AerCap Holdings N.V. (AER)

Price:

139.54 USD

( - -1.62 USD)

Your position:

0 USD

ACTION PANEL

ABOUT

Check the

KEY TAKEAWAYS

ASK OUR AI ABOUT THE COMPANY (REGISTER FOR EARLY ACCESS)

(REGISTER FOR EARLY ACCESS) CHOOSE A PROMPT ABOVE TO ASK OUR AI ABOUT THE SPECIFIC INFORMATION

SIMILAR COMPANIES STI SCORE

Similar STI Score

Vestis Corporation

VALUE SCORE:

3

2nd position

GATX Corporation

VALUE SCORE:

8

The best

Ryder System, Inc.

VALUE SCORE:

8

FUNDAMENTALS

FUNDAMENTALS

FUNDAMENTALS

FUNDAMENTALS PER SHARE

TECHNICAL

DIVIDEND

SIMILAR COMPANIES

DESCRIPTION

AerCap Holdings N.V. engages in the lease, financing, sale, and management of commercial flight equipment in China, Hong Kong, Macau, the United States, Ireland, and internationally. The company offers aircraft asset management services, such as remarketing aircraft and engines; collecting rental and maintenance rent payments, monitoring aircraft maintenance, monitoring and enforcing contract compliance, and accepting delivery and redelivery of aircraft and engines; and conducting ongoing lessee financial performance reviews. Its aircraft asset management services also include periodically inspecting the leased aircraft; coordinating technical modifications to aircraft to meet new lessee requirements; conducting restructuring negotiations in connection with lease defaults; repossessing aircraft and engines; arranging and monitoring insurance coverage; registering and de-registering aircraft; arranging for aircraft and engine valuations; and providing market research services. The company also provides cash management services, including treasury services, such as the financing, refinancing, hedging, and ongoing cash management of vehicles; and administrative services comprising accounting and corporate secretarial services consisting of the preparation of budgets and financial statements. In addition, it offers airframe and engine parts and supply chain solutions to airlines; maintenance, repair, and overhaul service providers; and aircraft parts distributors. As of December 31, 2021, the company had a portfolio of 2,369 owned, managed, or on order aircraft. AerCap Holdings N.V. was founded in 1995 and is headquartered in Dublin, Ireland.

NEWS

AerCap (AER) is a Great Momentum Stock: Should You Buy?

zacks.com

2025-12-12 13:01:32Does AerCap (AER) have what it takes to be a top stock pick for momentum investors? Let's find out.

Is Aercap (AER) Stock Outpacing Its Transportation Peers This Year?

zacks.com

2025-12-11 10:40:25Here is how AerCap (AER) and Knot Offshore (KNOP) have performed compared to their sector so far this year.

AER or WAB: Which Is the Better Value Stock Right Now?

zacks.com

2025-12-10 12:41:33Investors interested in stocks from the Transportation - Equipment and Leasing sector have probably already heard of AerCap (AER) and Westinghouse Air Brake Technologies (WAB). But which of these two stocks offers value investors a better bang for their buck right now?

AerCap Holdings Continues To Fly In Very Friendly Skies

seekingalpha.com

2025-12-09 04:13:10AerCap (AER) remains a top-tier aircraft lessor, capitalizing on strong demand, tight supply, and superior access to capital. Recent results showed 19% revenue growth, robust 28% gain on sale margin, and a net spread margin (8%) at a five-year high. AER benefits from a significant credit advantage over airline customers, as well as a preferred position in order books, giving them better and cheaper access to the most desirable aircraft.

AerCap Signs Lease Agreements with New Customer My Freighter for Two New Airbus A321NEO Aircraft

prnewswire.com

2025-12-09 04:00:00DUBLIN , Dec. 9, 2025 /PRNewswire/ -- AerCap Holdings N.V. ("AerCap" or the "Company") (NYSE: AER) today announced it has signed lease agreements for two new Airbus A321neo aircraft with My Freighter, an Uzbekistan-based cargo airline that also operates charter and scheduled passenger services as Centrum Air.

Best Value Stocks to Buy for December 8th

zacks.com

2025-12-08 08:21:08GM, CRMD and AER made it to the Zacks Rank #1 (Strong Buy) value stocks list on December 8, 2025.

