iShares Russell 1000 Pure U.S. Revenue ETF (AMCA)

Price:

37.55 USD

( - -0.04 USD)

Your position:

0 USD

ACTION PANEL

ABOUT

Check the

KEY TAKEAWAYS

ASK OUR AI ABOUT THE COMPANY (REGISTER FOR EARLY ACCESS)

(REGISTER FOR EARLY ACCESS) CHOOSE A PROMPT ABOVE TO ASK OUR AI ABOUT THE SPECIFIC INFORMATION

SIMILAR COMPANIES STI SCORE

Similar STI Score

Strategy Shares Nasdaq 7 Handl Index ETF

VALUE SCORE:

9

2nd position

Angel Oak Ultrashort Income ETF

VALUE SCORE:

12

The best

Invesco Variable Rate Investment Grade ETF

VALUE SCORE:

12

FUNDAMENTALS

FUNDAMENTALS

FUNDAMENTALS

FUNDAMENTALS PER SHARE

TECHNICAL

DIVIDEND

SIMILAR COMPANIES

No data to display

No data to display

No data to display

No data to display

No data to display

No data to display

No data to display

No data to display

No data to display

No data to display

DESCRIPTION

The investment seeks to track the investment results of the Russell 1000® Pure Domestic Exposure Index. The fund invests at least 80% of its assets in the component securities of its underlying index and in investments that have economic characteristics that are substantially identical to the component securities of its underlying index and may invest up to 20% of its assets in certain futures, options and swap contracts, cash and cash equivalents. The index composed of U.S. companies exhibiting higher domestic sales as a proportion of the company's total sales relative to other large- and mid-capitalization U.S. equities.

NEWS

ETF Odds & Ends: Bloomberg Rebrands Indexes

etf.com

2021-08-30 18:25:41Plus, Alerian and Galaxy Digital teamed up to develop an index family.

iShares Closes 7 ETFs

etf.com

2021-08-25 18:50:39The ETFs amount to nearly $88 million in assets.

ETF Odds & Ends: iShares To Close 7 ETFs

etf.com

2021-07-01 11:17:47Plus, the issuer swapped out indexes on two key ETFs.

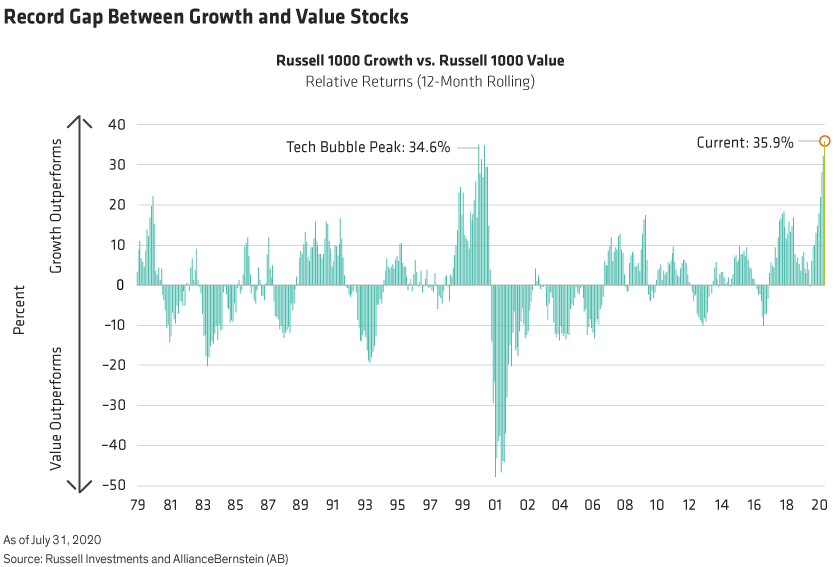

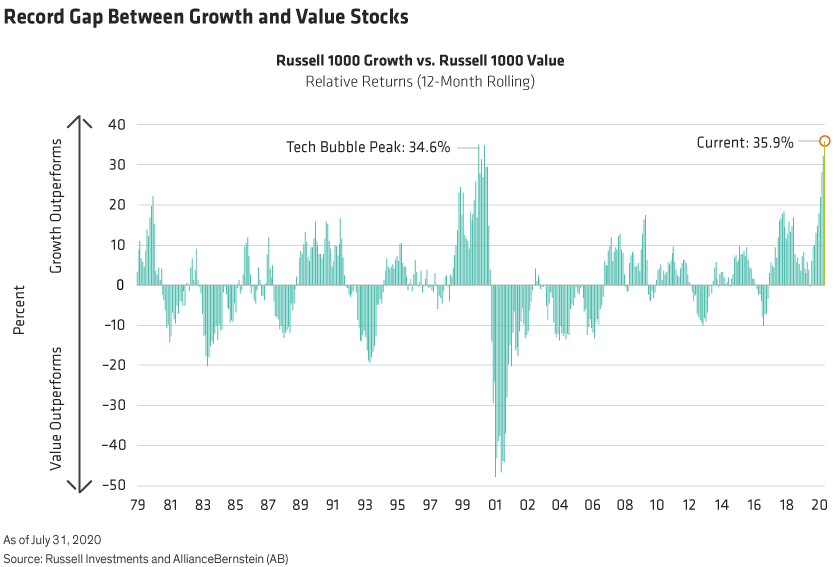

Style Tilt: Growth Surge Reshapes U.S. Stock Market In 2020

seekingalpha.com

2020-09-02 14:13:39During the coronavirus downturn and rebound, US growth stocks outpaced value stocks by a record margin.

