Aehr Test Systems (AEHR)

Price:

25.15 USD

( - -0.70 USD)

Your position:

0 USD

ACTION PANEL

ABOUT

Check the

KEY TAKEAWAYS

ASK OUR AI ABOUT THE COMPANY (REGISTER FOR EARLY ACCESS)

(REGISTER FOR EARLY ACCESS) CHOOSE A PROMPT ABOVE TO ASK OUR AI ABOUT THE SPECIFIC INFORMATION

SIMILAR COMPANIES STI SCORE

Similar STI Score

Advanced Micro Devices, Inc.

VALUE SCORE:

6

2nd position

Axcelis Technologies, Inc.

VALUE SCORE:

10

The best

ACM Research, Inc.

VALUE SCORE:

11

FUNDAMENTALS

FUNDAMENTALS

FUNDAMENTALS

FUNDAMENTALS PER SHARE

TECHNICAL

DIVIDEND

SIMILAR COMPANIES

DESCRIPTION

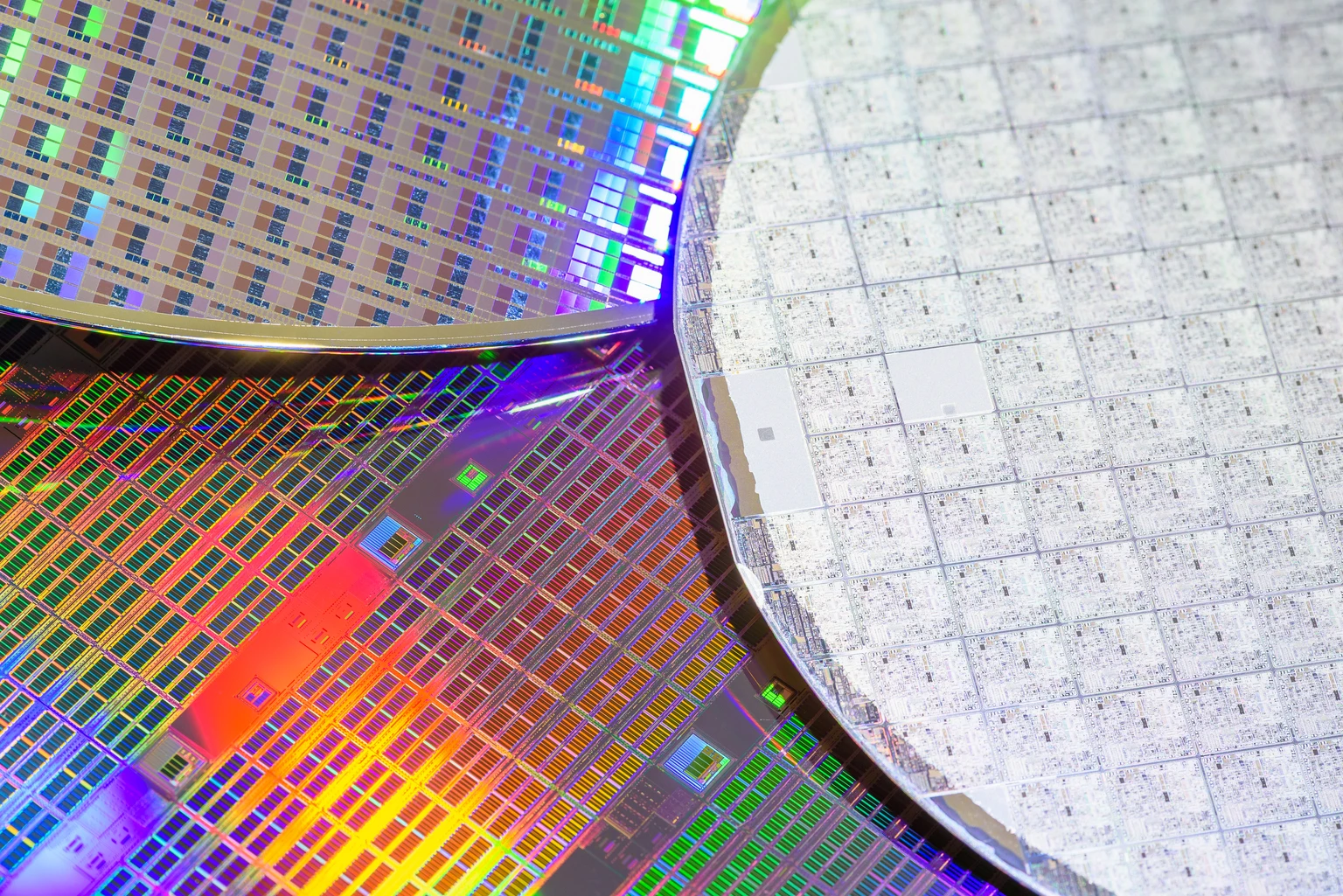

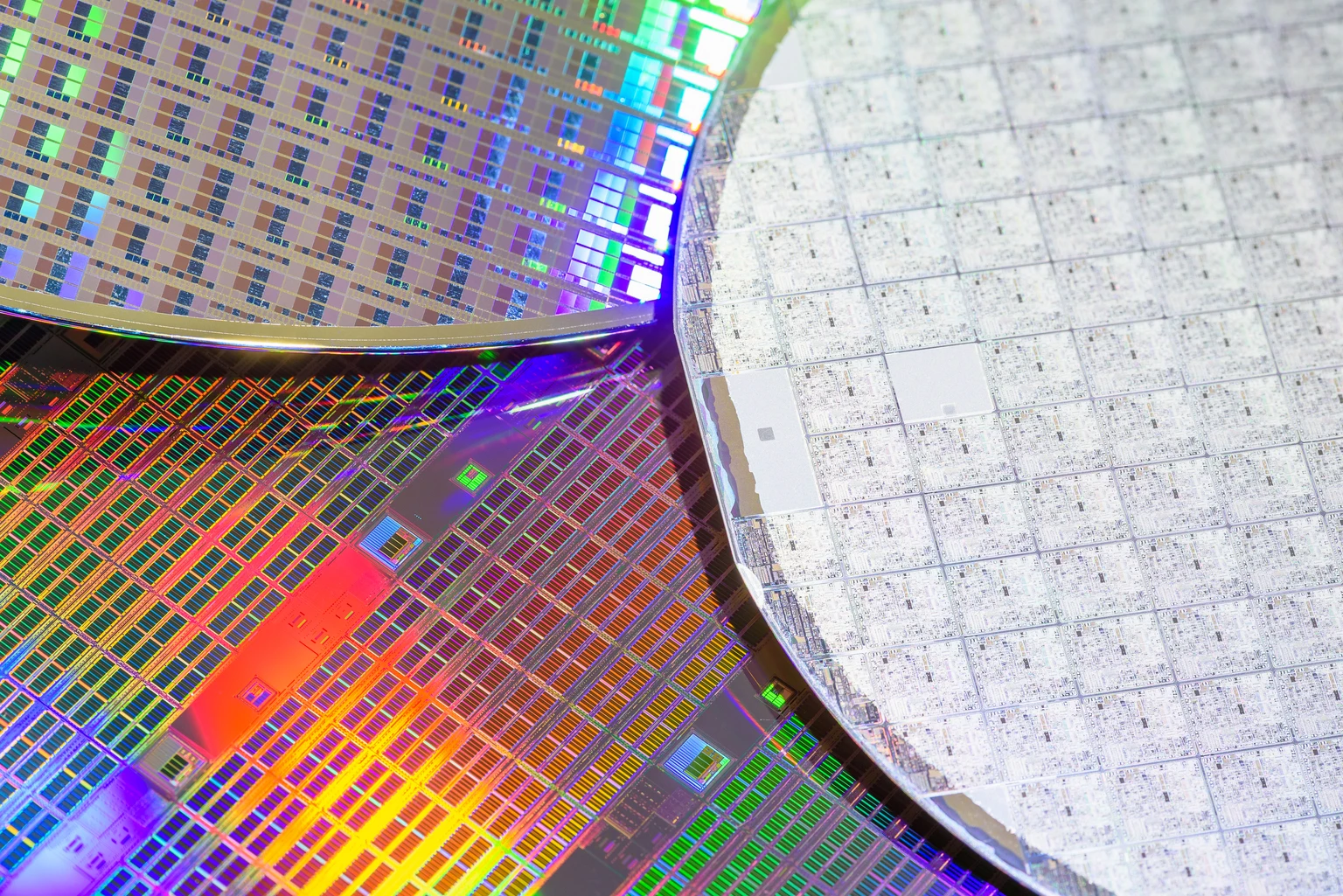

Aehr Test Systems provides test systems for burning-in and testing logic, optical, and memory integrated circuits worldwide. It offers products, such as the ABTS and FOX-P families of test and burn-in systems and FOX WaferPak Aligner, FOX-XP WaferPak Contactor, FOX DiePak Carrier, and FOX DiePak Loader. The ABTS system is used in production and qualification testing of packaged parts for lower power and higher power logic devices, as well as various common types of memory devices. The FOX-XP and FOX-NP systems are wafer contact and singulated die/module test and burn-in systems used for burn-in and functional test of complex devices, such