American Woodmark Corporation (AMWD)

Price:

51.43 USD

( - -0.53 USD)

Your position:

0 USD

ACTION PANEL

ABOUT

Check the

KEY TAKEAWAYS

ASK OUR AI ABOUT THE COMPANY (REGISTER FOR EARLY ACCESS)

(REGISTER FOR EARLY ACCESS) CHOOSE A PROMPT ABOVE TO ASK OUR AI ABOUT THE SPECIFIC INFORMATION

SIMILAR COMPANIES STI SCORE

Similar STI Score

Interface, Inc.

VALUE SCORE:

6

2nd position

Flexsteel Industries, Inc.

VALUE SCORE:

8

The best

Viomi Technology Co., Ltd

VALUE SCORE:

10

FUNDAMENTALS

FUNDAMENTALS

FUNDAMENTALS

FUNDAMENTALS PER SHARE

TECHNICAL

DIVIDEND

SIMILAR COMPANIES

No data to display

DESCRIPTION

American Woodmark Corporation manufactures and distributes kitchen, bath, office, home organization, and hardware products for the remodelling and new home construction markets in the United States. The company offers made-to-order and cash and carry products. It also provides turnkey installation services to its direct builder customers through a network of eight service centers. The company sells its products under the American Woodmark, Timberlake, Shenandoah Cabinetry, Waypoint Living Spaces, Estate, Stor-It-All, and Professional Cabinet Solutions brands, as well as Hampton Bay, Glacier Bay, Style Selections, Allen + Roth, Home Decorators Collection, and Project Source. It markets its products directly to home centers and builders, as well as through independent dealers and distributors. The company was incorporated in 1980 and is based in Winchester, Virginia.

NEWS

American Woodmark Corporation Announces Third Quarter Results

businesswire.com

2026-02-26 06:30:00WINCHESTER, Va.--(BUSINESS WIRE)---- $AMWD #AMWD--American Woodmark Corporation (NASDAQ: AMWD) (“American Woodmark,” “the Company,” “we,” “our,” or “us”) today announced results for its third fiscal quarter ended January 31, 2026. “Demand trends were once again challenging in both the new construction and remodel markets with new construction softening throughout the quarter. We delivered Adjusted EBITDA margins of 6.7% for the third fiscal quarter, as lower volumes impacted fixed cost absorption,” said Scott.

American Woodmark Corporation $AMWD Shares Sold by LSV Asset Management

defenseworld.net

2026-02-18 04:03:14LSV Asset Management decreased its holdings in American Woodmark Corporation (NASDAQ: AMWD) by 98.5% in the third quarter, according to its most recent filing with the Securities and Exchange Commission. The firm owned 4,555 shares of the company's stock after selling 308,607 shares during the quarter. LSV Asset Management's holdings in American Woodmark

Credit Industriel ET Commercial Buys New Stake in American Woodmark Corporation $AMWD

defenseworld.net

2026-02-16 04:18:57Credit Industriel ET Commercial purchased a new stake in shares of American Woodmark Corporation (NASDAQ: AMWD) during the third quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission. The institutional investor purchased 40,000 shares of the company's stock, valued at approximately $2,670,000. Credit Industriel ET Commercial

Alpine Associates Management Inc. Buys New Stake in American Woodmark Corporation $AMWD

defenseworld.net

2026-02-12 04:28:52Alpine Associates Management Inc. purchased a new position in shares of American Woodmark Corporation (NASDAQ: AMWD) in the third quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission (SEC). The firm purchased 209,424 shares of the company's stock, valued at approximately $13,981,000. American Woodmark accounts