New Strong Buy Stocks for December 8th

zacks.com

2025-12-08 06:31:07VFF, CRMD, AER, GM and FIVE have been added to the Zacks Rank #1 (Strong Buy) List on December 8, 2025.

Aercap Holdings N.V. (AER) Hit a 52 Week High, Can the Run Continue?

zacks.com

2025-12-05 10:16:17AerCap (AER) is at a 52-week high, but can investors hope for more gains in the future? We take a look at the company's fundamentals for clues.

Aercap Holdings N.V. $AER Stake Lifted by Hsbc Holdings PLC

defenseworld.net

2025-12-03 04:26:55Hsbc Holdings PLC boosted its position in Aercap Holdings N.V. (NYSE: AER) by 43.9% during the undefined quarter, according to the company in its most recent filing with the Securities and Exchange Commission. The fund owned 121,558 shares of the financial services provider's stock after purchasing an additional 37,100 shares during the quarter.

American Century Companies Inc. Purchases 16,938 Shares of Aercap Holdings N.V. $AER

defenseworld.net

2025-12-03 03:18:54American Century Companies Inc. increased its position in shares of Aercap Holdings N.V. (NYSE: AER) by 13.1% during the second quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission. The firm owned 146,279 shares of the financial services provider's stock after purchasing an additional 16,938 shares

Aercap Holdings N.V. $AER Position Reduced by Cetera Investment Advisers

defenseworld.net

2025-12-02 04:11:01Cetera Investment Advisers lessened its position in Aercap Holdings N.V. (NYSE: AER) by 26.3% during the second quarter, according to its most recent 13F filing with the SEC. The institutional investor owned 13,016 shares of the financial services provider's stock after selling 4,648 shares during the period. Cetera Investment Advisers' holdings in Aercap

AerCap Cargo Delivers First Boeing 777-300ERSF to Fly Meta

prnewswire.com

2025-12-01 03:00:00DUBLIN , Dec. 1, 2025 /PRNewswire/ -- AerCap Holdings N.V. ("AerCap" or the "Company") (NYSE: AER) today announced that it has delivered the first of three Boeing 777-300ERSF converted aircraft to Hong Kong-based aviation leasing and ACMI/CMI solutions provider Fly Meta Leasing Co., Ltd ("Fly Meta").

