Arhaus, Inc. (ARHS)

Price:

10.88 USD

( - -0.01 USD)

Your position:

0 USD

ACTION PANEL

ABOUT

Check the

KEY TAKEAWAYS

ASK OUR AI ABOUT THE COMPANY (REGISTER FOR EARLY ACCESS)

(REGISTER FOR EARLY ACCESS) CHOOSE A PROMPT ABOVE TO ASK OUR AI ABOUT THE SPECIFIC INFORMATION

SIMILAR COMPANIES STI SCORE

Similar STI Score

Live Ventures Incorporated

VALUE SCORE:

6

2nd position

Empro Group Inc. Ordinary shares

VALUE SCORE:

6

The best

Pinnacle Food Group Limited Class A Common Shares

VALUE SCORE:

8

FUNDAMENTALS

FUNDAMENTALS

FUNDAMENTALS

FUNDAMENTALS PER SHARE

TECHNICAL

DIVIDEND

SIMILAR COMPANIES

DESCRIPTION

Arhaus, Inc. operates as a lifestyle brand and premium retailer in the home furnishings market. It provides merchandise assortments across various categories, including furniture, lighting, textiles, décor, and outdoor. The company's furniture products comprise bedroom, dining room, living room, and home office furnishings, which includes sofas, dining tables and chairs, accent chairs, console and coffee tables, beds, headboards, dressers, desks, bookcases and modular storage, etc.; and outdoor products include outdoor dining tables, chairs, chaises and other furniture, lighting, textiles, décor, umbrellas, and fire pits. It also offers lighting products, such as various distinct and artistic lighting fixtures, including chandeliers, pendants, table and floor lamps, and sconces; textile products comprising handcrafted indoor and outdoor rugs, bed linens, and pillows and throws; and décor products, including various wall art to mirrors, vases to candles, and other decorative accessories. The company distributes its products through an omni-channel model comprising showrooms, e-commerce platform, catalog, and in-home designer services. As of December 31, 2021, it operated through a network of 71 traditional showrooms, 5 Design Studios, and 3 Outlets, as well as 58 showrooms with in-home interior designers. The company was founded in 1986 and is headquartered in Boston Heights, Ohio.

NEWS

Arhaus, Inc. (ARHS) Presents at Morgan Stanley Global Consumer & Retail Conference 2025 Transcript

seekingalpha.com

2025-12-02 10:13:29Arhaus, Inc. (ARHS) Presents at Morgan Stanley Global Consumer & Retail Conference 2025 Transcript

Arhaus Provides Mixed Signals About The Demand Cycle

seekingalpha.com

2025-12-02 00:33:36Arhaus posted strong Q3 revenue growth driven by underlying demand, but guidance points to a challenging Q4 with declining comparable sales. ARHS achieved solid SG&A leverage and strong adjusted EBITDA growth, though gross margin gains were offset by occupancy deleverage and tariff headwinds looming for 2026. The demand outlook remains uncertain, with recent positive trends not enough to confirm a turnaround amid ongoing macroeconomic pressures on the furniture sector.

