Arlington Asset Investment Corp. (AIW)

Price:

25.00 USD

( - -0.03 USD)

Your position:

0 USD

ACTION PANEL

ABOUT

Check the

KEY TAKEAWAYS

ASK OUR AI ABOUT THE COMPANY (REGISTER FOR EARLY ACCESS)

(REGISTER FOR EARLY ACCESS) CHOOSE A PROMPT ABOVE TO ASK OUR AI ABOUT THE SPECIFIC INFORMATION

SIMILAR COMPANIES STI SCORE

Similar STI Score

New Residential Investment Corp.

VALUE SCORE:

0

2nd position

Two Harbors Investment Corp.

VALUE SCORE:

10

The best

Two Harbors Investment Corp.

VALUE SCORE:

10

FUNDAMENTALS

FUNDAMENTALS

FUNDAMENTALS

FUNDAMENTALS PER SHARE

TECHNICAL

DIVIDEND

SIMILAR COMPANIES

No data to display

No data to display

No data to display

No data to display

No data to display

No data to display

DESCRIPTION

NEWS

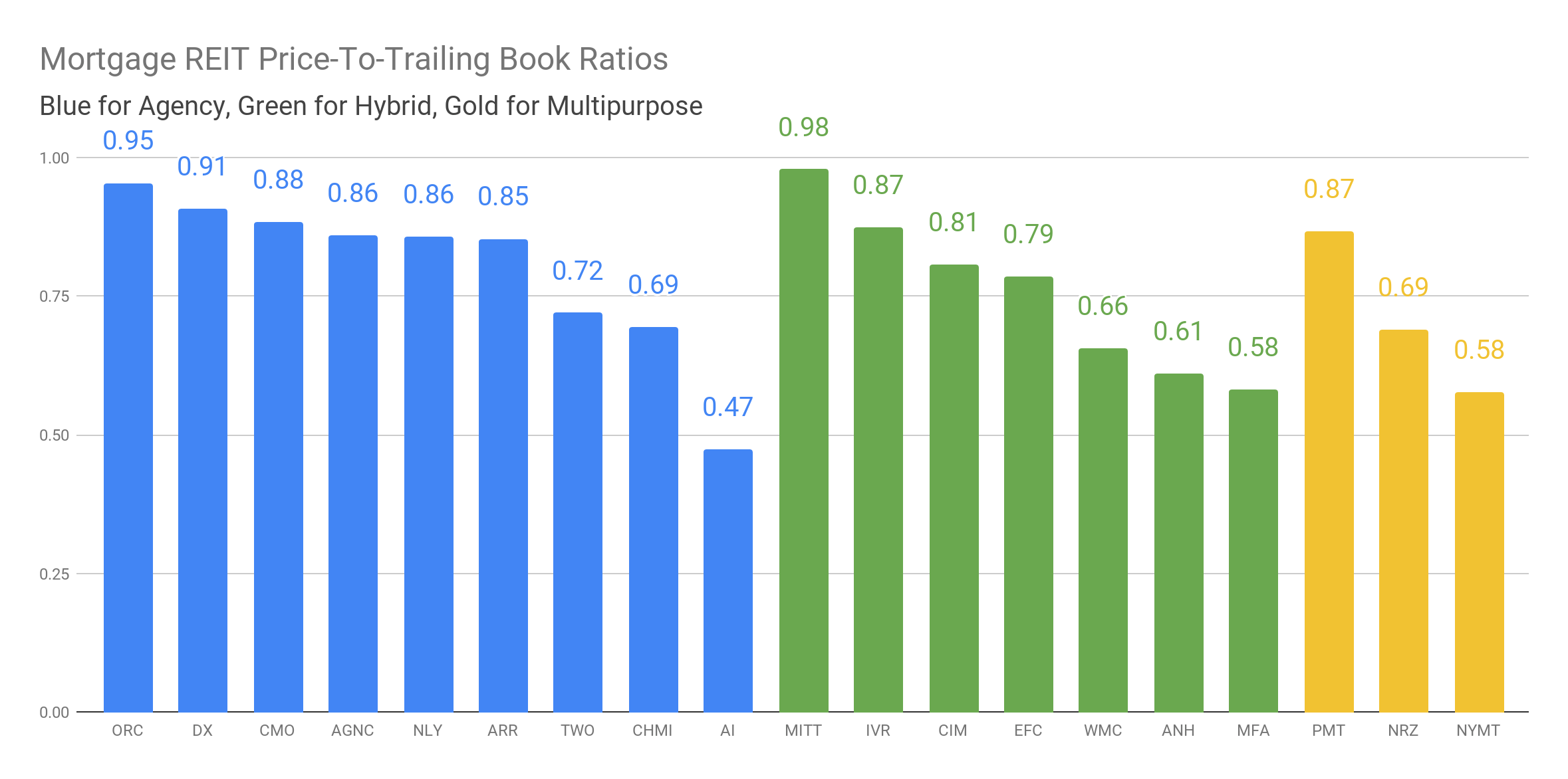

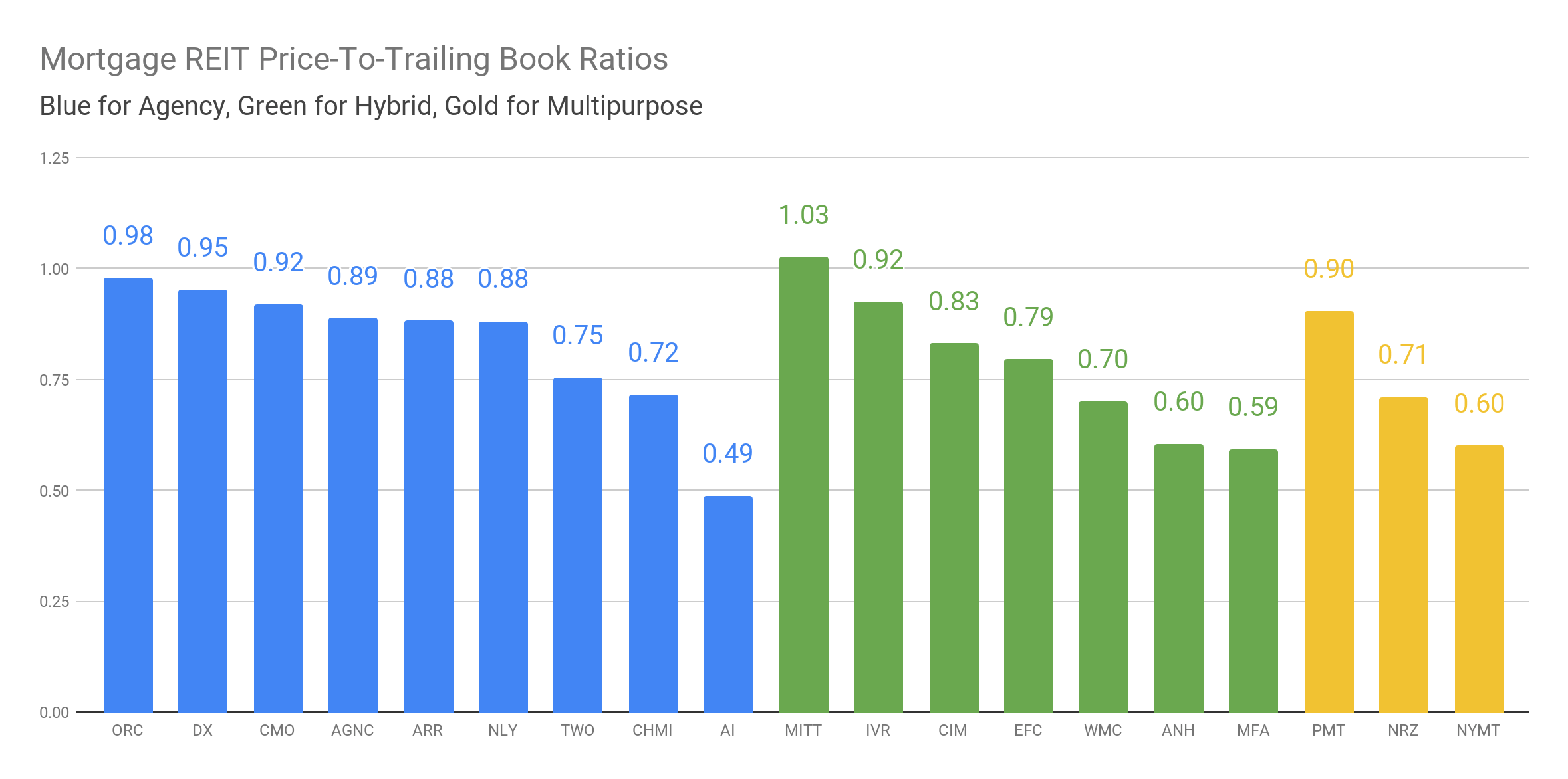

Plenty Of Upside From Discounts To NAV

seekingalpha.com

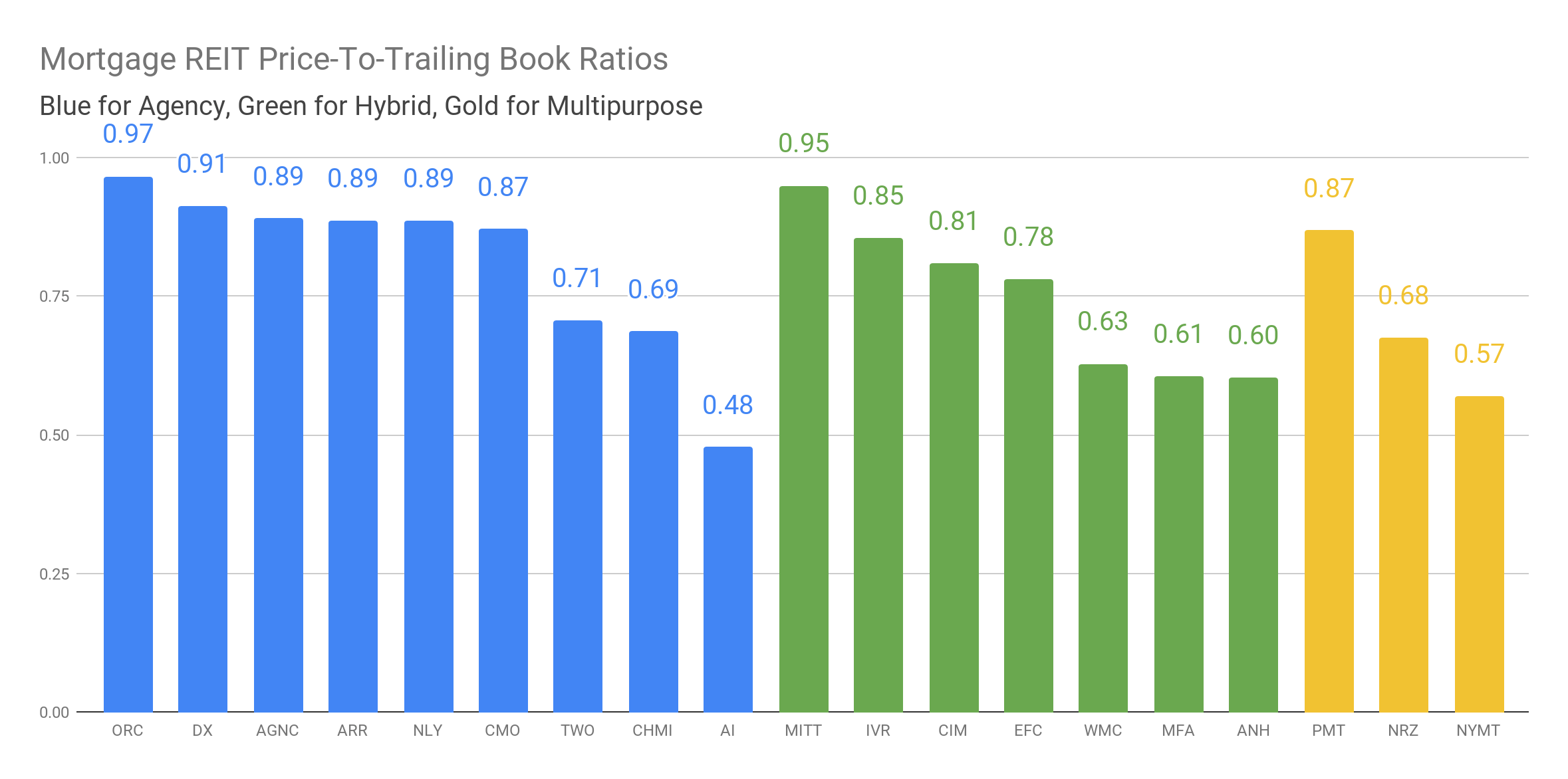

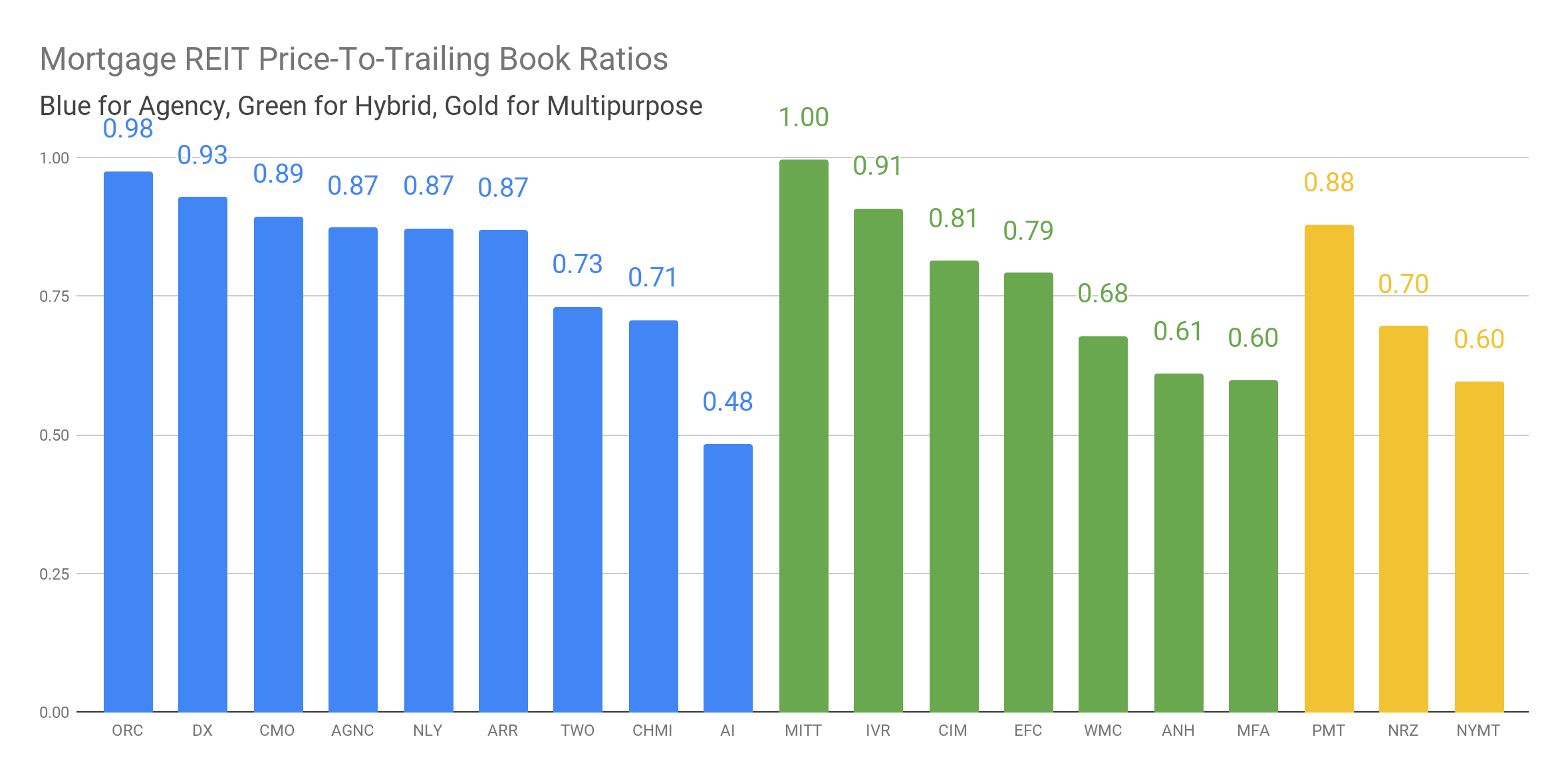

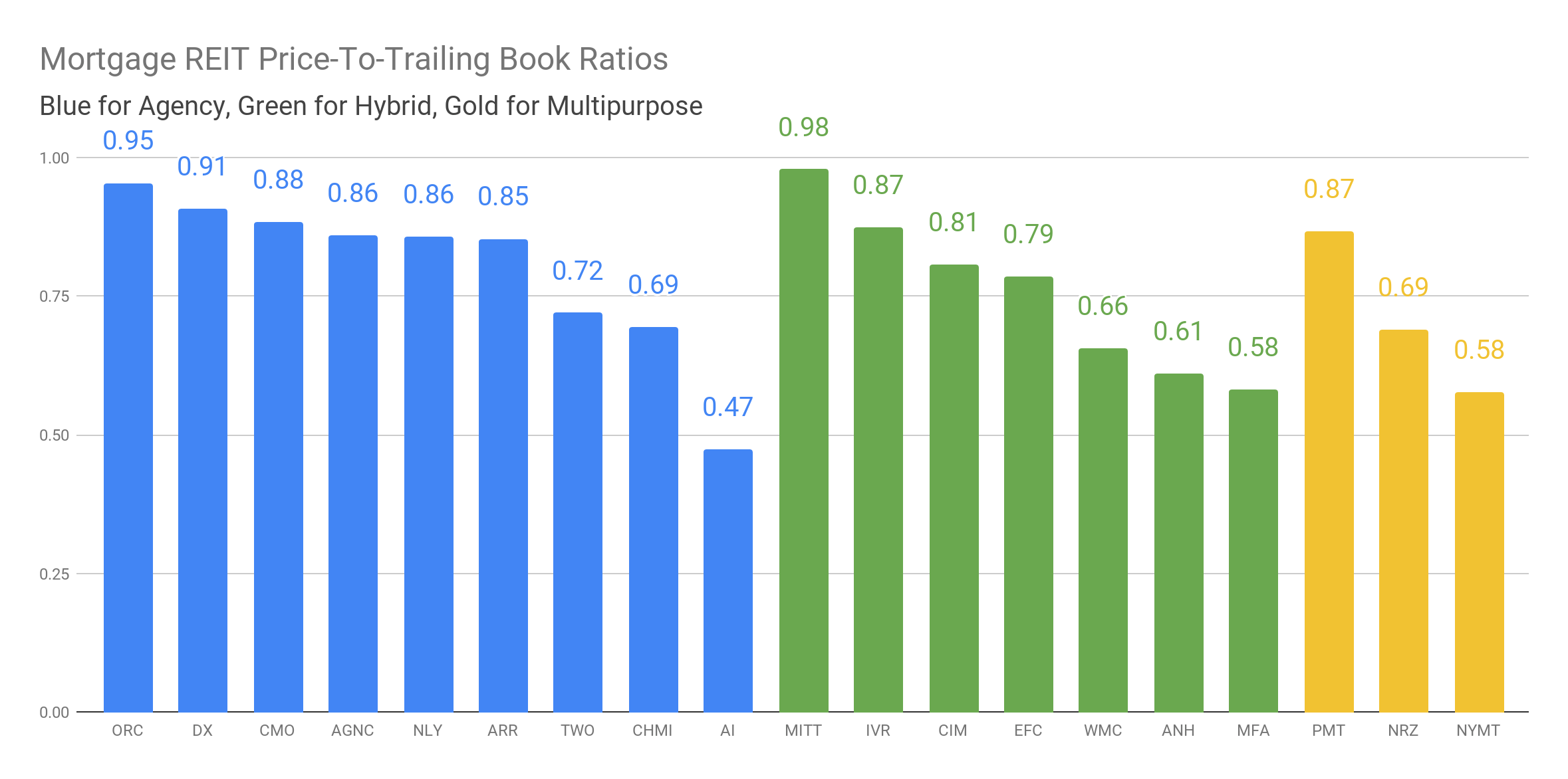

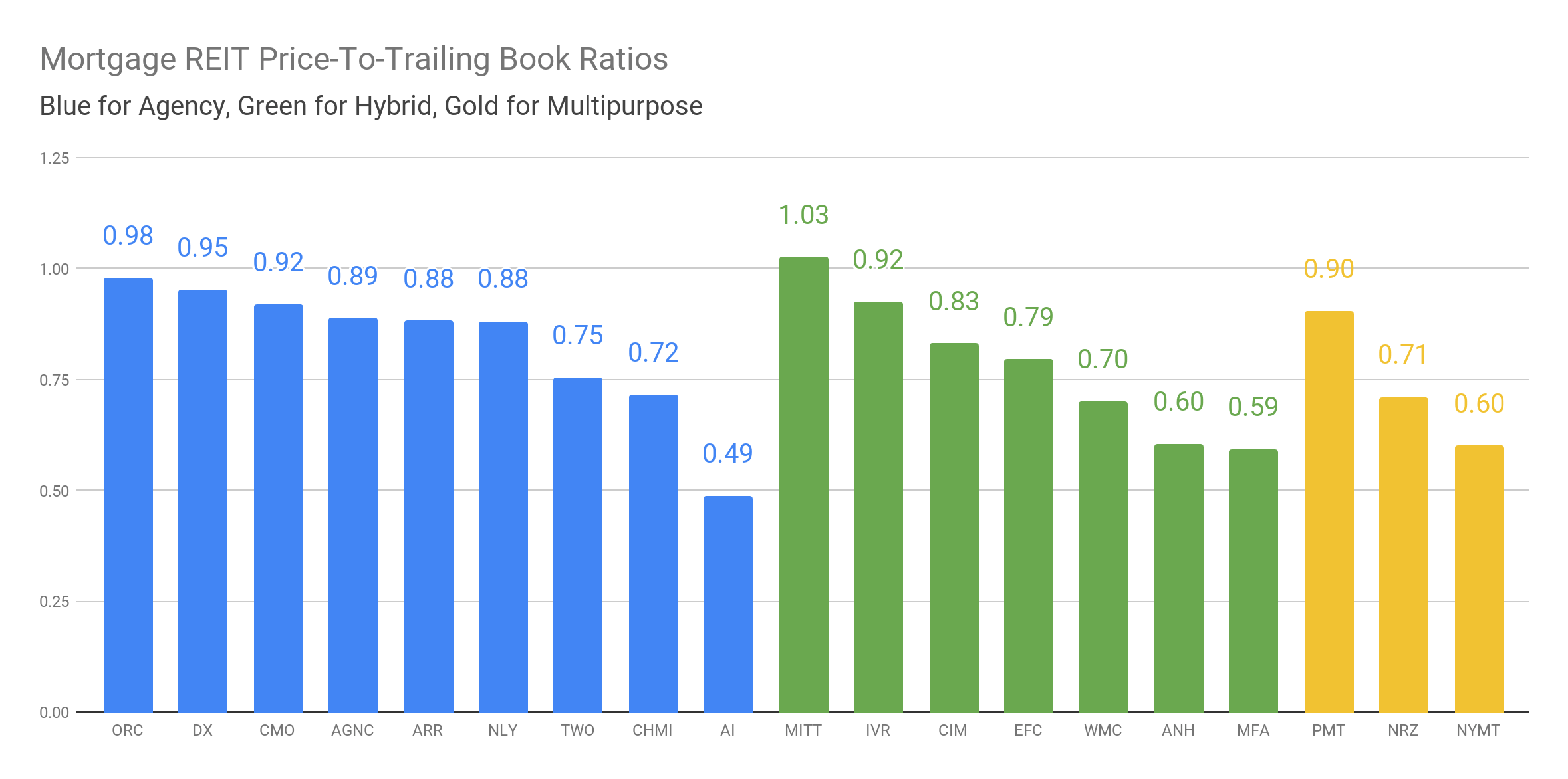

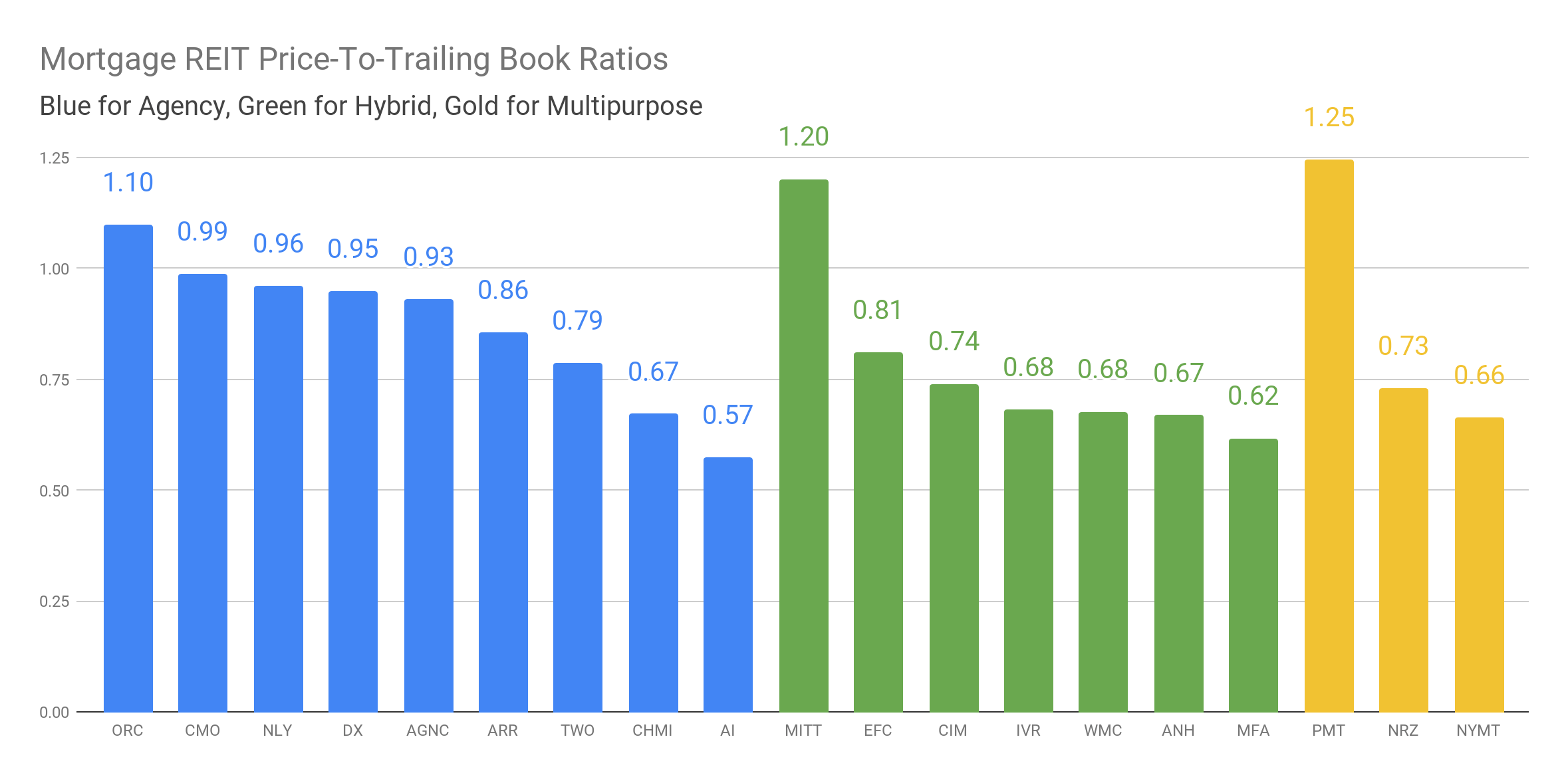

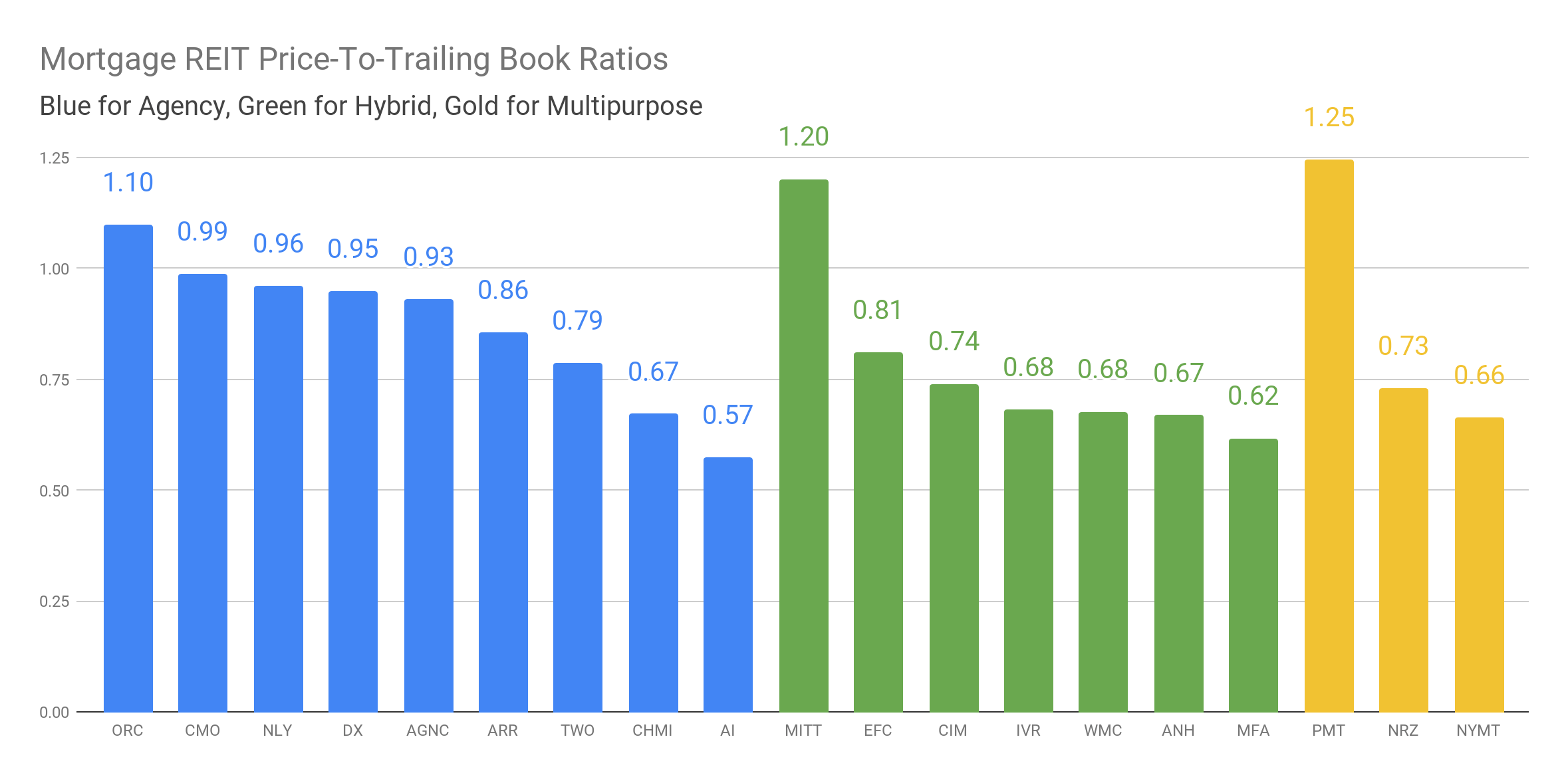

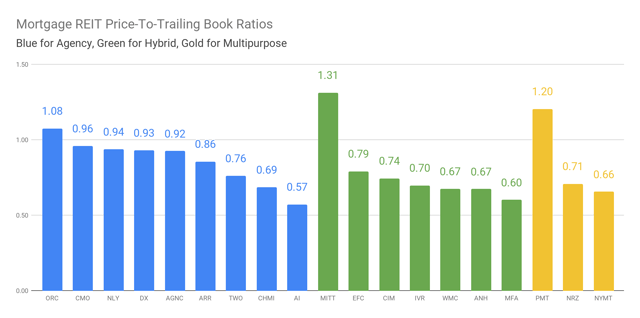

2020-09-13 17:17:34Discounts to book value (or NAV) are the start of your mortgage REIT analysis, but not the end. In this series we’re providing readers with the discounts to trailing book values throughout the sector and a few notes on the current environment.

Upgrading One Of Our Least Favorite Mortgage REITs

