WisdomTree Interest Rate Hedged U.S. Aggregate Bond Fund (AGZD)

Price:

22.41 USD

( - -0.06 USD)

Your position:

0 USD

ACTION PANEL

Check the

KEY TAKEAWAYS

ASK OUR AI ABOUT THE COMPANY (REGISTER FOR EARLY ACCESS)

(REGISTER FOR EARLY ACCESS) CHOOSE A PROMPT ABOVE TO ASK OUR AI ABOUT THE SPECIFIC INFORMATION

SIMILAR COMPANIES STI SCORE

Similar STI Score

Fidelity Low Duration Bond ETF

VALUE SCORE:

8

2nd position

Vanguard Emerging Markets Government Bond Index Fund

VALUE SCORE:

12

The best

Vanguard Long-Term Corporate Bond Index Fund

VALUE SCORE:

12

FUNDAMENTALS

FUNDAMENTALS

FUNDAMENTALS

FUNDAMENTALS PER SHARE

TECHNICAL

DIVIDEND

SIMILAR COMPANIES

DESCRIPTION

The index is designed to provide long exposure to the Bloomberg U.S. Aggregate Bond Index while seeking to manage interest rate risk through the use of short positions in U.S. Treasury securities. The fund normally invests at least 80% of its total assets in the component securities of the index and investments that have economic characteristics that are substantially identical to the economic characteristics of such component securities. It is non-diversified.

NEWS

End Of 2024 Trending Exchange-Traded Funds

seekingalpha.com

2024-12-16 14:10:54I updated my universe of exchange-traded funds to track based on superior long-term performance. Nearly 450 ETFs are ranked based on short-term monthly returns, exponential moving average, and money flows into funds. With valuations and concentrations high, I select twenty trending ETFs Lipper Categories with less risk of correction in 2025 for further analysis.

Rates To Remain Higher For Longer? ETFs to Hedge the Trend

zacks.com

2023-07-07 12:23:12The Fed recently released minutes from the June meeting of the Federal Open Market Committee (FOMC), revealing a debate among officials regarding a potential interest rate hike.

4 Bond ETFs to Play If Rates Continue to Rise

zacks.com

2022-03-25 09:02:03There are fixed-income ways that would help investors mitigate faster Fed rate hike threats yet emerge profitable.

ETFs to Play as U.S. Benchmark Treasury Yield Tops 2%

zacks.com

2022-02-11 16:09:09U.S. benchmark treasury yield topped 2% on Feb 10, 2022 for the first time since August 2019.

An Inflation Toolkit for Advisors From WisdomTree

etftrends.com

2022-02-09 15:17:39It's a difficult season for advisors who are still working to create optimal portfolios for their clients in a time of rising interest rates, inflation, supply chain disruptions, and more. WisdomTree Asset Management's Jeremy Schwartz, CFA and global CIO, and Kevin Flanagan, head of fixed income strategy, joined Dave Nadig, CIO and director of research [.

WisdomTree's ETFs to Keep in Mind for 2022

etftrends.com

2021-12-14 17:43:38As we consider the current economic cycle, exchange traded fund investors could focus on key macro themes to better adapt to the changes ahead. In the recent webcast, WisdomTree 2022 Outlook, Kevin Flanagan, head of fixed income strategy, highlighted the ongoing economic expansion with real GDP expected to grow 4.0% over 2022, with inflation easing [.

4 Bond ETFs to Play If Rates Rise

zacks.com

2021-08-12 10:06:39Two Federal Reserve officials recently gave cues of a sooner-than-expected QE taper. Play these bond ETFs if rates rise.

'Zero'ing In On A Rate-Hedged Solution

seekingalpha.com

2021-03-31 11:49:09Other than t-bills, the only other maturity that has managed to escape the Treasury yield rise fate - for now - has been the UST 2-Year note. The Fed's median economic projections revealed a setting where inflation is going to be either at or above the policymakers' 2% target.