as memories, digital signal processors, microprocessors, microcontrollers, systems-on-a-chip, and integrated optical devices. The FOX-CP system is a single-wafer compact test and reliability verification solution for logic, memory, and photonic devices. The WaferPak Contactor contains a unique full wafer probe card capable of testing wafers up to 300mm that enables IC manufacturers to perform test and burn-in of full wafers on Aehr Test FOX systems. The DiePak Carrier is a reusable, temporary package that enables IC manufacturers to perform final test and burn-in of bare die and modules. Aehr Test Systems was incorporated in 1977 and is headquartered in Fremont, California.

NEWS

After AI Hyperscaler Deal, Is Aehr Test Systems Stock on Sale?

marketbeat.com

2025-10-09 10:14:09After posting its largest single-day gain of 2025, small-cap chip stock Aehr Test Systems NASDAQ: AEHR just took a huge hit. On Oct. 7, shares closed down by more than 17% as the market reacted to the company's latest earnings report.

Aehr Test Systems: Plenty Of AI Enthusiasm But No Visibility - Hold

seekingalpha.com

2025-10-09 01:37:31While Aehr Test Systems reported Q1/FY2026 slightly ahead of muted expectations, the company's order intake was disappointing. In addition, management's persistent refusal to provide guidance wasn't exactly