seekingalpha.com

2020-09-08 13:34:14Discounts to book value are the start of your analysis, but not the end. In this series we’re providing readers with the discounts to trailing book values throughout the sector and a few notes on the current environment.

Sales Return For Mortgage REITs

seekingalpha.com

2020-09-04 13:48:13Price-to-book ratios dropped materially, creating new opportunities. Buying with a discount to book value doesn’t guarantee success, yet it does improve the odds dramatically.

Quick And Dirty Discounts To Book Value For September 1st, 2020

seekingalpha.com

2020-09-02 07:33:16Discounts to book value are the start of your analysis, but not the end. In this series, we’re providing readers with the discounts to trailing book values throughout the sector and a few notes on the current environment.

How To Pick Mortgage REITs

seekingalpha.com

2020-08-25 10:49:57Analysis starts with discount to book, but it doesn't end there. Using current estimates for book value is far superior to using trailing book values, but the trailing values will still give investors a rough idea.

Mortgage REIT Common Shares Are For Trading

seekingalpha.com

2020-08-17 20:42:37One topic that seems to come up regularly is investors wondering about using a buy-and-hold strategy for years on common shares.

Mortgage REITs: Earnings Recap

seekingalpha.com

2020-08-13 10:20:31Mortgage REIT earnings season wrapped up this week. As with their Equity REIT peers, earnings reports were generally better-than-expected.