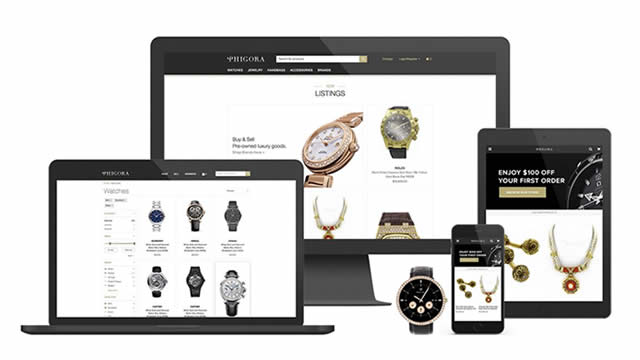

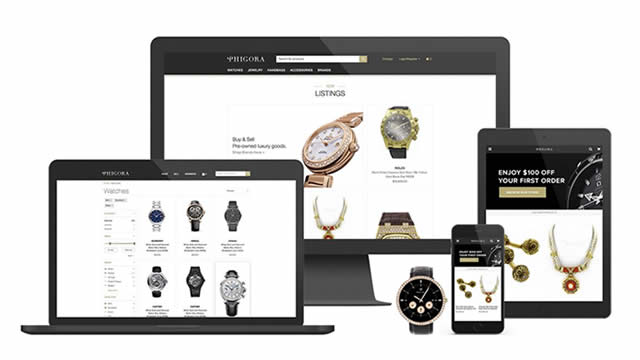

Comparing Winmark (NASDAQ:WINA) and Arhaus (NASDAQ:ARHS)

defenseworld.net

2025-11-30 01:46:56Winmark (NASDAQ: WINA - Get Free Report) and Arhaus (NASDAQ: ARHS - Get Free Report) are both small-cap retail/wholesale companies, but which is the superior stock? We will contrast the two companies based on the strength of their profitability, valuation, risk, dividends, institutional ownership, analyst recommendations and earnings. Volatility and Risk Winmark has a beta of 0.69,

Arhaus to Participate in Upcoming Investor Conferences

globenewswire.com

2025-11-25 16:01:00BOSTON HEIGHTS, Ohio, Nov. 25, 2025 (GLOBE NEWSWIRE) -- Arhaus, Inc. (“Arhaus” or the “Company”) (NASDAQ: ARHS), a growing lifestyle brand and omni-channel retailer of premium artisan-crafted home furnishings, today announced its participation in the following investor conferences. Morgan Stanley Global Consumer & Retail Conference—Tuesday, December 2, 2025 Chief Financial Officer Michael Lee and Vice President of Investor Relations Tara Atwood-Saja will participate in investor meetings at the Morgan Stanley Global Consumer & Retail Conference in New York City on December 2, 2025.

Arhaus, Inc. (ARHS) Q3 2025 Earnings Call Transcript

seekingalpha.com

2025-11-06 20:26:15Arhaus, Inc. ( ARHS ) Q3 2025 Earnings Call November 6, 2025 8:30 AM EST Company Participants Tara Atwood - Vice President of Investor Relations John Reed - Founder, Chairman, President & CEO Michael Lee - Chief Financial Officer Jennifer Porter - Chief Marketing & eCommerce Officer Conference Call Participants Julio Marquez - Guggenheim Securities, LLC, Research Division Jeremy Hamblin - Craig-Hallum Capital Group LLC, Research Division Seth Sigman - Barclays Bank PLC, Research Division Presentation Operator Good morning and welcome to the Arhaus Third Quarter 2025 Earnings Call. [Operator Instructions] I will now turn the call over to your host, Tara Atwood-Saja, Vice President of Investor Relations.

Arhaus, Inc. (ARHS) Reports Q3 Earnings: What Key Metrics Have to Say

zacks.com

2025-11-06 10:31:56The headline numbers for Arhaus, Inc. (ARHS) give insight into how the company performed in the quarter ended September 2025, but it may be worthwhile to compare some of its key metrics to Wall Street estimates and the year-ago actuals.

Arhaus, Inc. (ARHS) Beats Q3 Earnings and Revenue Estimates

zacks.com

2025-11-06 08:21:04Arhaus, Inc. (ARHS) came out with quarterly earnings of $0.09 per share, beating the Zacks Consensus Estimate of $0.08 per share. This compares to earnings of $0.07 per share a year ago.