suited to instill confidence in the company's near-term prospects. While management has succeeded in its efforts to shift the narrative to AI, persistent silicon carbide market weakness will continue to impact sales and margins in FY2026.

Aehr Test Systems: Post-Earnings Selloff Overlooks Its Expanding AI Opportunity

seekingalpha.com

2025-10-08 09:49:06I believe Aehr Test Systems' post-earnings selloff is an overreaction as weak earnings were expected due to the ongoing broader semiconductor industry weakness. The post-earnings selloff overlooks Aehr's potential to displace inefficient burn-in processes performed by ASIC suppliers with its FOX systems and the high-margin WaferPaks. Aehr's ongoing paid evaluation with a leading AI processor supplier could be a prelude to significant production orders for FOX-XP systems and WaferPaks in FY 2027.

Why Aehr Test Systems Stock Just Crashed

fool.com

2025-10-07 10:16:30Aehr Test Systems (AEHR -22.40%) stock tumbled 25.7% through 9:45 a.m. ET Tuesday despite beating on both top and bottom lines last night.

Aehr Test Systems Posts Q1 Earnings, Joins SANUWAVE Health And Other Big Stocks Moving Lower In Tuesday's Pre-Market Session

benzinga.com

2025-10-07 08:09:20U.S. stock futures were slightly higher this morning, with the Dow futures gaining around 0.1% on Tuesday.