What The 2020 Russell Recon Tells The Market

seekingalpha.com

2020-07-02 10:01:44The Russell US Indexes' annual reconstitution process is critical to maintaining accurate representation of U.S. equity markets. The reconstitution is a major e

Small-Cap Stocks Have Historically Outperformed After Recessions

seekingalpha.com

2020-07-02 06:43:48Since the March 18 trough, small caps have rebounded with a 43.7% gain, outpacing large caps by 11.4%. Small caps have outperformed large caps coming out of the

The Reopening Killed The V-Shaped Recovery

seekingalpha.com

2020-06-29 07:43:33This is a weekly series focused on analyzing the previous week’s economic data releases. The objective is to concentrate on leading indicators of economic activ

S&P 500 Earnings Update: Revisions Turned Slightly Negative (Again) This Past Week

seekingalpha.com

2020-06-27 10:18:24Next week, readers will see the quarterly bump in the forward four-quarter estimate. Looking at the forward S&P 500 EPS curve, the revisions this week turned sl

Has The Negative EPS Cycle Turned A Corner?

seekingalpha.com

2020-06-22 07:51:18Investors have decisively turned their sights to 2021 recovery prospects, even as consensus 2020 EPS forecasts have continued their steep downhill slide. The co

Coronavirus Roundtable - Watching Out For Real Economy Pain (Video)

seekingalpha.com

2020-04-29 10:45:04Nick Gomez of ANG Traders warns that there's still a wide disconnect between the markets and the economic reality. He argues that more stimulus is needed for th

The 3 Cs Of Trading Markets In Turmoil

seekingalpha.com

2020-03-12 20:11:54Here’s something to take some of the sting out of hard investing decisions. I call it the 3 Cs of trading in a crisis. Capital. Conviction. Courage. In order to

No data to display

ETF Odds & Ends: Bloomberg Rebrands Indexes

etf.com

2021-08-30 18:25:41Plus, Alerian and Galaxy Digital teamed up to develop an index family.

iShares Closes 7 ETFs

etf.com

2021-08-25 18:50:39The ETFs amount to nearly $88 million in assets.

ETF Odds & Ends: iShares To Close 7 ETFs

etf.com

2021-07-01 11:17:47Plus, the issuer swapped out indexes on two key ETFs.

Style Tilt: Growth Surge Reshapes U.S. Stock Market In 2020

seekingalpha.com

2020-09-02 14:13:39During the coronavirus downturn and rebound, US growth stocks outpaced value stocks by a record margin.

What The 2020 Russell Recon Tells The Market

seekingalpha.com

2020-07-02 10:01:44The Russell US Indexes' annual reconstitution process is critical to maintaining accurate representation of U.S. equity markets. The reconstitution is a major e

Small-Cap Stocks Have Historically Outperformed After Recessions

seekingalpha.com

2020-07-02 06:43:48Since the March 18 trough, small caps have rebounded with a 43.7% gain, outpacing large caps by 11.4%. Small caps have outperformed large caps coming out of the

The Reopening Killed The V-Shaped Recovery

seekingalpha.com

2020-06-29 07:43:33This is a weekly series focused on analyzing the previous week’s economic data releases. The objective is to concentrate on leading indicators of economic activ

S&P 500 Earnings Update: Revisions Turned Slightly Negative (Again) This Past Week

seekingalpha.com

2020-06-27 10:18:24Next week, readers will see the quarterly bump in the forward four-quarter estimate. Looking at the forward S&P 500 EPS curve, the revisions this week turned sl

Has The Negative EPS Cycle Turned A Corner?

seekingalpha.com

2020-06-22 07:51:18Investors have decisively turned their sights to 2021 recovery prospects, even as consensus 2020 EPS forecasts have continued their steep downhill slide. The co

Coronavirus Roundtable - Watching Out For Real Economy Pain (Video)

seekingalpha.com

2020-04-29 10:45:04Nick Gomez of ANG Traders warns that there's still a wide disconnect between the markets and the economic reality. He argues that more stimulus is needed for th

The 3 Cs Of Trading Markets In Turmoil

seekingalpha.com

2020-03-12 20:11:54Here’s something to take some of the sting out of hard investing decisions. I call it the 3 Cs of trading in a crisis. Capital. Conviction. Courage. In order to