Arhaus Reports Third Quarter 2025 Financial Results

globenewswire.com

2025-11-06 06:00:00BOSTON HEIGHTS, Ohio, Nov. 06, 2025 (GLOBE NEWSWIRE) -- Arhaus, Inc. (“Arhaus” or the “Company”) (NASDAQ: ARHS), a growing lifestyle brand and omni-channel retailer of premium artisan-crafted home furnishings, reported third quarter 2025 results for the period ended September 30, 2025. Third Quarter 2025 Highlights Net revenue increased 8.0% to $345 million, compared to the third quarter of 2024 Gross margin increased 8.4% to $133 million, compared to the third quarter of 2024 Selling, general and administrative expenses increased 4.1% to $117 million, compared to the third quarter of 2024 Net and comprehensive income increased 23.1% to $12 million, compared to the third quarter of 2024 Adjusted EBITDA increased 35.2% to $31 million, compared to the third quarter of 2024 Comparable growth (1) of 4.1% John Reed, Co-Founder and Chief Executive Officer, said: “We delivered another strong quarter, with net revenue of $345 million, up 8.0% year-over-year—marking the highest third-quarter net revenue in our company's history.

Why ULTA & 3 Retail-Miscellaneous Stocks Could Be the Next Big Winners

zacks.com

2025-10-10 11:36:14ULTA, SBH, ARHS & WOOF show resilience in the Retail-Miscellaneous sector as companies adapt to shifting consumer demand with omnichannel platforms, lifestyle-focused products and personalization.

Are Retail-Wholesale Stocks Lagging Arhaus, Inc. (ARHS) This Year?

zacks.com

2025-10-07 10:41:54Here is how Arhaus, Inc. (ARHS) and Macy's (M) have performed compared to their sector so far this year.

Arhaus Q2: An Unwarranted Stock Rally

seekingalpha.com

2025-08-09 23:25:00Arhaus reported very strong Q2 results after previously slashing the 2025 guidance. The strength was due to Arhaus's move to in-house distribution, temporarily boosting growth through delivery efficiency. Macroeconomic uncertainty still stands in Arhaus's way. Underlying demand growth has been weak, and the reaffirmed 2025 guidance suggests slowing growth ahead. The stock's post-earnings rally was not justified by the Q2 report. I now estimate 23% downside to $9.24.

Arhaus: Down On An Adjusted Basis And Does Not Deserve Its Valuation

seekingalpha.com

2025-08-08 17:18:31Arhaus, Inc.'s reported revenue growth in Q2 2025 was driven by non-recurring factors, masking underlying weakness in core demand and comparable sales. Despite expanding store count, Arhaus is not generating meaningful adjusted growth or margin leverage, with demand comparable growth remaining negative year-over-year. The company's high valuation—trading at nearly 20x cycle-average earnings—is unjustified given flat revenues, deteriorating margins, and exposure to discretionary consumer risk.

Arhaus, Inc. (ARHS) Q2 2025 Earnings Call Transcript

seekingalpha.com

2025-08-08 03:05:36Arhaus, Inc. (NASDAQ:ARHS ) Q2 2025 Earnings Conference Call August 7, 2025 8:30 AM ET Company Participants Jennifer E. Porter - Chief Marketing & eCommerce Officer John P.

UPDATE -- Arhaus Debuts First-Ever Bath Collection, Extending Its Signature Craftsmanship to a New Room in the Home

globenewswire.com

2025-08-07 16:25:00The Arhaus Bath collection features artisan-crafted vanities, fixtures, textiles and accessories that reflect the brand's commitment to enduring materials and thoughtful design The Arhaus Bath collection features artisan-crafted vanities, fixtures, textiles and accessories that reflect the brand's commitment to enduring materials and thoughtful design

Arhaus, Inc. (ARHS) Reports Q2 Earnings: What Key Metrics Have to Say

zacks.com

2025-08-07 14:30:15While the top- and bottom-line numbers for Arhaus, Inc. (ARHS) give a sense of how the business performed in the quarter ended June 2025, it could be worth looking at how some of its key metrics compare to Wall Street estimates and year-ago values.