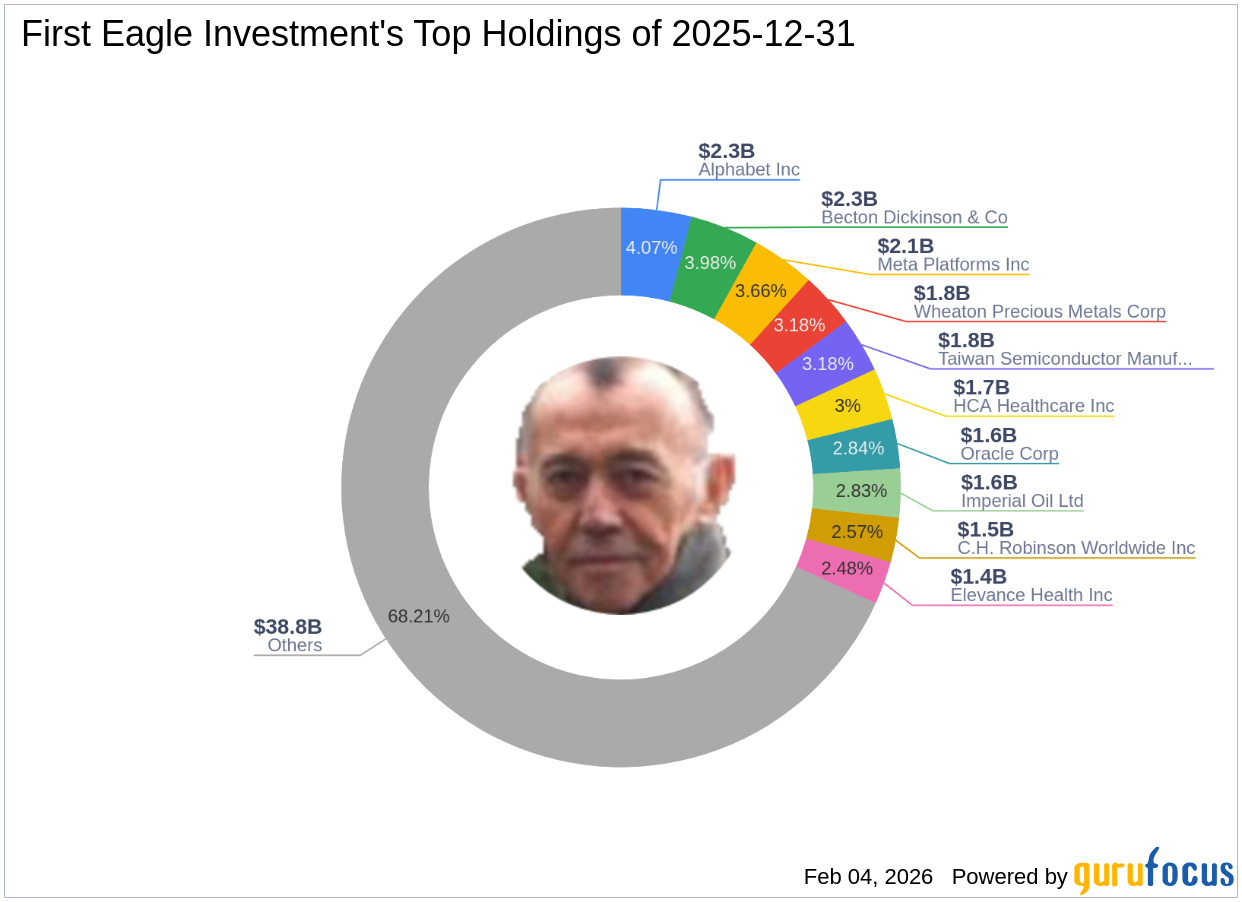

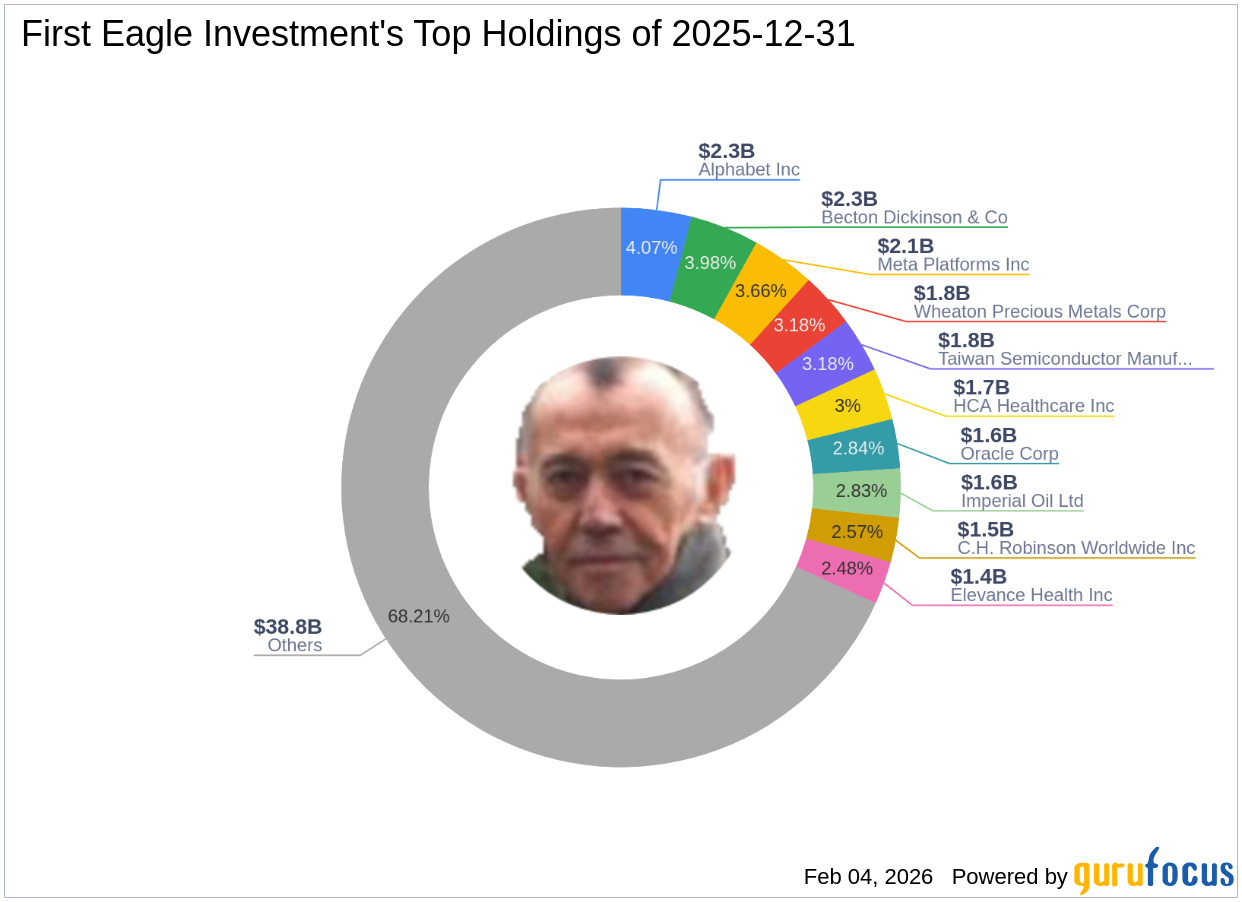

Weyerhaeuser Co: A Significant Addition to First Eagle Investment's Portfolio

gurufocus.com

2026-02-04 17:02:00First Eagle Investment (Trades, Portfolio)'s Strategic Moves in Q4 2025 First Eagle Investment (Trades, Portfolio) recently submitted its 13F filing for the fo

American Woodmark Corporation $AMWD Shares Acquired by Cooke & Bieler LP

defenseworld.net

2026-01-26 05:10:59Cooke and Bieler LP boosted its holdings in American Woodmark Corporation (NASDAQ: AMWD) by 3.7% in the third quarter, according to its most recent Form 13F filing with the SEC. The fund owned 930,460 shares of the company's stock after purchasing an additional 32,832 shares during the period. Cooke and Bieler LP owned