ETFs to Win/Lose If U.S. 10-Year Yield Shoots Up to 2%

zacks.com

2021-03-12 08:44:20Growing vaccine distribution and the rollout of the $1.9 trillion fiscal stimulus under the Biden era have resulted in a sooner-than-expected recovery of the U.S. economy. These have stoked inflation concerns and pushed up treasury yields.

Play 4 Rate-Proof Bond ETFs in a Rising Rate Environment

zacks.com

2021-03-05 15:12:03Rising rate worries started bothering both equity and bond markets from February-end. Bonds have registered steep selloffs.

A Novel Way to Play the Reflation Trade

etftrends.com

2021-01-24 12:19:28By Kevin Flanagan, Head of Fixed Income Strategy, WisdomTree I know it's only three weeks into the new year, but the unmistakable trend in bond land thus far has been the ‘Reflation Trade.' Sure, we could all debate whether this theme will continue in 2021 (I believe it will), but more importantly, ask yourself this [.

A Novel Way To Play The Reflation Trade

seekingalpha.com

2021-01-22 14:36:55A Novel Way To Play The Reflation Trade

The Reopening Killed The V-Shaped Recovery

seekingalpha.com

2020-06-29 07:43:33This is a weekly series focused on analyzing the previous week’s economic data releases. The objective is to concentrate on leading indicators of economic activ

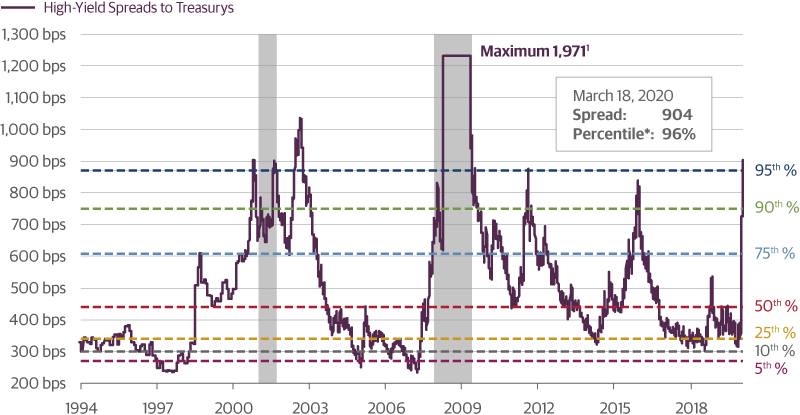

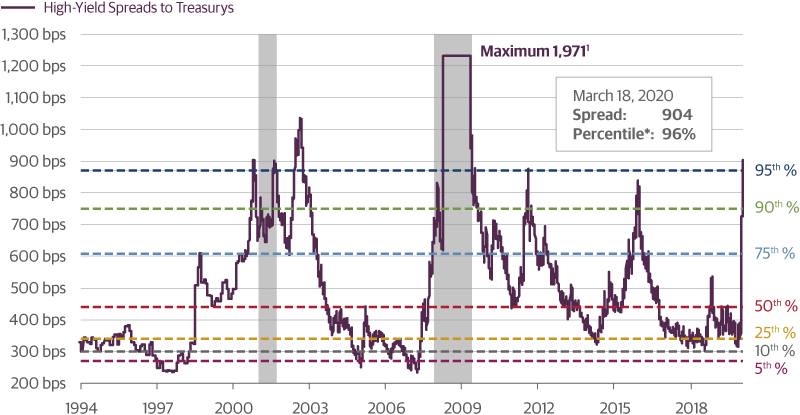

Value Is A Poor Timing Tool

seekingalpha.com

2020-03-20 20:38:16Investment-grade and high-yield bonds have traded cheaper than where they are right now less than 10 percent of the time. But markets often overshoot, and just

No data to display

End Of 2024 Trending Exchange-Traded Funds

seekingalpha.com

2024-12-16 14:10:54I updated my universe of exchange-traded funds to track based on superior long-term performance. Nearly 450 ETFs are ranked based on short-term monthly returns, exponential moving average, and money flows into funds. With valuations and concentrations high, I select twenty trending ETFs Lipper Categories with less risk of correction in 2025 for further analysis.