Arhaus, Inc. (ARHS) Presents at Morgan Stanley Global Consumer & Retail Conference 2025 Transcript

seekingalpha.com

2025-12-02 10:13:29Arhaus, Inc. (ARHS) Presents at Morgan Stanley Global Consumer & Retail Conference 2025 Transcript

Arhaus Provides Mixed Signals About The Demand Cycle

seekingalpha.com

2025-12-02 00:33:36Arhaus posted strong Q3 revenue growth driven by underlying demand, but guidance points to a challenging Q4 with declining comparable sales. ARHS achieved solid SG&A leverage and strong adjusted EBITDA growth, though gross margin gains were offset by occupancy deleverage and tariff headwinds looming for 2026. The demand outlook remains uncertain, with recent positive trends not enough to confirm a turnaround amid ongoing macroeconomic pressures on the furniture sector.

Comparing Winmark (NASDAQ:WINA) and Arhaus (NASDAQ:ARHS)

defenseworld.net

2025-11-30 01:46:56Winmark (NASDAQ: WINA - Get Free Report) and Arhaus (NASDAQ: ARHS - Get Free Report) are both small-cap retail/wholesale companies, but which is the superior stock? We will contrast the two companies based on the strength of their profitability, valuation, risk, dividends, institutional ownership, analyst recommendations and earnings. Volatility and Risk Winmark has a beta of 0.69,

Arhaus to Participate in Upcoming Investor Conferences

globenewswire.com

2025-11-25 16:01:00BOSTON HEIGHTS, Ohio, Nov. 25, 2025 (GLOBE NEWSWIRE) -- Arhaus, Inc. (“Arhaus” or the “Company”) (NASDAQ: ARHS), a growing lifestyle brand and omni-channel retailer of premium artisan-crafted home furnishings, today announced its participation in the following investor conferences. Morgan Stanley Global Consumer & Retail Conference—Tuesday, December 2, 2025 Chief Financial Officer Michael Lee and Vice President of Investor Relations Tara Atwood-Saja will participate in investor meetings at the Morgan Stanley Global Consumer & Retail Conference in New York City on December 2, 2025.

Arhaus, Inc. (ARHS) Q3 2025 Earnings Call Transcript

seekingalpha.com

2025-11-06 20:26:15Arhaus, Inc. ( ARHS ) Q3 2025 Earnings Call November 6, 2025 8:30 AM EST Company Participants Tara Atwood - Vice President of Investor Relations John Reed - Founder, Chairman, President & CEO Michael Lee - Chief Financial Officer Jennifer Porter - Chief Marketing & eCommerce Officer Conference Call Participants Julio Marquez - Guggenheim Securities, LLC, Research Division Jeremy Hamblin - Craig-Hallum Capital Group LLC, Research Division Seth Sigman - Barclays Bank PLC, Research Division Presentation Operator Good morning and welcome to the Arhaus Third Quarter 2025 Earnings Call. [Operator Instructions] I will now turn the call over to your host, Tara Atwood-Saja, Vice President of Investor Relations.

Arhaus, Inc. (ARHS) Reports Q3 Earnings: What Key Metrics Have to Say

zacks.com

2025-11-06 10:31:56The headline numbers for Arhaus, Inc. (ARHS) give insight into how the company performed in the quarter ended September 2025, but it may be worthwhile to compare some of its key metrics to Wall Street estimates and the year-ago actuals.

Arhaus, Inc. (ARHS) Beats Q3 Earnings and Revenue Estimates

zacks.com

2025-11-06 08:21:04Arhaus, Inc. (ARHS) came out with quarterly earnings of $0.09 per share, beating the Zacks Consensus Estimate of $0.08 per share. This compares to earnings of $0.07 per share a year ago.