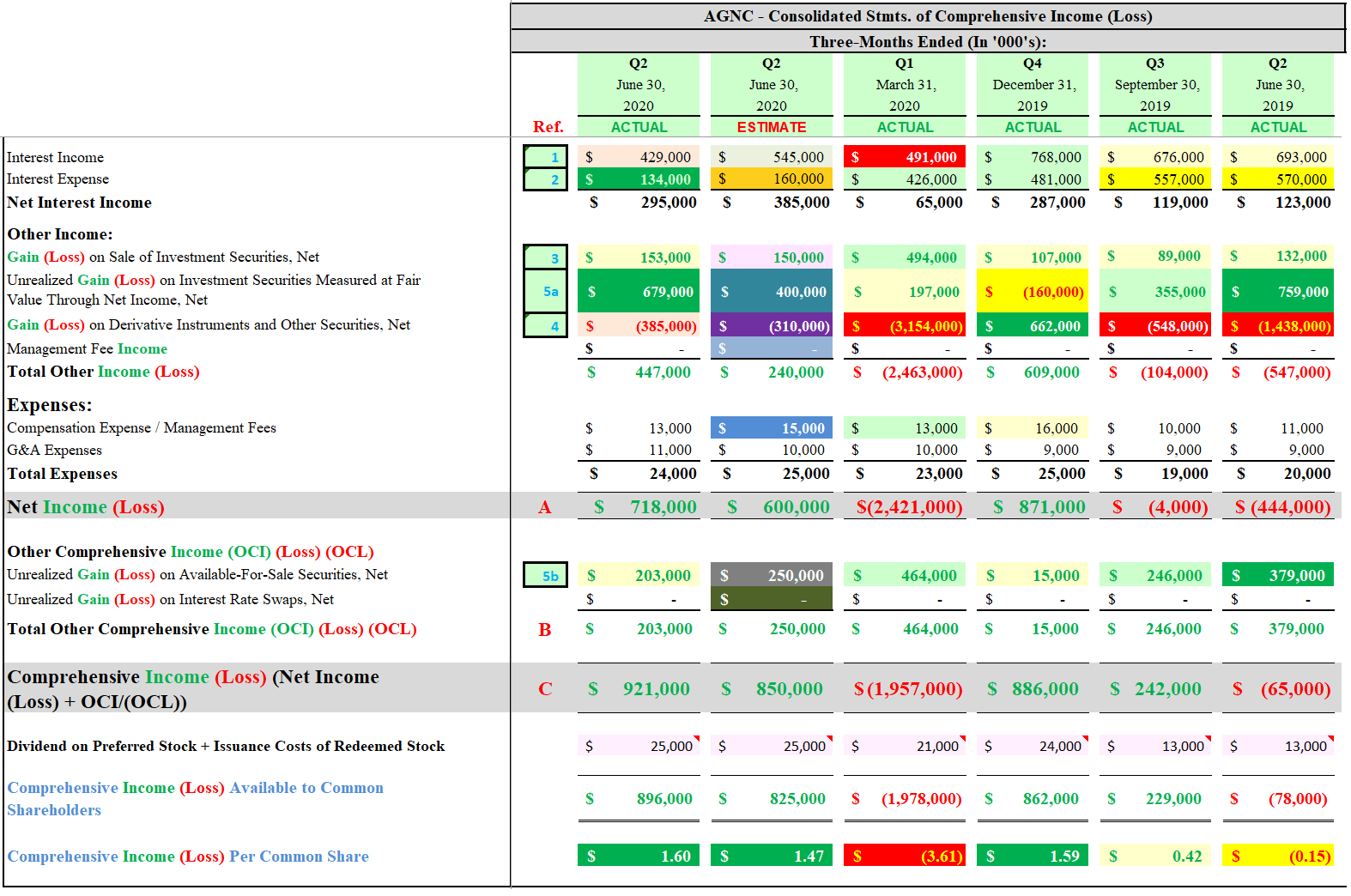

Assessing AGNC Investment's Results For Q2 2020 (Running On All Cylinders)

