AMETEK, Inc. (AME)

Price:

181.42 USD

( - -1.57 USD)

Your position:

0 USD

ACTION PANEL

ABOUT

Check the

KEY TAKEAWAYS

ASK OUR AI ABOUT THE COMPANY (REGISTER FOR EARLY ACCESS)

(REGISTER FOR EARLY ACCESS) CHOOSE A PROMPT ABOVE TO ASK OUR AI ABOUT THE SPECIFIC INFORMATION

SIMILAR COMPANIES STI SCORE

Similar STI Score

Eaton Corporation plc

VALUE SCORE:

8

2nd position

Dover Corporation

VALUE SCORE:

10

The best

Cummins Inc.

VALUE SCORE:

11

FUNDAMENTALS

FUNDAMENTALS

FUNDAMENTALS

FUNDAMENTALS PER SHARE

TECHNICAL

DIVIDEND

SIMILAR COMPANIES

DESCRIPTION

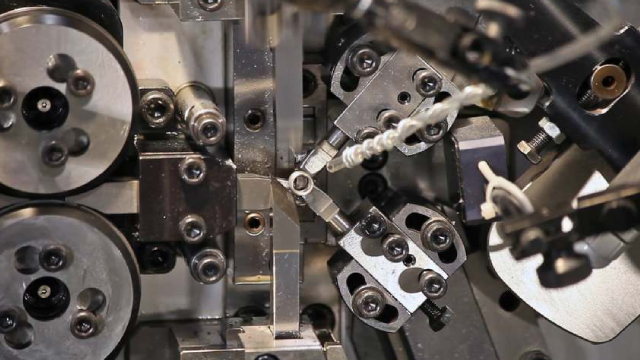

AMETEK, Inc. manufactures and sells electronic instruments and electromechanical devices worldwide. It operates in two segments, Electronic Instruments (EIG) and Electromechanical (EMG). The company's EIG segment offers advanced instruments for the process, aerospace, power, and industrial markets; process and analytical instruments for the oil and gas, petrochemical, pharmaceutical, semiconductor, automation, and food and beverage industries; and instruments to the laboratory equipment, ultra-precision manufacturing, medical, and test and measurement markets. This segment also provides power quality monitoring and metering devices, uninterruptible power supplies, programmable power equipment, electromagnetic compatibility test equipment, gas turbines, and environmental health and safety market sensors, dashboard instruments for heavy trucks and other vehicles, and instrumentation and controls for the food and beverage industries; and aircraft and engine sensors, monitoring systems, power supplies, fuel and fluid measurement systems, and data acquisition systems for the aerospace industry. Its EMG segment offers engineered electrical connectors and electronics packaging to protect sensitive devices and mission-critical electronics; precision motion control products for data storage, medical devices, business equipment, automation, and other applications; high-purity powdered metals, strips and foils, specialty clad metals, and metal matrix composites; motor-blower systems and heat exchangers for use in thermal management, military, commercial aircraft, and military ground vehicles; and motors for use in commercial appliances, fitness equipment, food and beverage machines, hydraulic pumps, and industrial blowers. This segment also operates a network of aviation maintenance, repair, and overhaul facilities. In addition, the company offers clinical and educational communication solutions. AMETEK, Inc. was founded in 1930 and is headquartered in Berwyn, Pennsylvania.

NEWS

2 Electronics Testing Stocks to Watch From a Challenging Industry

zacks.com

2025-08-13 14:16:05The Zacks Electronics -Testing Equipment industry players, such as AME and ITRI, are poised to benefit from the solid demand for testing instruments.

AMETEK Declares Quarterly Dividend

prnewswire.com

2025-08-08 08:00:00BERWYN, Pa. , Aug. 8, 2025 /PRNewswire/ -- The Board of Directors of AMETEK, Inc. (NYSE: AME) declared a regular quarterly dividend of $0.31 per share for the third quarter ending September 30, 2025.

Unlocking Ametek (AME) International Revenues: Trends, Surprises, and Prospects

zacks.com

2025-08-04 10:16:39Review Ametek's (AME) international revenue performance and how it affects the predictions of financial analysts on Wall Street and the future prospects for the stock.

Ametek (AME) Q2 EPS Jumps 7% to Record

fool.com

2025-08-02 04:02:59Ametek (AME) Q2 EPS Jumps 7% to Record

AMETEK, Inc. (AME) Q2 2025 Earnings Call Transcript

seekingalpha.com

2025-07-31 11:27:52AMETEK, Inc. (NYSE:AME ) Q2 2025 Earnings Conference Call July 31, 2025 8:30 AM ET Company Participants Dalip Mohan Puri - Executive VP & CFO David A. Zapico - Chairman of the Board & CEO Kevin C.