Arhaus Reports Third Quarter 2025 Financial Results

globenewswire.com

2025-11-06 06:00:00BOSTON HEIGHTS, Ohio, Nov. 06, 2025 (GLOBE NEWSWIRE) -- Arhaus, Inc. (“Arhaus” or the “Company”) (NASDAQ: ARHS), a growing lifestyle brand and omni-channel retailer of premium artisan-crafted home furnishings, reported third quarter 2025 results for the period ended September 30, 2025. Third Quarter 2025 Highlights Net revenue increased 8.0% to $345 million, compared to the third quarter of 2024 Gross margin increased 8.4% to $133 million, compared to the third quarter of 2024 Selling, general and administrative expenses increased 4.1% to $117 million, compared to the third quarter of 2024 Net and comprehensive income increased 23.1% to $12 million, compared to the third quarter of 2024 Adjusted EBITDA increased 35.2% to $31 million, compared to the third quarter of 2024 Comparable growth (1) of 4.1% John Reed, Co-Founder and Chief Executive Officer, said: “We delivered another strong quarter, with net revenue of $345 million, up 8.0% year-over-year—marking the highest third-quarter net revenue in our company's history.

Why ULTA & 3 Retail-Miscellaneous Stocks Could Be the Next Big Winners

zacks.com

2025-10-10 11:36:14ULTA, SBH, ARHS & WOOF show resilience in the Retail-Miscellaneous sector as companies adapt to shifting consumer demand with omnichannel platforms, lifestyle-focused products and personalization.

Are Retail-Wholesale Stocks Lagging Arhaus, Inc. (ARHS) This Year?

zacks.com

2025-10-07 10:41:54Here is how Arhaus, Inc. (ARHS) and Macy's (M) have performed compared to their sector so far this year.

Arhaus Q2: An Unwarranted Stock Rally

seekingalpha.com

2025-08-09 23:25:00Arhaus reported very strong Q2 results after previously slashing the 2025 guidance. The strength was due to Arhaus's move to in-house distribution, temporarily boosting growth through delivery efficiency. Macroeconomic uncertainty still stands in Arhaus's way. Underlying demand growth has been weak, and the reaffirmed 2025 guidance suggests slowing growth ahead. The stock's post-earnings rally was not justified by the Q2 report. I now estimate 23% downside to $9.24.

Arhaus: Down On An Adjusted Basis And Does Not Deserve Its Valuation

seekingalpha.com

2025-08-08 17:18:31Arhaus, Inc.'s reported revenue growth in Q2 2025 was driven by non-recurring factors, masking underlying weakness in core demand and comparable sales. Despite expanding store count, Arhaus is not generating meaningful adjusted growth or margin leverage, with demand comparable growth remaining negative year-over-year. The company's high valuation—trading at nearly 20x cycle-average earnings—is unjustified given flat revenues, deteriorating margins, and exposure to discretionary consumer risk.

Arhaus, Inc. (ARHS) Q2 2025 Earnings Call Transcript

seekingalpha.com

2025-08-08 03:05:36Arhaus, Inc. (NASDAQ:ARHS ) Q2 2025 Earnings Conference Call August 7, 2025 8:30 AM ET Company Participants Jennifer E. Porter - Chief Marketing & eCommerce Officer John P.

UPDATE -- Arhaus Debuts First-Ever Bath Collection, Extending Its Signature Craftsmanship to a New Room in the Home

globenewswire.com

2025-08-07 16:25:00The Arhaus Bath collection features artisan-crafted vanities, fixtures, textiles and accessories that reflect the brand's commitment to enduring materials and thoughtful design The Arhaus Bath collection features artisan-crafted vanities, fixtures, textiles and accessories that reflect the brand's commitment to enduring materials and thoughtful design

Arhaus, Inc. (ARHS) Reports Q2 Earnings: What Key Metrics Have to Say

zacks.com

2025-08-07 14:30:15While the top- and bottom-line numbers for Arhaus, Inc. (ARHS) give a sense of how the business performed in the quarter ended June 2025, it could be worth looking at how some of its key metrics compare to Wall Street estimates and year-ago values.