seekingalpha.com

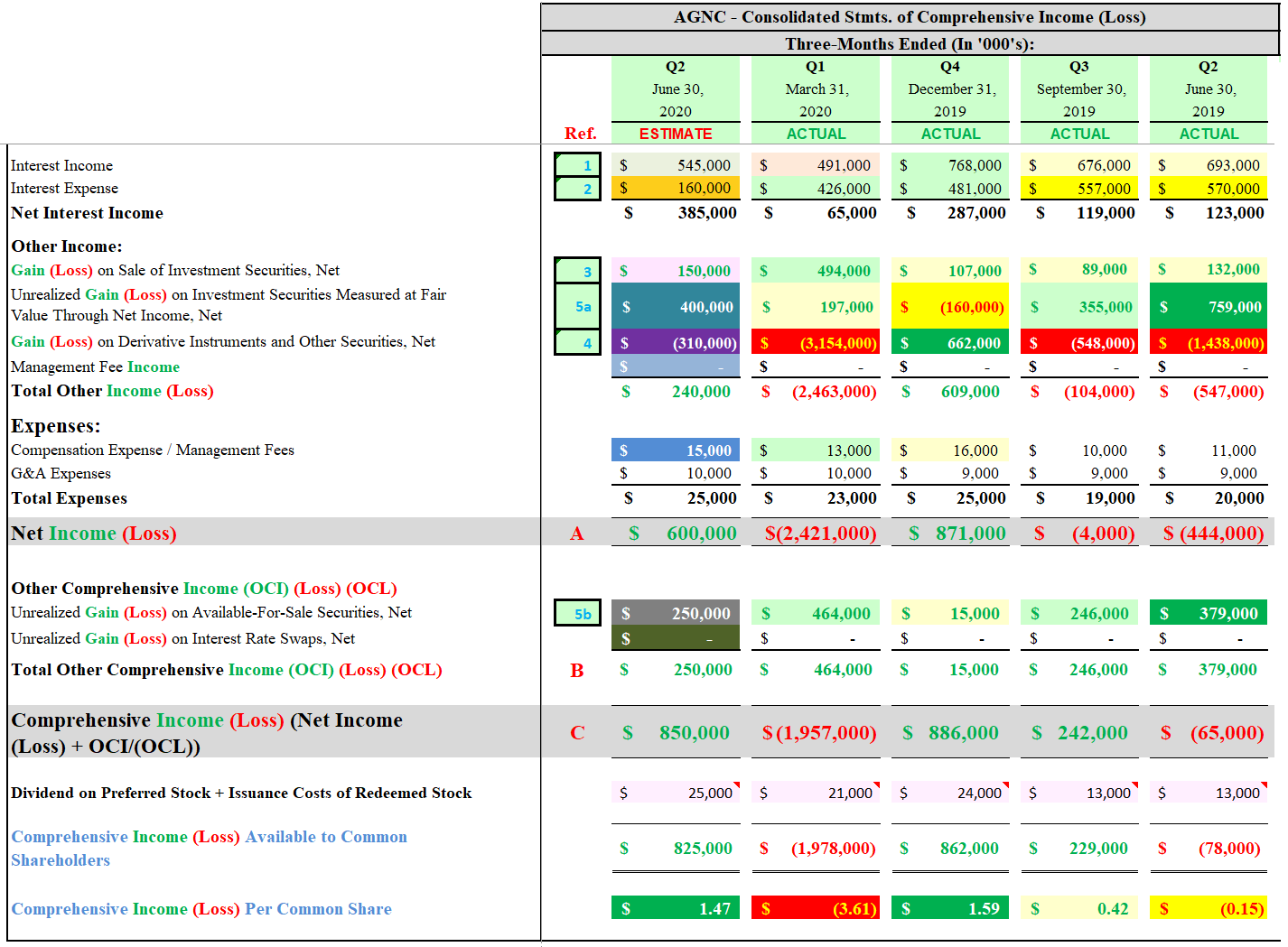

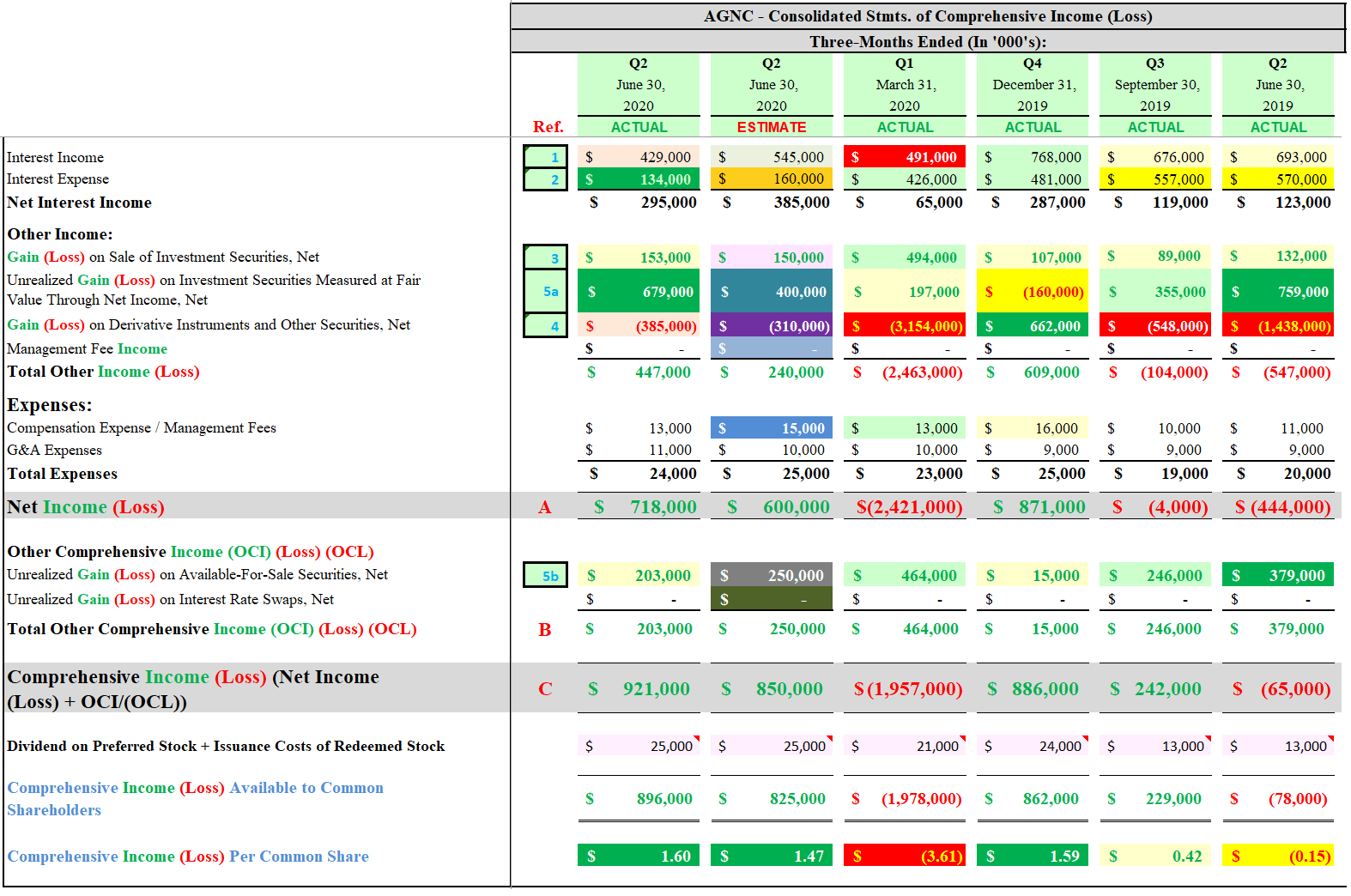

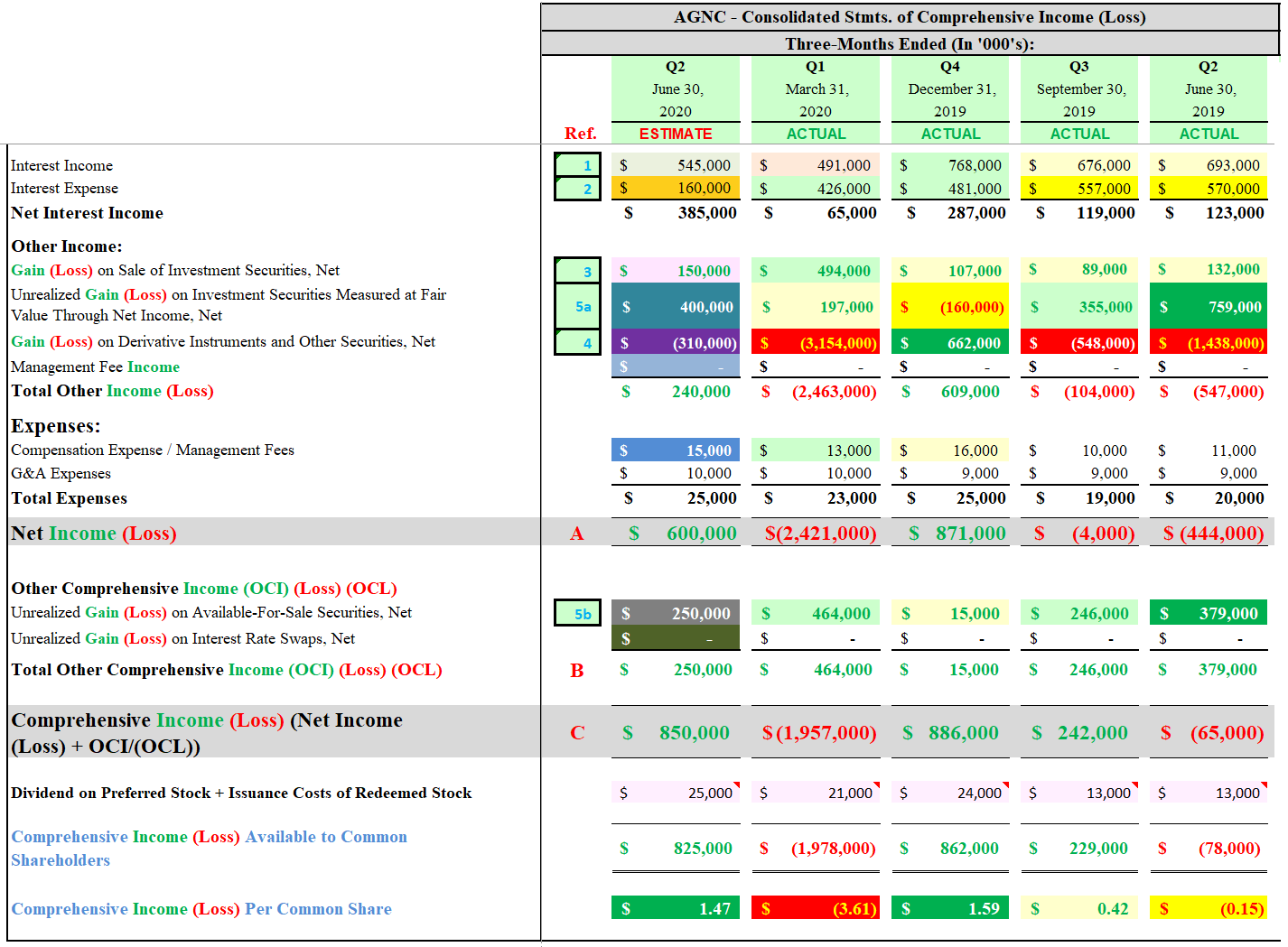

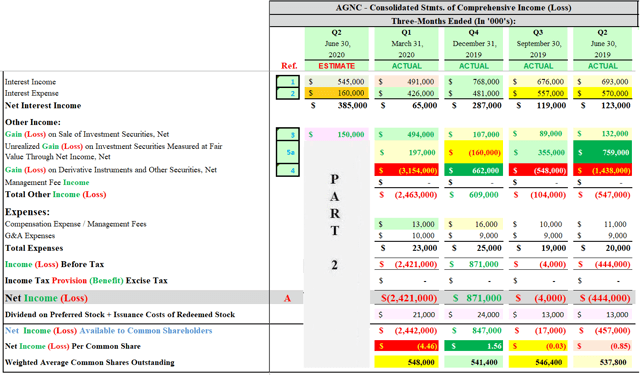

2020-08-13 04:55:14On 7/27/2020, AGNC reported results for the second quarter of 2020. AGNC reported comprehensive income of $921 million and a non-tangible BV as of 6/30/2020 of $15.86 per common share.

Arlington Asset Investment's (AI) CEO Rock Tonkel on Q2 2020 Results - Earnings Call Transcript

seekingalpha.com

2020-07-31 14:22:09Arlington Asset Investment Corp. (NYSE:AI) Q2 2020 Earnings Conference Call July 31, 2020 9:00 AM ET Company Participants Richard Konzmann – Chief Financial Officer Rock Tonkel – President and Chief Executive Officer Conference Call Participants Doug Harter – Credit Suisse Trevor Cranston – JMP Securities Jason Stewart – Jones Trading Christopher Nolan – Ladenburg Thalmann Presentation Operator Good morning.

Mortgage REITs: Back From The Brink

seekingalpha.com

2020-07-28 15:00:00Few asset classes have been slammed harder by the pandemic than Mortgage REITs, which have seen a dividend cut bloodbath with 33 of 42 mREITs suspending or reducing their dividends.

AGNC Investment's Q2 2020 And 7/24/2020 BV Projection (Indication Of An Undervalued Stock; NLY BV Projection Included)

seekingalpha.com

2020-07-27 07:16:58I am projecting AGNC will report a modest (at or greater than 5% but less than 10%) BV increase for the second quarter of 2020.

AGNC Investment's Q2 2020 Income Statement And Earnings Preview - Part 3 (Includes Price Target And Recommendation)

seekingalpha.com

2020-07-23 20:43:04I am projecting AGNC will report a combined notable net unrealized gain on available-for-sale securities and investment securities measured at FMV for the second quarter of 2020.

Caution In Mortgage REITs, Beware The Rally

seekingalpha.com

2020-07-23 18:52:01A few mortgage REITs have outperformed by a bit too much. Shares are trading near estimated book value, or even above estimated book value.