Aehr Test Systems, Inc. (AEHR) Q1 2026 Earnings Call Transcript

seekingalpha.com

2025-10-06 23:45:19Aehr Test Systems, Inc. (NASDAQ:AEHR ) Q1 2026 Earnings Call October 6, 2025 5:00 PM EDT Company Participants Gayn Erickson - President, CEO & Director Chris Siu - CFO, Executive VP of Finance & Secretary Conference Call Participants Jim Byers - PondelWilkinson Inc. Christian Schwab - Craig-Hallum Capital Group LLC, Research Division Mark Shooter - William Blair & Company L.L.C., Research Division Bradford Ferguson - Halter Ferguson Financial, Inc. Larry Chlebina - Chlebina Capital Management, LLC Presentation Operator Greetings.

Aehr Test Systems Reports Fiscal 2026 First Quarter Financial Results; Strong AI and Data Center-Related Semiconductor Test and Burn-in Activity Underscores Multi-Year Market Opportunity

accessnewswire.com

2025-10-06 16:05:00FREMONT, CA / ACCESS Newswire / October 6, 2025 / Aehr Test Systems (NASDAQ:AEHR), a worldwide supplier of semiconductor test and burn-in equipment, today announced financial results for its first quarter of fiscal 2026 ended August 29, 2025. Fiscal First Quarter Financial Results: Net revenue was $11.0 million, compared to $13.1 million in the first quarter of fiscal 2025.

Wall Street Week Ahead

seekingalpha.com

2025-10-05 06:01:09Listen on the go! A daily podcast of Wall Street Breakfast will be available by 8:00 a.m.

Aehr Test Systems: Positioned To Reap From Rapidly Growing AI Sector

seekingalpha.com

2025-09-30 07:50:13Aehr Test Systems is poised for growth, driven by new orders from a leading AI processor and major hyperscalers in the semiconductor sector. AEHR's advanced wafer-level burn-in and test solutions position it to benefit from surging AI infrastructure and customized chip demand among hyperscalers. Despite recent tariff-related revenue setbacks, AEHR is expected to rebound, with a projected 37% upside and a price target of $41.47.

Aehr Test Systems to Announce First Quarter Fiscal 2026 Financial Results on October 6, 2025

accessnewswire.com

2025-09-29 07:30:00FREMONT, CA / ACCESS Newswire / September 29, 2025 / Aehr Test Systems (NASDAQ:AEHR), a worldwide supplier of semiconductor test and burn-in equipment, today announced that it will report financial results for its first quarter of fiscal 2026 ended August 30, 2025 on Monday, October 6, 2025 following the close of the market. The Company will host a conference call and webcast at 5:00 p.m.

Aehr Test Systems to Participate in 17th Annual CEO Investor Summit 2025 in Phoenix, AZ

accessnewswire.com

2025-09-18 07:30:00FREMONT, CA / ACCESS Newswire / September 18, 2025 / Aehr Test Systems (NASDAQ:AEHR), a worldwide supplier of semiconductor test and burn-in equipment, today announced that President and CEO Gayn Erickson will be participating in the 17th Annual CEO Investor Summit 2025 being held Tuesday, October 7that The Arrogant Butcher restaurant in Phoenix, Arizona. "I once again look forward to engaging with investors and shareholders to discuss Aehr's innovative wafer-level test and packaged part burn-in solutions that are enabling the next generation of semiconductor devices across diverse markets," said Mr.

Up 300%, This Artificial Intelligence (AI) Upstart Has Room to Soar

fool.com

2025-09-05 17:00:00One stock that is not on the radar of most mainstream investors has quietly risen by more than 300% since April 2025, moving from an intraday low of $6.27 per share all the way to an intraday high of $26.43 per share in late August. Previously, the stock had peaked at over $50 per share in 2024.

AEHR Spikes 36% on Hyperscaler Order—Investors Should Take Notice

marketbeat.com

2025-08-27 11:04:14On Aug. 25, Aehr said it had received a follow-on order for six of its Sonoma “ultra-high-power packaged part burn-in systems” from a major AI hyperscaler. Let's break down this complex technological jargon to understand what this really means and why investors should care.