American Woodmark (NASDAQ:AMWD) Share Price Passes Above Two Hundred Day Moving Average – Time to Sell?

defenseworld.net

2026-01-21 03:45:01Shares of American Woodmark Corporation (NASDAQ: AMWD - Get Free Report) passed above its 200-day moving average during trading on Tuesday. The stock has a 200-day moving average of $59.90 and traded as high as $61.74. American Woodmark shares last traded at $60.50, with a volume of 84,276 shares. Wall Street Analysts Forecast Growth A

Stock Market Live January 2: S&P 500 (VOO) Rises on Last Day of Week, First Trading Day of 2026

247wallst.com

2026-01-02 09:53:24Live Updates Taking Another Bite At Apple 45 minutes ago Live Raymond James analyst Srini Pajjuri started off 2026 by resuming coverage of Apple (Nasdaq: AAPL) stock - but don't get too excited. Pajjuri only gives Apple a market perform rating (so hold). "Despite strong fundamentals and improving product cycles, we believe Apple's current valuation appropriately reflects... Stock Market Live January 2: S&P 500 (VOO) Rises on Last Day of Week, First Trading Day of 2026.

Ensign Peak Advisors Inc Sells 3,050 Shares of American Woodmark Corporation $AMWD

defenseworld.net

2025-12-01 05:50:57Ensign Peak Advisors Inc decreased its stake in American Woodmark Corporation (NASDAQ: AMWD) by 29.9% in the second quarter, according to the company in its most recent Form 13F filing with the Securities and Exchange Commission. The institutional investor owned 7,147 shares of the company's stock after selling 3,050 shares during the quarter.

American Woodmark Corporation $AMWD Shares Sold by Geode Capital Management LLC

defenseworld.net

2025-12-01 05:06:46Geode Capital Management LLC lowered its stake in American Woodmark Corporation (NASDAQ: AMWD) by 1.5% in the second quarter, according to the company in its most recent disclosure with the SEC. The institutional investor owned 358,633 shares of the company's stock after selling 5,414 shares during the quarter. Geode Capital Management LLC owned

American Woodmark Corporation Announces Second Quarter Results

businesswire.com

2025-11-25 06:30:00WINCHESTER, Va.--(BUSINESS WIRE)---- $AMWD #AMWD--American Woodmark Corporation (NASDAQ: AMWD) (“American Woodmark,” “the Company,” “we,” “our,” or “us”) today announced results for its second fiscal quarter ended October 31, 2025. “Demand trends remain challenged in both the new construction and remodel markets. Our teams are executing well despite the lower volumes and delivered Adjusted EBITDA margins of 10.0% for the second fiscal quarter,” said Scott Culbreth, President and CEO. “Actions have been put in.

Merger Between MasterBrand and American Woodmark Receives Shareholder Approval

businesswire.com

2025-10-30 16:05:00BEACHWOOD, Ohio & WINCHESTER, Va.--(BUSINESS WIRE)--MasterBrand, Inc. (“MasterBrand”) (NYSE: MBC) and American Woodmark Corporation (“American Woodmark”) (NASDAQ: AMWD) today jointly announced that, at their respective special meetings of shareholders held earlier today, they each received the necessary shareholder approvals for the previously announced combination of MasterBrand and American Woodmark. The final results for the proposals voted on at the special meetings of each company's shareh.

$HAREHOLDER ALERT: The M&A Class Action Firm Reminds $hareholders of Upcoming Merger Deadlines - MLNK, CCRD, AMWD, and PNFP

globenewswire.com

2025-10-15 21:30:00NEW YORK, Oct. 15, 2025 (GLOBE NEWSWIRE) -- Class Action Attorney Juan Monteverde with Monteverde and Associates PC (the "M&A Class Action Firm"), has recovered millions of dollars for shareholders and is recognized as a Top 50 Firm in the 2024 ISS Securities Class Action Services Report.