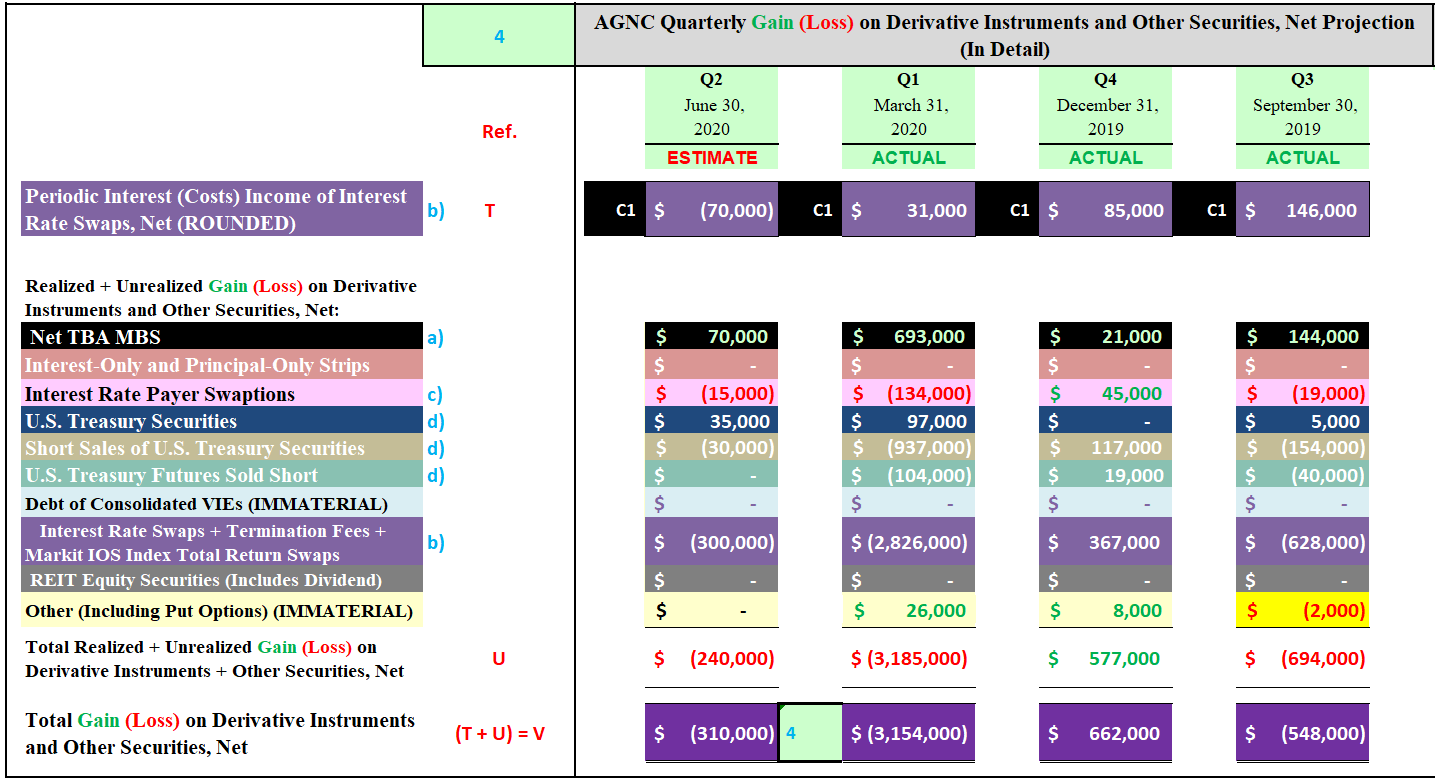

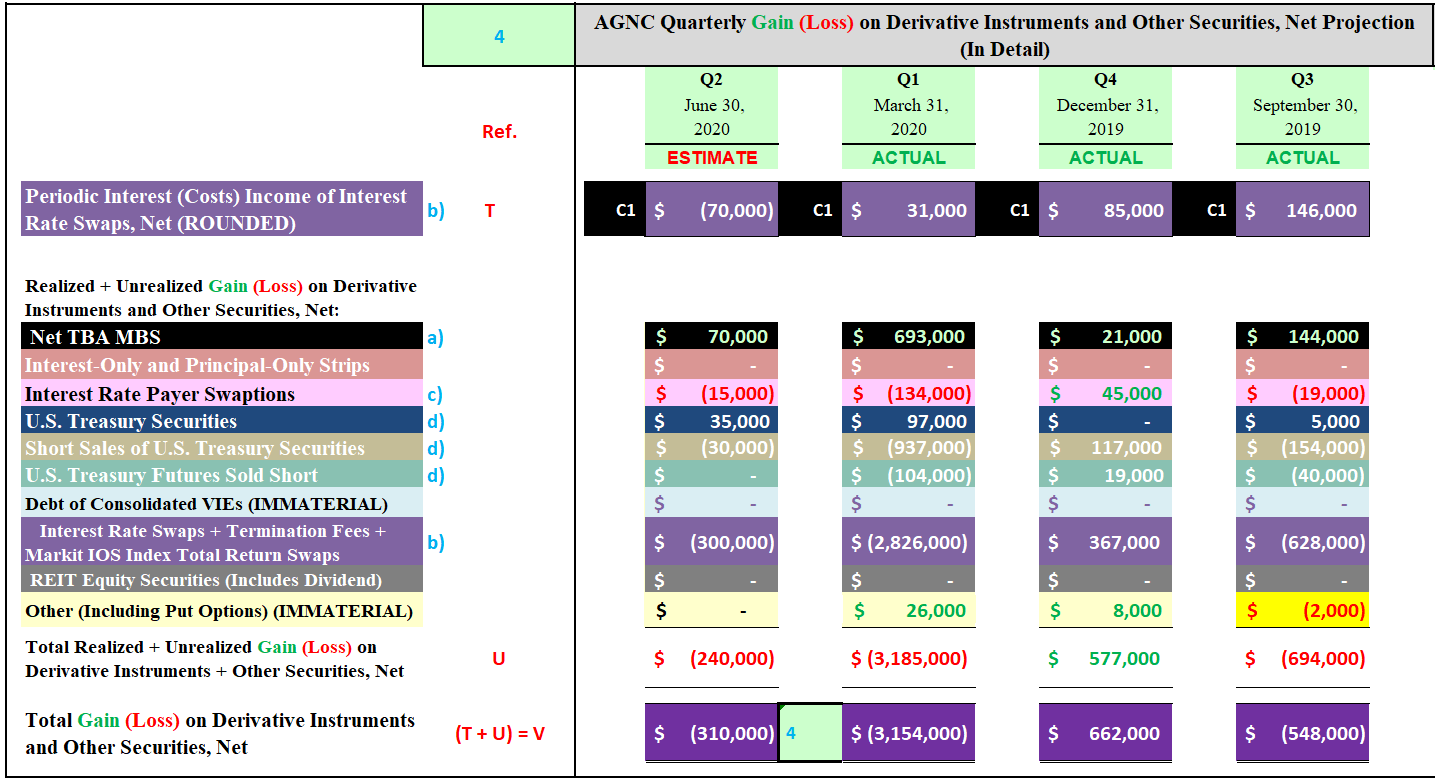

AGNC Investment's Q2 2020 Income Statement And Earnings Projection - Part 2 (Includes Dividend Sustainability Metric And Recommendation)

seekingalpha.com

2020-07-20 12:36:38Unlike the prior quarter, I'm projecting AGNC will report a notably less severe loss regarding the company’s derivative instruments and other securities for the second quarter of 2020.

Mortgage REITs Rally Hard

seekingalpha.com

2020-07-16 17:09:16Bargains still exist in the sector, but you’ve got to know where to look. Analysis on mortgage REITs should start with evaluating the price-to-book ratios.