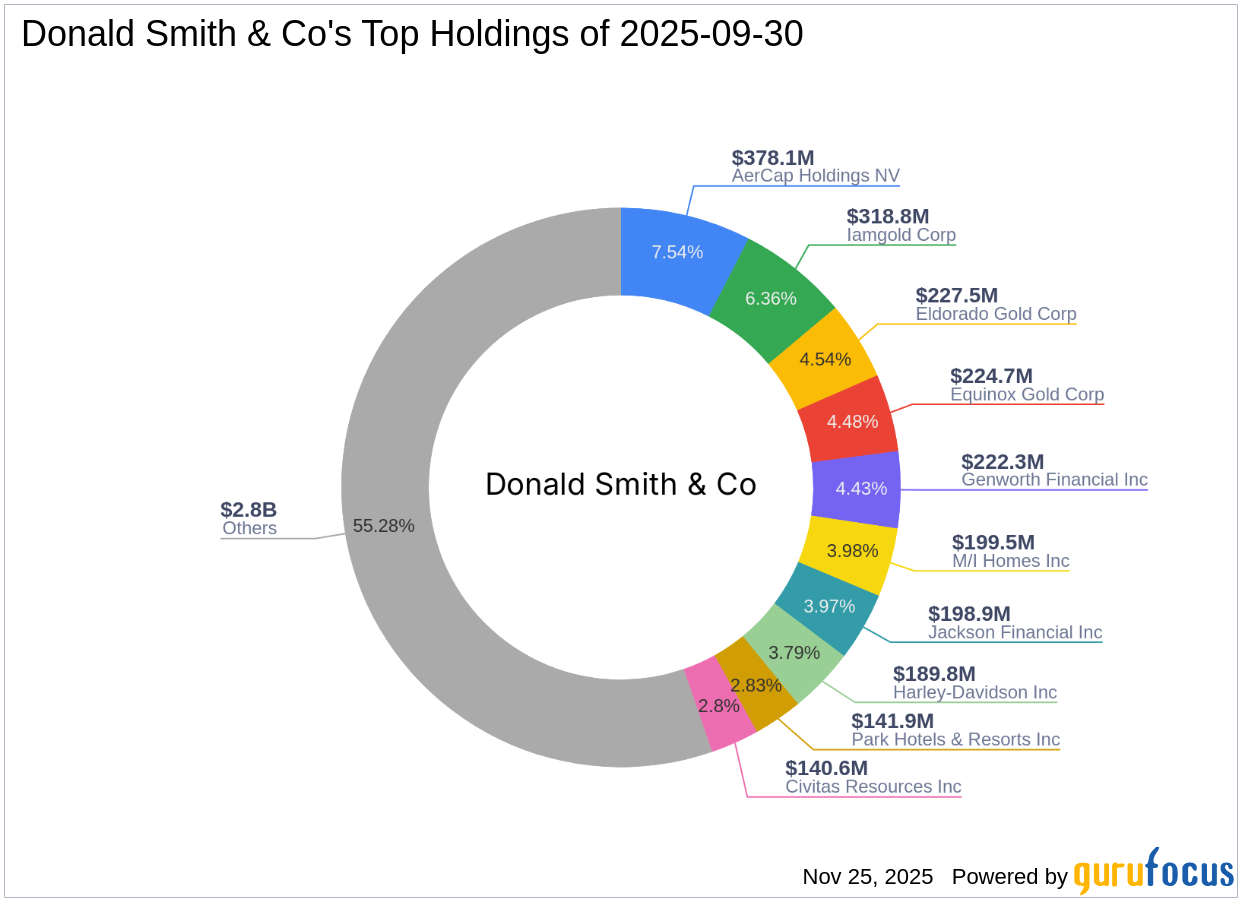

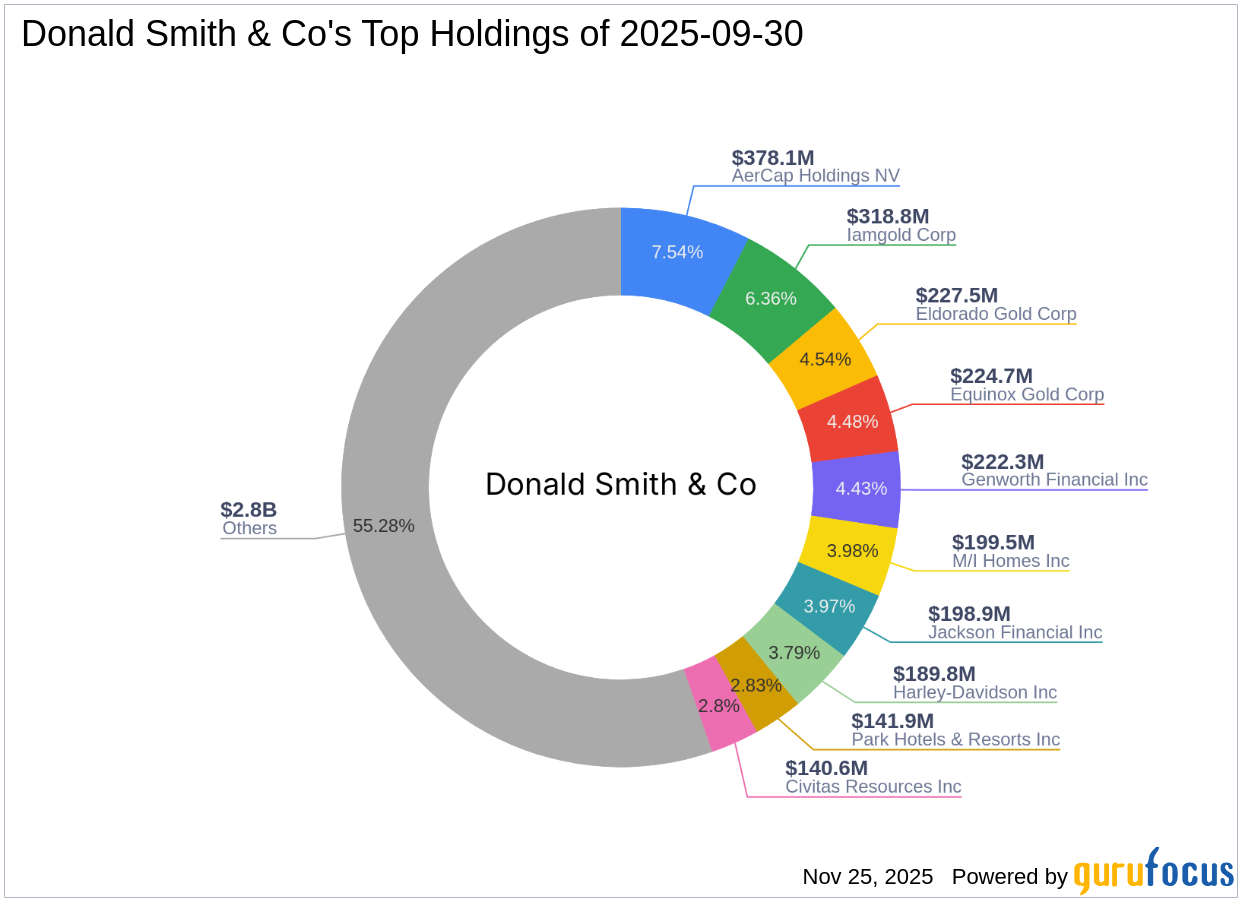

Donald Smith & Co's Strategic Moves: Honda Motor Co Ltd Takes Center Stage

gurufocus.com

2025-11-25 11:02:00Exploring the Latest 13F Filing and Investment Strategies Donald Smith and Co (Trades, Portfolio) recently submitted its 13F filing for the third quarter of 2025

Are Transportation Stocks Lagging Aercap (AER) This Year?

zacks.com

2025-11-25 10:41:44Here is how AerCap (AER) and Seacor Marine (SMHI) have performed compared to their sector so far this year.

AER or WAB: Which Is the Better Value Stock Right Now?

zacks.com

2025-11-24 12:40:21Investors looking for stocks in the Transportation - Equipment and Leasing sector might want to consider either AerCap (AER) or Westinghouse Air Brake Technologies (WAB). But which of these two stocks is more attractive to value investors?

AerCap Signs Lease Agreements for Three New Boeing 737 MAX Aircraft and Two Boeing 737NG Aircraft with New Customer FlySafair

prnewswire.com

2025-11-18 02:00:00DUBAI, UAE, Nov. 18, 2025 /PRNewswire/ -- AerCap Holdings N.V. ("AerCap" or the "Company") (NYSE: AER) today announced it has signed lease agreements with FlySafair for three new Boeing 737 MAX 8 aircraft, which are scheduled for delivery beginning Q1 2028, and two Boeing 737-800NG aircraft, expected to deliver beginning Q3 2026.

AerCap (AER) is a Great Momentum Stock: Should You Buy?

zacks.com

2025-12-12 13:01:32Does AerCap (AER) have what it takes to be a top stock pick for momentum investors? Let's find out.

Is Aercap (AER) Stock Outpacing Its Transportation Peers This Year?

zacks.com

2025-12-11 10:40:25Here is how AerCap (AER) and Knot Offshore (KNOP) have performed compared to their sector so far this year.

AER or WAB: Which Is the Better Value Stock Right Now?

zacks.com

2025-12-10 12:41:33Investors interested in stocks from the Transportation - Equipment and Leasing sector have probably already heard of AerCap (AER) and Westinghouse Air Brake Technologies (WAB). But which of these two stocks offers value investors a better bang for their buck right now?

AerCap Holdings Continues To Fly In Very Friendly Skies

seekingalpha.com

2025-12-09 04:13:10AerCap (AER) remains a top-tier aircraft lessor, capitalizing on strong demand, tight supply, and superior access to capital. Recent results showed 19% revenue growth, robust 28% gain on sale margin, and a net spread margin (8%) at a five-year high. AER benefits from a significant credit advantage over airline customers, as well as a preferred position in order books, giving them better and cheaper access to the most desirable aircraft.