MasterBrand: Undervalued Play With Upside Potential Thanks To American Woodmark Deal

seekingalpha.com

2025-10-03 12:44:13MasterBrand, Inc. is positioned to benefit significantly from its merger with American Woodmark Corporation, driven by operational synergies and digital transformation. Employees will most likely understand and be prepared for the merger because MBC reported a number of acquisitions in the past. MBC appears undervalued on a standalone basis, with free cash flow and EV/EBITDA metrics suggesting 30% upside potential even if the merger does not close.

American Woodmark Corporation Announces Third Quarter Results

businesswire.com

2026-02-26 06:30:00WINCHESTER, Va.--(BUSINESS WIRE)---- $AMWD #AMWD--American Woodmark Corporation (NASDAQ: AMWD) (“American Woodmark,” “the Company,” “we,” “our,” or “us”) today announced results for its third fiscal quarter ended January 31, 2026. “Demand trends were once again challenging in both the new construction and remodel markets with new construction softening throughout the quarter. We delivered Adjusted EBITDA margins of 6.7% for the third fiscal quarter, as lower volumes impacted fixed cost absorption,” said Scott.

American Woodmark Corporation $AMWD Shares Sold by LSV Asset Management

defenseworld.net

2026-02-18 04:03:14LSV Asset Management decreased its holdings in American Woodmark Corporation (NASDAQ: AMWD) by 98.5% in the third quarter, according to its most recent filing with the Securities and Exchange Commission. The firm owned 4,555 shares of the company's stock after selling 308,607 shares during the quarter. LSV Asset Management's holdings in American Woodmark

Credit Industriel ET Commercial Buys New Stake in American Woodmark Corporation $AMWD

defenseworld.net

2026-02-16 04:18:57Credit Industriel ET Commercial purchased a new stake in shares of American Woodmark Corporation (NASDAQ: AMWD) during the third quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission. The institutional investor purchased 40,000 shares of the company's stock, valued at approximately $2,670,000. Credit Industriel ET Commercial

Alpine Associates Management Inc. Buys New Stake in American Woodmark Corporation $AMWD

defenseworld.net

2026-02-12 04:28:52Alpine Associates Management Inc. purchased a new position in shares of American Woodmark Corporation (NASDAQ: AMWD) in the third quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission (SEC). The firm purchased 209,424 shares of the company's stock, valued at approximately $13,981,000. American Woodmark accounts

Weyerhaeuser Co: A Significant Addition to First Eagle Investment's Portfolio

gurufocus.com

2026-02-04 17:02:00First Eagle Investment (Trades, Portfolio)'s Strategic Moves in Q4 2025 First Eagle Investment (Trades, Portfolio) recently submitted its 13F filing for the fo

American Woodmark Corporation $AMWD Shares Acquired by Cooke & Bieler LP

defenseworld.net

2026-01-26 05:10:59Cooke and Bieler LP boosted its holdings in American Woodmark Corporation (NASDAQ: AMWD) by 3.7% in the third quarter, according to its most recent Form 13F filing with the SEC. The fund owned 930,460 shares of the company's stock after purchasing an additional 32,832 shares during the period. Cooke and Bieler LP owned

American Woodmark (NASDAQ:AMWD) Share Price Passes Above Two Hundred Day Moving Average – Time to Sell?

defenseworld.net

2026-01-21 03:45:01Shares of American Woodmark Corporation (NASDAQ: AMWD - Get Free Report) passed above its 200-day moving average during trading on Tuesday. The stock has a 200-day moving average of $59.90 and traded as high as $61.74. American Woodmark shares last traded at $60.50, with a volume of 84,276 shares. Wall Street Analysts Forecast Growth A