Compared to Estimates, Ametek (AME) Q2 Earnings: A Look at Key Metrics

zacks.com

2025-07-31 10:31:54While the top- and bottom-line numbers for Ametek (AME) give a sense of how the business performed in the quarter ended June 2025, it could be worth looking at how some of its key metrics compare to Wall Street estimates and year-ago values.

Ametek (AME) Q2 Earnings and Revenues Top Estimates

zacks.com

2025-07-31 09:06:10Ametek (AME) came out with quarterly earnings of $1.78 per share, beating the Zacks Consensus Estimate of $1.68 per share. This compares to earnings of $1.66 per share a year ago.

AMETEK Announces Record Second Quarter Results and Raises Full Year Guidance

prnewswire.com

2025-07-31 06:55:00BERWYN, Pa. , July 31, 2025 /PRNewswire/ -- AMETEK, Inc. (NYSE: AME) today announced its financial results for the second quarter ended June 30, 2025.

Ametek Has Major Macroeconomic Tailwinds Pushing For Growth In H2

seekingalpha.com

2025-07-29 06:19:44I am upgrading AMETEK to a 'Buy' with a $199 price target, anticipating an earnings surprise despite negative analyst sentiment. Aerospace, defense, and power markets may provide strong tailwinds, while industrials and medical devices are set for recovery as inventory digestion winds down. Recent acquisitions, robust US/EU industrial investments, and macroeconomic certainty from tariff policy position AME for moderate growth in FY25 and beyond.

Will Ametek (AME) Beat Estimates Again in Its Next Earnings Report?

zacks.com

2025-07-24 13:10:24Ametek (AME) has an impressive earnings surprise history and currently possesses the right combination of the two key ingredients for a likely beat in its next quarterly report.

Ametek (AME) Earnings Expected to Grow: Should You Buy?

zacks.com

2025-07-24 11:01:06Ametek (AME) possesses the right combination of the two key ingredients for a likely earnings beat in its upcoming report. Get prepared with the key expectations.

AMETEK Completes Acquisition of FARO Technologies, Strengthening Leadership in 3D Metrology, Laser Projection & Digital Reality Solutions

globenewswire.com

2025-07-21 10:20:00LAKE MARY, Fla., July 21, 2025 (GLOBE NEWSWIRE) -- AMETEK, Inc. today announced that it has completed its acquisition of FARO Technologies, a global leader in 3D measurement and imaging solutions. FARO will join Creaform and Virtek as part of AMETEK's Ultra Precision Technologies Division.

AMETEK Completes Acquisition of FARO Technologies

prnewswire.com

2025-07-21 09:15:00BERWYN, Pa. , July 21, 2025 /PRNewswire/ -- AMETEK, Inc. (NYSE: AME) today announced that it has completed its acquisition of FARO Technologies, Inc. for $44.00 per share in cash, or approximately $920 million, net of cash acquired.

AMETEK Announces Second Quarter 2025 Earnings Call and Webcasted Investor Conference Call Information

prnewswire.com

2025-07-15 08:00:00- Earnings to be released before market opens on Thursday, July 31, 2025 - BERWYN, Pa. , July 15, 2025 /PRNewswire/ -- AMETEK, Inc. (NYSE: AME) will issue its second quarter 2025 earnings release before the market opens on Thursday, July 31, 2025.

FARO TECHNOLOGIES INVESTOR ALERT by the Former Attorney General of Louisiana: Kahn Swick & Foti, LLC Investigates Adequacy of Price and Process in Proposed Sale of FARO Technologies, Inc. - FARO

businesswire.com

2025-06-20 16:42:00NEW YORK & NEW ORLEANS--(BUSINESS WIRE)--Former Attorney General of Louisiana Charles C. Foti, Jr., Esq. and the law firm of Kahn Swick & Foti, LLC (“KSF”) are investigating the proposed sale of FARO Technologies, Inc. (NasdaqGS: FARO) to AMETEK, Inc. (NYSE: AME). Under the terms of the proposed transaction, shareholders of FARO will receive $44.00 in cash for each share of FARO that they own. KSF is seeking to determine whether this consideration and the process that led to it are adequate.

2 Electronics Testing Stocks to Watch From a Challenging Industry

zacks.com

2025-08-13 14:16:05The Zacks Electronics -Testing Equipment industry players, such as AME and ITRI, are poised to benefit from the solid demand for testing instruments.

AMETEK Declares Quarterly Dividend

prnewswire.com

2025-08-08 08:00:00BERWYN, Pa. , Aug. 8, 2025 /PRNewswire/ -- The Board of Directors of AMETEK, Inc. (NYSE: AME) declared a regular quarterly dividend of $0.31 per share for the third quarter ending September 30, 2025.

Unlocking Ametek (AME) International Revenues: Trends, Surprises, and Prospects

zacks.com

2025-08-04 10:16:39Review Ametek's (AME) international revenue performance and how it affects the predictions of financial analysts on Wall Street and the future prospects for the stock.