Aehr Test Systems: Follow-On Orders Validate The Bullish Thesis

seekingalpha.com

2025-08-26 10:35:46Aehr Test Systems, Inc.'s latest follow-on orders from its leading AI hyperscaler customer for Sonoma systems represent a significant validation to its technology. AEHR appears to be a key pillar to its hyperscaler customer's long-term plans due to the large-scale deployment of its Sonoma systems. AEHR's consumable BIM sales are likely to grow significantly as the hyperscaler customer intends to ramp production of their own AI processors and introduce new chip designs in CY 2026.

Aehr Test Systems Heads Into A Critical Year

seekingalpha.com

2025-08-26 10:09:00AEHR is a high-risk, high-reward binary play, with fiscal 2026 hugely important for the mid- to long-term investment case. The recent acquisition of Incal and AI processor exposure have repositioned Aehr from an 'EV loser' to a potential 'AI winner,' expanding its addressable market. Despite optimism, fundamentals remain weak: high valuation, margin pressure, and a history of failed growth spurts raise caution.

No data to display

After AI Hyperscaler Deal, Is Aehr Test Systems Stock on Sale?

marketbeat.com

2025-10-09 10:14:09After posting its largest single-day gain of 2025, small-cap chip stock Aehr Test Systems NASDAQ: AEHR just took a huge hit. On Oct. 7, shares closed down by more than 17% as the market reacted to the company's latest earnings report.

Aehr Test Systems: Plenty Of AI Enthusiasm But No Visibility - Hold

seekingalpha.com

2025-10-09 01:37:31While Aehr Test Systems reported Q1/FY2026 slightly ahead of muted expectations, the company's order intake was disappointing. In addition, management's persistent refusal to provide guidance wasn't exactly suited to instill confidence in the company's near-term prospects. While management has succeeded in its efforts to shift the narrative to AI, persistent silicon carbide market weakness will continue to impact sales and margins in FY2026.

Aehr Test Systems: Post-Earnings Selloff Overlooks Its Expanding AI Opportunity

seekingalpha.com

2025-10-08 09:49:06I believe Aehr Test Systems' post-earnings selloff is an overreaction as weak earnings were expected due to the ongoing broader semiconductor industry weakness. The post-earnings selloff overlooks Aehr's potential to displace inefficient burn-in processes performed by ASIC suppliers with its FOX systems and the high-margin WaferPaks. Aehr's ongoing paid evaluation with a leading AI processor supplier could be a prelude to significant production orders for FOX-XP systems and WaferPaks in FY 2027.

Why Aehr Test Systems Stock Just Crashed

fool.com

2025-10-07 10:16:30Aehr Test Systems (AEHR -22.40%) stock tumbled 25.7% through 9:45 a.m. ET Tuesday despite beating on both top and bottom lines last night.

Aehr Test Systems Posts Q1 Earnings, Joins SANUWAVE Health And Other Big Stocks Moving Lower In Tuesday's Pre-Market Session

benzinga.com

2025-10-07 08:09:20U.S. stock futures were slightly higher this morning, with the Dow futures gaining around 0.1% on Tuesday.

Aehr Test Systems, Inc. (AEHR) Q1 2026 Earnings Call Transcript

seekingalpha.com

2025-10-06 23:45:19Aehr Test Systems, Inc. (NASDAQ:AEHR ) Q1 2026 Earnings Call October 6, 2025 5:00 PM EDT Company Participants Gayn Erickson - President, CEO & Director Chris Siu - CFO, Executive VP of Finance & Secretary Conference Call Participants Jim Byers - PondelWilkinson Inc. Christian Schwab - Craig-Hallum Capital Group LLC, Research Division Mark Shooter - William Blair & Company L.L.C., Research Division Bradford Ferguson - Halter Ferguson Financial, Inc. Larry Chlebina - Chlebina Capital Management, LLC Presentation Operator Greetings.

Aehr Test Systems Reports Fiscal 2026 First Quarter Financial Results; Strong AI and Data Center-Related Semiconductor Test and Burn-in Activity Underscores Multi-Year Market Opportunity

accessnewswire.com

2025-10-06 16:05:00FREMONT, CA / ACCESS Newswire / October 6, 2025 / Aehr Test Systems (NASDAQ:AEHR), a worldwide supplier of semiconductor test and burn-in equipment, today announced financial results for its first quarter of fiscal 2026 ended August 29, 2025. Fiscal First Quarter Financial Results: Net revenue was $11.0 million, compared to $13.1 million in the first quarter of fiscal 2025.