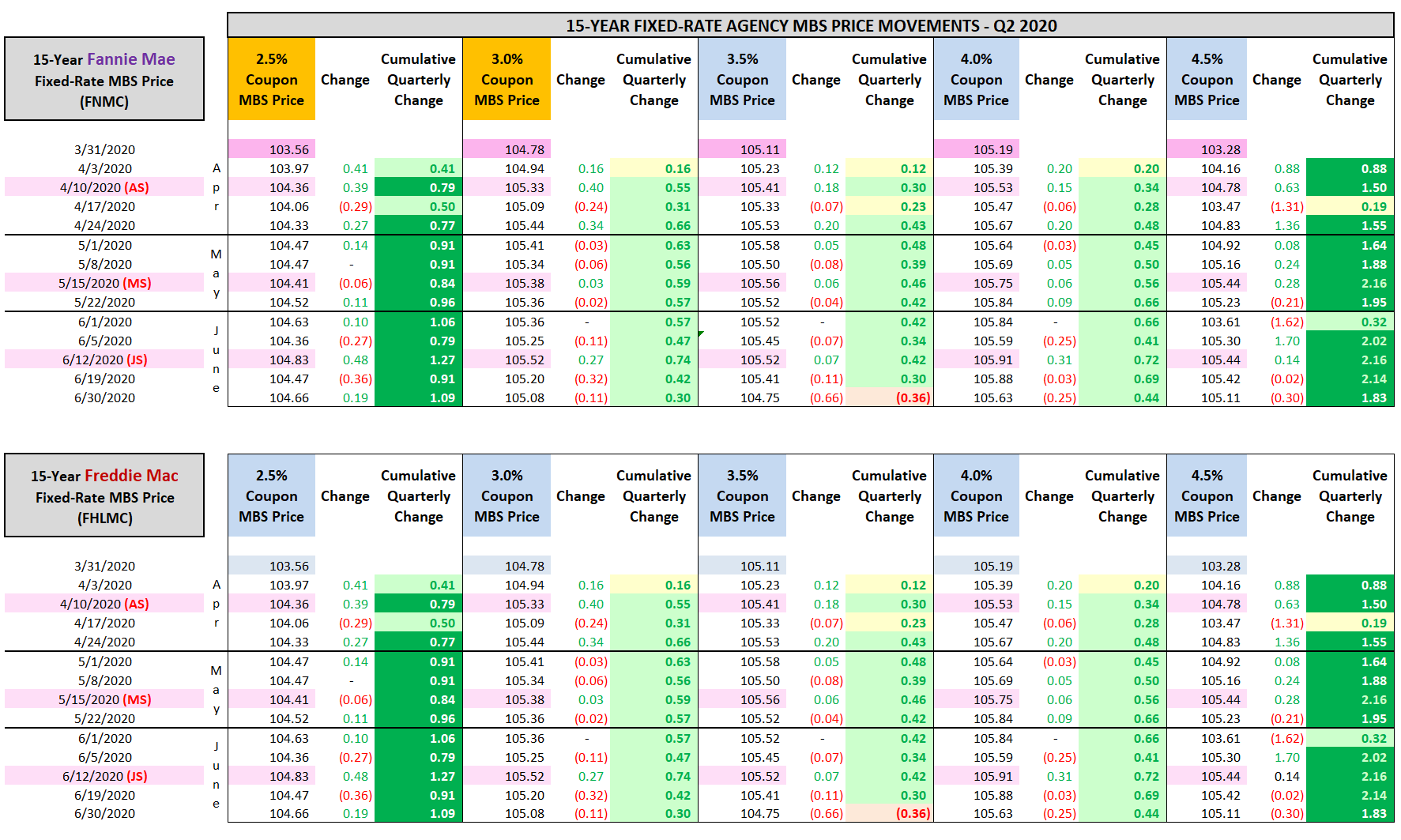

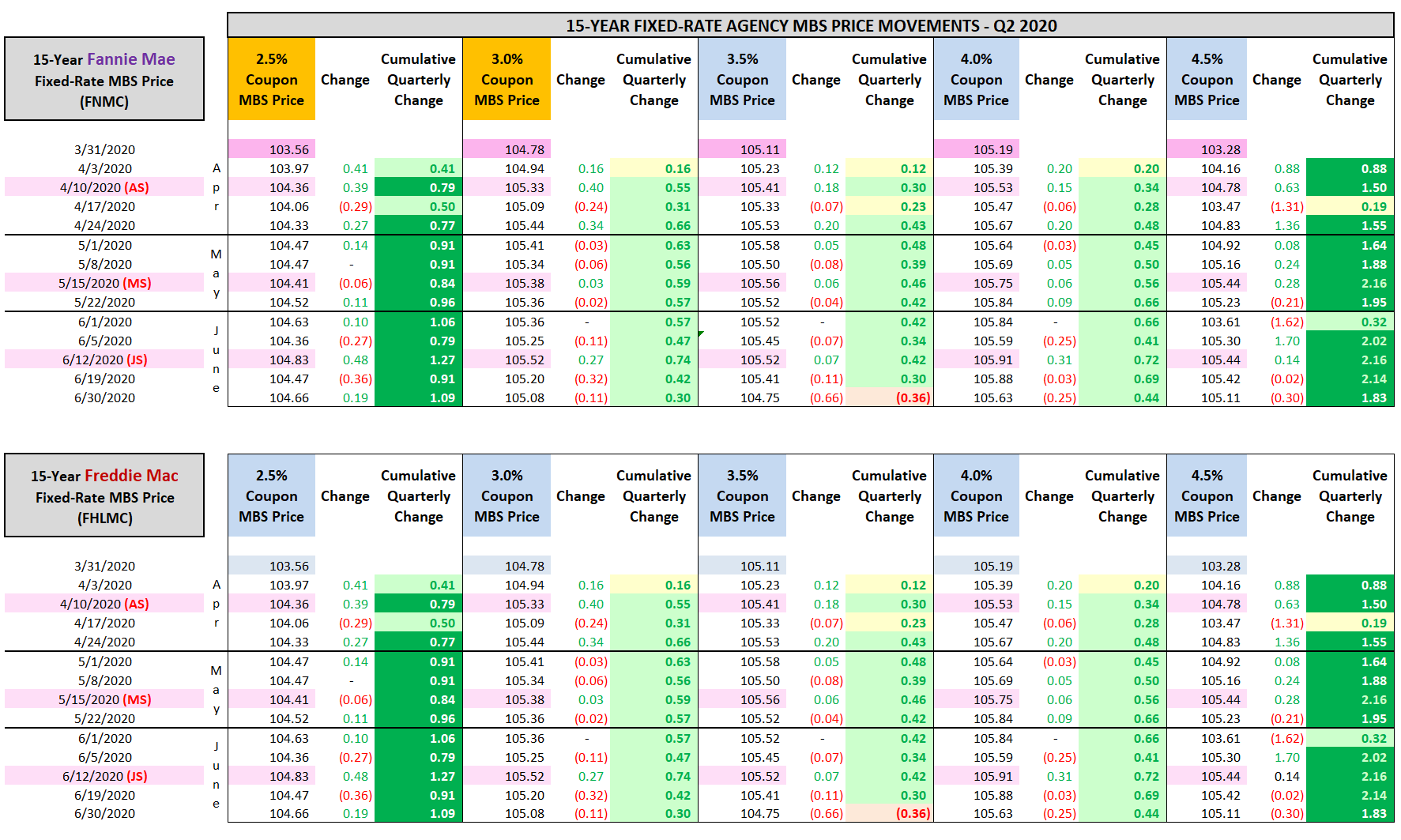

AGNC Investment's Q2 2020 Income Statement And Earnings Projection - Part 1 (Notable Changes; Includes Current Recommendation)

seekingalpha.com

2020-07-15 08:06:27This series projects AGNC’s income statement for the second quarter of 2020. These projections help readers understand how most of the fixed-rate agency mREIT sector performed (valuable insight).

Plenty Of Upside From Discounts To NAV

seekingalpha.com

2020-09-13 17:17:34Discounts to book value (or NAV) are the start of your mortgage REIT analysis, but not the end. In this series we’re providing readers with the discounts to trailing book values throughout the sector and a few notes on the current environment.

Upgrading One Of Our Least Favorite Mortgage REITs

seekingalpha.com

2020-09-08 13:34:14Discounts to book value are the start of your analysis, but not the end. In this series we’re providing readers with the discounts to trailing book values throughout the sector and a few notes on the current environment.

Sales Return For Mortgage REITs

seekingalpha.com

2020-09-04 13:48:13Price-to-book ratios dropped materially, creating new opportunities. Buying with a discount to book value doesn’t guarantee success, yet it does improve the odds dramatically.

Quick And Dirty Discounts To Book Value For September 1st, 2020

seekingalpha.com

2020-09-02 07:33:16Discounts to book value are the start of your analysis, but not the end. In this series, we’re providing readers with the discounts to trailing book values throughout the sector and a few notes on the current environment.

How To Pick Mortgage REITs

seekingalpha.com

2020-08-25 10:49:57Analysis starts with discount to book, but it doesn't end there. Using current estimates for book value is far superior to using trailing book values, but the trailing values will still give investors a rough idea.

Mortgage REIT Common Shares Are For Trading

seekingalpha.com

2020-08-17 20:42:37One topic that seems to come up regularly is investors wondering about using a buy-and-hold strategy for years on common shares.

Mortgage REITs: Earnings Recap

seekingalpha.com

2020-08-13 10:20:31Mortgage REIT earnings season wrapped up this week. As with their Equity REIT peers, earnings reports were generally better-than-expected.

Assessing AGNC Investment's Results For Q2 2020 (Running On All Cylinders)

seekingalpha.com

2020-08-13 04:55:14On 7/27/2020, AGNC reported results for the second quarter of 2020. AGNC reported comprehensive income of $921 million and a non-tangible BV as of 6/30/2020 of $15.86 per common share.

Arlington Asset Investment's (AI) CEO Rock Tonkel on Q2 2020 Results - Earnings Call Transcript

seekingalpha.com

2020-07-31 14:22:09Arlington Asset Investment Corp. (NYSE:AI) Q2 2020 Earnings Conference Call July 31, 2020 9:00 AM ET Company Participants Richard Konzmann – Chief Financial Officer Rock Tonkel – President and Chief Executive Officer Conference Call Participants Doug Harter – Credit Suisse Trevor Cranston – JMP Securities Jason Stewart – Jones Trading Christopher Nolan – Ladenburg Thalmann Presentation Operator Good morning.

Mortgage REITs: Back From The Brink

seekingalpha.com

2020-07-28 15:00:00Few asset classes have been slammed harder by the pandemic than Mortgage REITs, which have seen a dividend cut bloodbath with 33 of 42 mREITs suspending or reducing their dividends.

AGNC Investment's Q2 2020 And 7/24/2020 BV Projection (Indication Of An Undervalued Stock; NLY BV Projection Included)

seekingalpha.com

2020-07-27 07:16:58I am projecting AGNC will report a modest (at or greater than 5% but less than 10%) BV increase for the second quarter of 2020.

AGNC Investment's Q2 2020 Income Statement And Earnings Preview - Part 3 (Includes Price Target And Recommendation)

seekingalpha.com

2020-07-23 20:43:04I am projecting AGNC will report a combined notable net unrealized gain on available-for-sale securities and investment securities measured at FMV for the second quarter of 2020.

Caution In Mortgage REITs, Beware The Rally

seekingalpha.com

2020-07-23 18:52:01A few mortgage REITs have outperformed by a bit too much. Shares are trading near estimated book value, or even above estimated book value.

AGNC Investment's Q2 2020 Income Statement And Earnings Projection - Part 2 (Includes Dividend Sustainability Metric And Recommendation)

seekingalpha.com

2020-07-20 12:36:38Unlike the prior quarter, I'm projecting AGNC will report a notably less severe loss regarding the company’s derivative instruments and other securities for the second quarter of 2020.

Mortgage REITs Rally Hard

seekingalpha.com

2020-07-16 17:09:16Bargains still exist in the sector, but you’ve got to know where to look. Analysis on mortgage REITs should start with evaluating the price-to-book ratios.

AGNC Investment's Q2 2020 Income Statement And Earnings Projection - Part 1 (Notable Changes; Includes Current Recommendation)

seekingalpha.com

2020-07-15 08:06:27This series projects AGNC’s income statement for the second quarter of 2020. These projections help readers understand how most of the fixed-rate agency mREIT sector performed (valuable insight).