Ametek (AME) Q2 EPS Jumps 7% to Record

fool.com

2025-08-02 04:02:59Ametek (AME) Q2 EPS Jumps 7% to Record

AMETEK, Inc. (AME) Q2 2025 Earnings Call Transcript

seekingalpha.com

2025-07-31 11:27:52AMETEK, Inc. (NYSE:AME ) Q2 2025 Earnings Conference Call July 31, 2025 8:30 AM ET Company Participants Dalip Mohan Puri - Executive VP & CFO David A. Zapico - Chairman of the Board & CEO Kevin C.

Compared to Estimates, Ametek (AME) Q2 Earnings: A Look at Key Metrics

zacks.com

2025-07-31 10:31:54While the top- and bottom-line numbers for Ametek (AME) give a sense of how the business performed in the quarter ended June 2025, it could be worth looking at how some of its key metrics compare to Wall Street estimates and year-ago values.

Ametek (AME) Q2 Earnings and Revenues Top Estimates

zacks.com

2025-07-31 09:06:10Ametek (AME) came out with quarterly earnings of $1.78 per share, beating the Zacks Consensus Estimate of $1.68 per share. This compares to earnings of $1.66 per share a year ago.

AMETEK Announces Record Second Quarter Results and Raises Full Year Guidance

prnewswire.com

2025-07-31 06:55:00BERWYN, Pa. , July 31, 2025 /PRNewswire/ -- AMETEK, Inc. (NYSE: AME) today announced its financial results for the second quarter ended June 30, 2025.

Ametek Has Major Macroeconomic Tailwinds Pushing For Growth In H2

seekingalpha.com

2025-07-29 06:19:44I am upgrading AMETEK to a 'Buy' with a $199 price target, anticipating an earnings surprise despite negative analyst sentiment. Aerospace, defense, and power markets may provide strong tailwinds, while industrials and medical devices are set for recovery as inventory digestion winds down. Recent acquisitions, robust US/EU industrial investments, and macroeconomic certainty from tariff policy position AME for moderate growth in FY25 and beyond.

Will Ametek (AME) Beat Estimates Again in Its Next Earnings Report?

zacks.com

2025-07-24 13:10:24Ametek (AME) has an impressive earnings surprise history and currently possesses the right combination of the two key ingredients for a likely beat in its next quarterly report.

Ametek (AME) Earnings Expected to Grow: Should You Buy?

zacks.com

2025-07-24 11:01:06Ametek (AME) possesses the right combination of the two key ingredients for a likely earnings beat in its upcoming report. Get prepared with the key expectations.

AMETEK Completes Acquisition of FARO Technologies, Strengthening Leadership in 3D Metrology, Laser Projection & Digital Reality Solutions

globenewswire.com

2025-07-21 10:20:00LAKE MARY, Fla., July 21, 2025 (GLOBE NEWSWIRE) -- AMETEK, Inc. today announced that it has completed its acquisition of FARO Technologies, a global leader in 3D measurement and imaging solutions. FARO will join Creaform and Virtek as part of AMETEK's Ultra Precision Technologies Division.

AMETEK Completes Acquisition of FARO Technologies

prnewswire.com

2025-07-21 09:15:00BERWYN, Pa. , July 21, 2025 /PRNewswire/ -- AMETEK, Inc. (NYSE: AME) today announced that it has completed its acquisition of FARO Technologies, Inc. for $44.00 per share in cash, or approximately $920 million, net of cash acquired.

AMETEK Announces Second Quarter 2025 Earnings Call and Webcasted Investor Conference Call Information

prnewswire.com

2025-07-15 08:00:00- Earnings to be released before market opens on Thursday, July 31, 2025 - BERWYN, Pa. , July 15, 2025 /PRNewswire/ -- AMETEK, Inc. (NYSE: AME) will issue its second quarter 2025 earnings release before the market opens on Thursday, July 31, 2025.

FARO TECHNOLOGIES INVESTOR ALERT by the Former Attorney General of Louisiana: Kahn Swick & Foti, LLC Investigates Adequacy of Price and Process in Proposed Sale of FARO Technologies, Inc. - FARO

businesswire.com

2025-06-20 16:42:00NEW YORK & NEW ORLEANS--(BUSINESS WIRE)--Former Attorney General of Louisiana Charles C. Foti, Jr., Esq. and the law firm of Kahn Swick & Foti, LLC (“KSF”) are investigating the proposed sale of FARO Technologies, Inc. (NasdaqGS: FARO) to AMETEK, Inc. (NYSE: AME). Under the terms of the proposed transaction, shareholders of FARO will receive $44.00 in cash for each share of FARO that they own. KSF is seeking to determine whether this consideration and the process that led to it are adequate.