Wall Street Week Ahead

seekingalpha.com

2025-10-05 06:01:09Listen on the go! A daily podcast of Wall Street Breakfast will be available by 8:00 a.m.

Aehr Test Systems: Positioned To Reap From Rapidly Growing AI Sector

seekingalpha.com

2025-09-30 07:50:13Aehr Test Systems is poised for growth, driven by new orders from a leading AI processor and major hyperscalers in the semiconductor sector. AEHR's advanced wafer-level burn-in and test solutions position it to benefit from surging AI infrastructure and customized chip demand among hyperscalers. Despite recent tariff-related revenue setbacks, AEHR is expected to rebound, with a projected 37% upside and a price target of $41.47.

Aehr Test Systems to Announce First Quarter Fiscal 2026 Financial Results on October 6, 2025

accessnewswire.com

2025-09-29 07:30:00FREMONT, CA / ACCESS Newswire / September 29, 2025 / Aehr Test Systems (NASDAQ:AEHR), a worldwide supplier of semiconductor test and burn-in equipment, today announced that it will report financial results for its first quarter of fiscal 2026 ended August 30, 2025 on Monday, October 6, 2025 following the close of the market. The Company will host a conference call and webcast at 5:00 p.m.

Aehr Test Systems to Participate in 17th Annual CEO Investor Summit 2025 in Phoenix, AZ

accessnewswire.com

2025-09-18 07:30:00FREMONT, CA / ACCESS Newswire / September 18, 2025 / Aehr Test Systems (NASDAQ:AEHR), a worldwide supplier of semiconductor test and burn-in equipment, today announced that President and CEO Gayn Erickson will be participating in the 17th Annual CEO Investor Summit 2025 being held Tuesday, October 7that The Arrogant Butcher restaurant in Phoenix, Arizona. "I once again look forward to engaging with investors and shareholders to discuss Aehr's innovative wafer-level test and packaged part burn-in solutions that are enabling the next generation of semiconductor devices across diverse markets," said Mr.

Up 300%, This Artificial Intelligence (AI) Upstart Has Room to Soar

fool.com

2025-09-05 17:00:00One stock that is not on the radar of most mainstream investors has quietly risen by more than 300% since April 2025, moving from an intraday low of $6.27 per share all the way to an intraday high of $26.43 per share in late August. Previously, the stock had peaked at over $50 per share in 2024.

AEHR Spikes 36% on Hyperscaler Order—Investors Should Take Notice

marketbeat.com

2025-08-27 11:04:14On Aug. 25, Aehr said it had received a follow-on order for six of its Sonoma “ultra-high-power packaged part burn-in systems” from a major AI hyperscaler. Let's break down this complex technological jargon to understand what this really means and why investors should care.

Aehr Test Systems: Follow-On Orders Validate The Bullish Thesis

seekingalpha.com

2025-08-26 10:35:46Aehr Test Systems, Inc.'s latest follow-on orders from its leading AI hyperscaler customer for Sonoma systems represent a significant validation to its technology. AEHR appears to be a key pillar to its hyperscaler customer's long-term plans due to the large-scale deployment of its Sonoma systems. AEHR's consumable BIM sales are likely to grow significantly as the hyperscaler customer intends to ramp production of their own AI processors and introduce new chip designs in CY 2026.

Aehr Test Systems Heads Into A Critical Year

seekingalpha.com

2025-08-26 10:09:00AEHR is a high-risk, high-reward binary play, with fiscal 2026 hugely important for the mid- to long-term investment case. The recent acquisition of Incal and AI processor exposure have repositioned Aehr from an 'EV loser' to a potential 'AI winner,' expanding its addressable market. Despite optimism, fundamentals remain weak: high valuation, margin pressure, and a history of failed growth spurts raise caution.