10:00:00PHILADELPHIA--(BUSINESS WIRE)--Audacy, Inc. (NYSE: AUD) will report its 2023 first quarter financial results before the market opens on Wednesday, May 10, 2023. The Company will host a conference call and simultaneous webcast at 10:00 a.m. ET that morning to review the results and recent progress against its strategic initiatives. To participate in the conference call, please dial (877) 407-9208 or (201) 493-6784 five minutes prior to the start of the call and provide the following conference n.

Audacy, Inc. (AUD) Q4 2022 Earnings Call Transcript

seekingalpha.com

2023-03-15 12:47:10Audacy, Inc. (NYSE:AUD ) Q4 2022 Earnings Conference Call March 15, 2023 10:00 AM ET Company Participants Richard Schmaeling - Chief Financial Officer and Executive Vice President David Field - Chairman, President, and Chief Executive Officer Conference Call Participants Aaron Watts - Deutsch Bank Avi Steiner - JPMorgan Dan Day - B. Riley Securities Craig Huber - Huber Research Partners Operator Good morning and welcome to Audacy's Fourth Quarter 2022 Earnings Release Conference Call.

Audacy, Inc. to Report 2022 Fourth Quarter Financial Results, Host Conference Call on March 15

businesswire.com

2023-02-22 11:38:00PHILADELPHIA--(BUSINESS WIRE)--Audacy, Inc. (NYSE: AUD) will report its 2022 fourth quarter financial results before the market opens on Wednesday, March 15, 2023. The Company will host a conference call and simultaneous webcast at 10:00 a.m. ET that morning to review the results and recent progress against its strategic initiatives.