Stock Market Live January 2: S&P 500 (VOO) Rises on Last Day of Week, First Trading Day of 2026

247wallst.com

2026-01-02 09:53:24Live Updates Taking Another Bite At Apple 45 minutes ago Live Raymond James analyst Srini Pajjuri started off 2026 by resuming coverage of Apple (Nasdaq: AAPL) stock - but don't get too excited. Pajjuri only gives Apple a market perform rating (so hold). "Despite strong fundamentals and improving product cycles, we believe Apple's current valuation appropriately reflects... Stock Market Live January 2: S&P 500 (VOO) Rises on Last Day of Week, First Trading Day of 2026.

Ensign Peak Advisors Inc Sells 3,050 Shares of American Woodmark Corporation $AMWD

defenseworld.net

2025-12-01 05:50:57Ensign Peak Advisors Inc decreased its stake in American Woodmark Corporation (NASDAQ: AMWD) by 29.9% in the second quarter, according to the company in its most recent Form 13F filing with the Securities and Exchange Commission. The institutional investor owned 7,147 shares of the company's stock after selling 3,050 shares during the quarter.

American Woodmark Corporation $AMWD Shares Sold by Geode Capital Management LLC

defenseworld.net

2025-12-01 05:06:46Geode Capital Management LLC lowered its stake in American Woodmark Corporation (NASDAQ: AMWD) by 1.5% in the second quarter, according to the company in its most recent disclosure with the SEC. The institutional investor owned 358,633 shares of the company's stock after selling 5,414 shares during the quarter. Geode Capital Management LLC owned

American Woodmark Corporation Announces Second Quarter Results

businesswire.com

2025-11-25 06:30:00WINCHESTER, Va.--(BUSINESS WIRE)---- $AMWD #AMWD--American Woodmark Corporation (NASDAQ: AMWD) (“American Woodmark,” “the Company,” “we,” “our,” or “us”) today announced results for its second fiscal quarter ended October 31, 2025. “Demand trends remain challenged in both the new construction and remodel markets. Our teams are executing well despite the lower volumes and delivered Adjusted EBITDA margins of 10.0% for the second fiscal quarter,” said Scott Culbreth, President and CEO. “Actions have been put in.

Merger Between MasterBrand and American Woodmark Receives Shareholder Approval

businesswire.com

2025-10-30 16:05:00BEACHWOOD, Ohio & WINCHESTER, Va.--(BUSINESS WIRE)--MasterBrand, Inc. (“MasterBrand”) (NYSE: MBC) and American Woodmark Corporation (“American Woodmark”) (NASDAQ: AMWD) today jointly announced that, at their respective special meetings of shareholders held earlier today, they each received the necessary shareholder approvals for the previously announced combination of MasterBrand and American Woodmark. The final results for the proposals voted on at the special meetings of each company's shareh.

$HAREHOLDER ALERT: The M&A Class Action Firm Reminds $hareholders of Upcoming Merger Deadlines - MLNK, CCRD, AMWD, and PNFP

globenewswire.com

2025-10-15 21:30:00NEW YORK, Oct. 15, 2025 (GLOBE NEWSWIRE) -- Class Action Attorney Juan Monteverde with Monteverde and Associates PC (the "M&A Class Action Firm"), has recovered millions of dollars for shareholders and is recognized as a Top 50 Firm in the 2024 ISS Securities Class Action Services Report.

MasterBrand: Undervalued Play With Upside Potential Thanks To American Woodmark Deal

seekingalpha.com

2025-10-03 12:44:13MasterBrand, Inc. is positioned to benefit significantly from its merger with American Woodmark Corporation, driven by operational synergies and digital transformation. Employees will most likely understand and be prepared for the merger because MBC reported a number of acquisitions in the past. MBC appears undervalued on a standalone basis, with free cash flow and EV/EBITDA metrics suggesting 30% upside potential even if the merger does not close.