Rates To Remain Higher For Longer? ETFs to Hedge the Trend

zacks.com

2023-07-07 12:23:12The Fed recently released minutes from the June meeting of the Federal Open Market Committee (FOMC), revealing a debate among officials regarding a potential interest rate hike.

4 Bond ETFs to Play If Rates Continue to Rise

zacks.com

2022-03-25 09:02:03There are fixed-income ways that would help investors mitigate faster Fed rate hike threats yet emerge profitable.

ETFs to Play as U.S. Benchmark Treasury Yield Tops 2%

zacks.com

2022-02-11 16:09:09U.S. benchmark treasury yield topped 2% on Feb 10, 2022 for the first time since August 2019.

An Inflation Toolkit for Advisors From WisdomTree

etftrends.com

2022-02-09 15:17:39It's a difficult season for advisors who are still working to create optimal portfolios for their clients in a time of rising interest rates, inflation, supply chain disruptions, and more. WisdomTree Asset Management's Jeremy Schwartz, CFA and global CIO, and Kevin Flanagan, head of fixed income strategy, joined Dave Nadig, CIO and director of research [.

WisdomTree's ETFs to Keep in Mind for 2022

etftrends.com

2021-12-14 17:43:38As we consider the current economic cycle, exchange traded fund investors could focus on key macro themes to better adapt to the changes ahead. In the recent webcast, WisdomTree 2022 Outlook, Kevin Flanagan, head of fixed income strategy, highlighted the ongoing economic expansion with real GDP expected to grow 4.0% over 2022, with inflation easing [.

4 Bond ETFs to Play If Rates Rise

zacks.com

2021-08-12 10:06:39Two Federal Reserve officials recently gave cues of a sooner-than-expected QE taper. Play these bond ETFs if rates rise.

'Zero'ing In On A Rate-Hedged Solution

seekingalpha.com

2021-03-31 11:49:09Other than t-bills, the only other maturity that has managed to escape the Treasury yield rise fate - for now - has been the UST 2-Year note. The Fed's median economic projections revealed a setting where inflation is going to be either at or above the policymakers' 2% target.

ETFs to Win/Lose If U.S. 10-Year Yield Shoots Up to 2%

zacks.com

2021-03-12 08:44:20Growing vaccine distribution and the rollout of the $1.9 trillion fiscal stimulus under the Biden era have resulted in a sooner-than-expected recovery of the U.S. economy. These have stoked inflation concerns and pushed up treasury yields.

Play 4 Rate-Proof Bond ETFs in a Rising Rate Environment

zacks.com

2021-03-05 15:12:03Rising rate worries started bothering both equity and bond markets from February-end. Bonds have registered steep selloffs.

A Novel Way to Play the Reflation Trade

etftrends.com

2021-01-24 12:19:28By Kevin Flanagan, Head of Fixed Income Strategy, WisdomTree I know it's only three weeks into the new year, but the unmistakable trend in bond land thus far has been the ‘Reflation Trade.' Sure, we could all debate whether this theme will continue in 2021 (I believe it will), but more importantly, ask yourself this [.

A Novel Way To Play The Reflation Trade

seekingalpha.com

2021-01-22 14:36:55A Novel Way To Play The Reflation Trade

The Reopening Killed The V-Shaped Recovery

seekingalpha.com

2020-06-29 07:43:33This is a weekly series focused on analyzing the previous week’s economic data releases. The objective is to concentrate on leading indicators of economic activ

Value Is A Poor Timing Tool

seekingalpha.com

2020-03-20 20:38:16Investment-grade and high-yield bonds have traded cheaper than where they are right now less than 10 percent of the time. But markets often overshoot, and just