AerCap Signs Lease Agreements with New Customer My Freighter for Two New Airbus A321NEO Aircraft

prnewswire.com

2025-12-09 04:00:00DUBLIN , Dec. 9, 2025 /PRNewswire/ -- AerCap Holdings N.V. ("AerCap" or the "Company") (NYSE: AER) today announced it has signed lease agreements for two new Airbus A321neo aircraft with My Freighter, an Uzbekistan-based cargo airline that also operates charter and scheduled passenger services as Centrum Air.

Best Value Stocks to Buy for December 8th

zacks.com

2025-12-08 08:21:08GM, CRMD and AER made it to the Zacks Rank #1 (Strong Buy) value stocks list on December 8, 2025.

New Strong Buy Stocks for December 8th

zacks.com

2025-12-08 06:31:07VFF, CRMD, AER, GM and FIVE have been added to the Zacks Rank #1 (Strong Buy) List on December 8, 2025.

Aercap Holdings N.V. (AER) Hit a 52 Week High, Can the Run Continue?

zacks.com

2025-12-05 10:16:17AerCap (AER) is at a 52-week high, but can investors hope for more gains in the future? We take a look at the company's fundamentals for clues.

Aercap Holdings N.V. $AER Stake Lifted by Hsbc Holdings PLC

defenseworld.net

2025-12-03 04:26:55Hsbc Holdings PLC boosted its position in Aercap Holdings N.V. (NYSE: AER) by 43.9% during the undefined quarter, according to the company in its most recent filing with the Securities and Exchange Commission. The fund owned 121,558 shares of the financial services provider's stock after purchasing an additional 37,100 shares during the quarter.

American Century Companies Inc. Purchases 16,938 Shares of Aercap Holdings N.V. $AER

defenseworld.net

2025-12-03 03:18:54American Century Companies Inc. increased its position in shares of Aercap Holdings N.V. (NYSE: AER) by 13.1% during the second quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission. The firm owned 146,279 shares of the financial services provider's stock after purchasing an additional 16,938 shares

Aercap Holdings N.V. $AER Position Reduced by Cetera Investment Advisers

defenseworld.net

2025-12-02 04:11:01Cetera Investment Advisers lessened its position in Aercap Holdings N.V. (NYSE: AER) by 26.3% during the second quarter, according to its most recent 13F filing with the SEC. The institutional investor owned 13,016 shares of the financial services provider's stock after selling 4,648 shares during the period. Cetera Investment Advisers' holdings in Aercap

AerCap Cargo Delivers First Boeing 777-300ERSF to Fly Meta

prnewswire.com

2025-12-01 03:00:00DUBLIN , Dec. 1, 2025 /PRNewswire/ -- AerCap Holdings N.V. ("AerCap" or the "Company") (NYSE: AER) today announced that it has delivered the first of three Boeing 777-300ERSF converted aircraft to Hong Kong-based aviation leasing and ACMI/CMI solutions provider Fly Meta Leasing Co., Ltd ("Fly Meta").

Donald Smith & Co's Strategic Moves: Honda Motor Co Ltd Takes Center Stage

gurufocus.com

2025-11-25 11:02:00Exploring the Latest 13F Filing and Investment Strategies Donald Smith and Co (Trades, Portfolio) recently submitted its 13F filing for the third quarter of 2025

Are Transportation Stocks Lagging Aercap (AER) This Year?

zacks.com

2025-11-25 10:41:44Here is how AerCap (AER) and Seacor Marine (SMHI) have performed compared to their sector so far this year.

AER or WAB: Which Is the Better Value Stock Right Now?

zacks.com

2025-11-24 12:40:21Investors looking for stocks in the Transportation - Equipment and Leasing sector might want to consider either AerCap (AER) or Westinghouse Air Brake Technologies (WAB). But which of these two stocks is more attractive to value investors?

AerCap Signs Lease Agreements for Three New Boeing 737 MAX Aircraft and Two Boeing 737NG Aircraft with New Customer FlySafair

prnewswire.com

2025-11-18 02:00:00DUBAI, UAE, Nov. 18, 2025 /PRNewswire/ -- AerCap Holdings N.V. ("AerCap" or the "Company") (NYSE: AER) today announced it has signed lease agreements with FlySafair for three new Boeing 737 MAX 8 aircraft, which are scheduled for delivery beginning Q1 2028, and two Boeing 737-800NG aircraft, expected to deliver beginning Q3 2026.